Lowest EUR/USD Spread Forex Brokers – Cheapest Brokers Revealed

Forex is the biggest and most liquid financial market in existence. Just last year, the forex market was valued at more than $2 quadrillion. Yet, surprisingly, this market didn’t even exist one hundred years ago.

With that said, if you’re interested in trading the major EUR/USD currency pair you will need to find a broker that suits your forex trading goals. In this guide, we cover the lowest EUR/USD spread forex brokers in 2021, along with the key metrics from fees to trading strategies and more.

Top 5 Lowest EUR/USD Spread Forex Brokers 2021

- eToro – Best Overall Copy Trading Broker with Low Spreads

- Capital.com – Low Spread Broker for Forex Trading

- Avatrade – Best Forex Broker with Low Fees

- VantageFX – Top-rated Forex Broker with Market-Leading Spreads

- Pepperstone – Best Forex Broker with Zero Spread Offering

Best Lowest EUR/USD Spread Brokers Reviewed

In this section of our lowest EUR/USD spread forex brokers review we will explore the ins and outs of the best low spread forex brokers in 2021 to trade the major EUR/USD currency pair with tight market variable spreads.

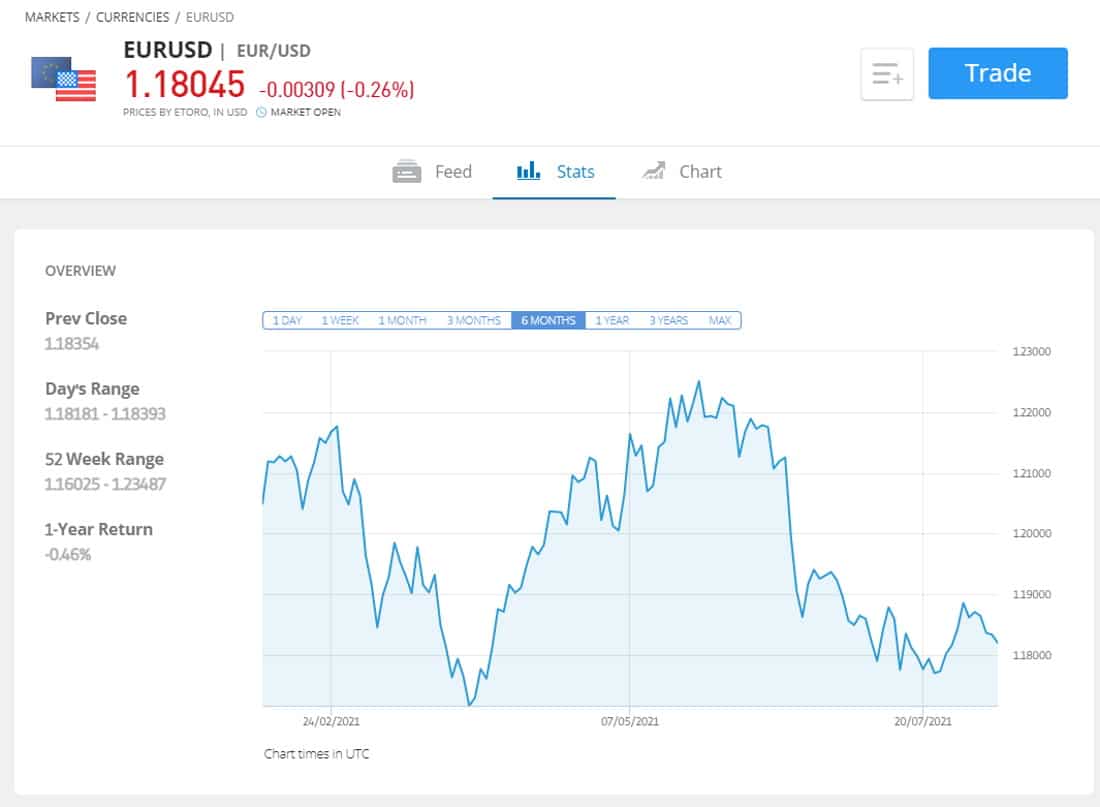

1. eToro – Best Overall Copy Trading Forex and CFD Broker with Low Spreads

eToro claims a place amongst the lowest EUR/USD spread forex brokers in 2021 as it offers 0% commission on heaps of markets including stocks and forex, and was created to democratize online trading and make it accessible for everyday retail traders. Founded in 2006, this social trading platform now serves over 20 million traders worldwide and provides heaps of useful and effective trading features and low trading fees.

