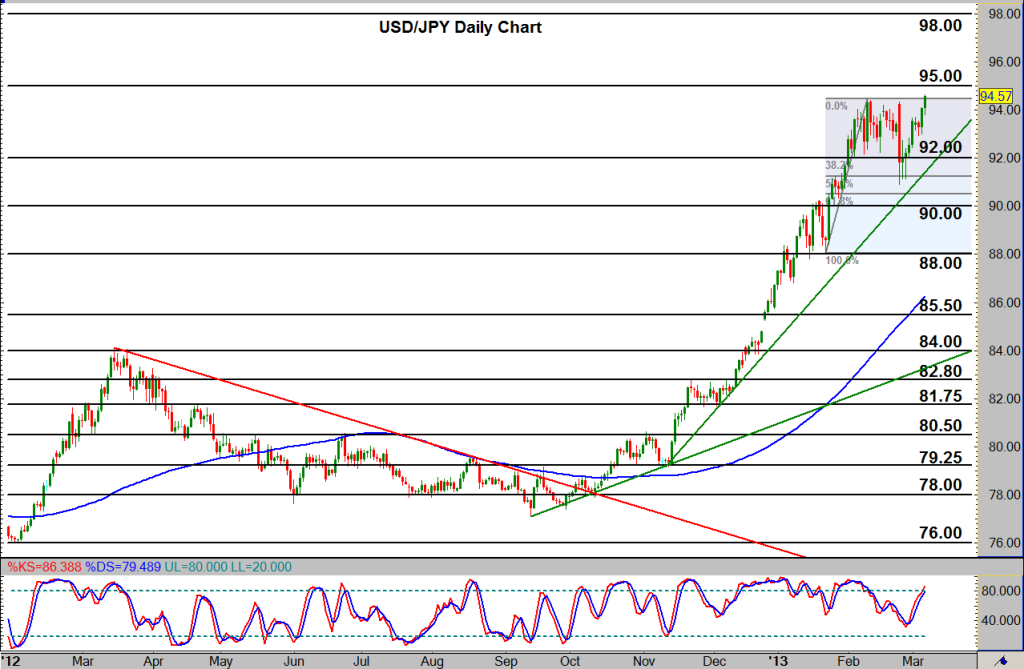

USD/JPY (daily chart) as of March 7, 2013 has broken out above its long-term high of 94.44 set in mid-February, establishing a new 34-month high for the pair. This renewed bullishness has been in place for the past week after price made a minor pullback in late February slightly below the 91.00 level. This also occurs within the context of a strong and steep bullish trend that has been in place for the past five months. During the course of this bullish trend there has still been very little in the way of significant pullbacks or corrections.

Although the noted late-February pullback broke below key 92.00 support, it was far from a major correction, and did not pose any real threat to the integrity of the entrenched uptrend. Currently, price is approaching its key upside target around the 95.00 resistance area. In the further event of a strong breakout above that level, the next major resistance objective to the upside resides around the 98.00 level. To the downside, key support continues to reside around 92.00.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.