Tradable assets

At eToro, you can gain exposure to heaps of markets and financial products with the click of a button. As such, you can invest in heaps of CFD derivatives, as well as over 45 currency pairs. If you’re interested in digital assets, you’ll be happy to learn that eToro allows you to buy, sell, and store 17 different cryptocurrencies with tight spreads and 0% commission.

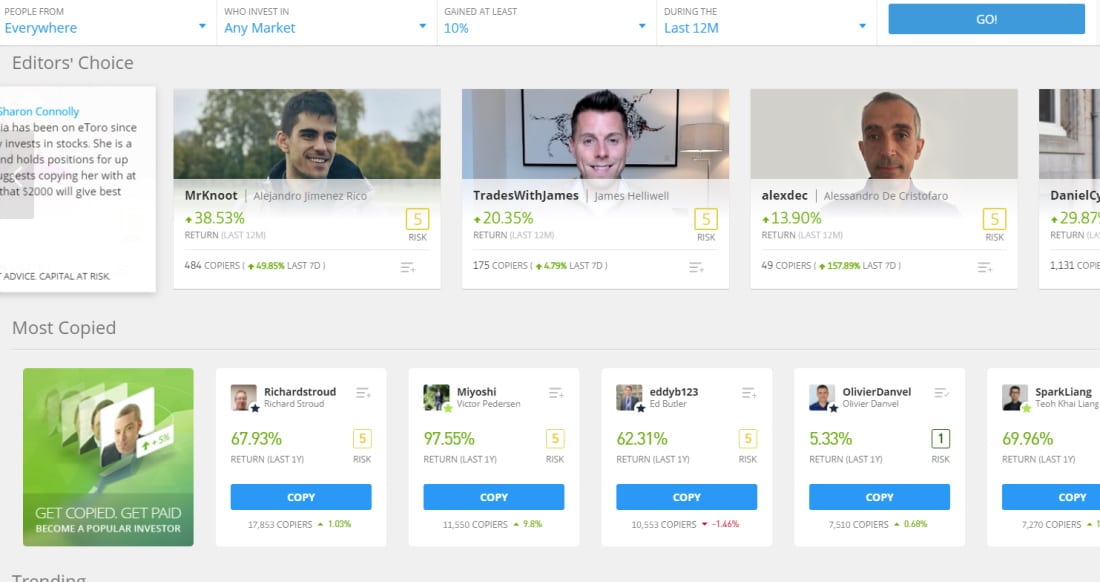

Perhaps one of eToro’s best selling points is that it offers copy trading features referred to as CopyTrader and CopyPortfolio. Put simply, these allow you to copy the trades of other experienced traders. In other words, eToro facilitates passive trading strategies allowing you to invest in fully diversified portfolios or individual traders with ease.

Fees and Commissions

| Fee | Charge |

| Stock trading fee | 0% Commission, invest in Amazon stock with as little as $50 |

| Forex trading fee | 0% commission, Spread of 1 pip for EUR/USD |

| Crypto trading fee | 0% commission, Spread 0.75% for Bitcoin |

| Inactivity fee | $10 a month after one year |

| Withdrawal fee | $5 |

| Deposit fee | None |

| Account fee | None |

| Platforms | Web trading platform, Mobile app |

| Minimum Deposit | $50 |

eToro is widely popular as a global forex and CFD broker with market-leading fees, tight spreads, and commission-free trading. For example, if you wanted to trade the EUR/USD pair on eToro you would pay a EUR/USD bid-ask spread of 1 pip and 0% commission.

In terms of non-trading fees, there are no deposit fees or account fees, but there is a $5 withdrawal fee and a monthly $10 inactivity fee after 12 months.

When it comes to payment methods, eToro supports a wide range of options for your convenience. As such you can deposit and withdraw funds using debit/credit cards, bank transfers, and a myriad of e-wallets such as PayPal and Skrill.

Regulations

eToro is fully authorized and regulated by the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Your funds are also held in segregated bank accounts or segregated accounts with a third-party regulated company, usually an affiliate. Negative balance protection is available on eToro, and UK-based clients are covered by the Financial Services Compensation Scheme (FSCS), which covers up to £85,000 if the broker goes bankrupt.

- Fully regulated by the FCA, CySEC, ASIC

- Commission-free stock and ETF trading

- Heaps of major, minor and exotic forex pairs

- Advanced ProCharts with heaps of tools for technical analysis

- Wide range of payment methods

- Access to Copy Trading features

- Lower spreads than most of its competitors

Cons

- $10 inactivity fee after 12 months

67% of retail investor accounts lose money when trading CFDs with this provider.

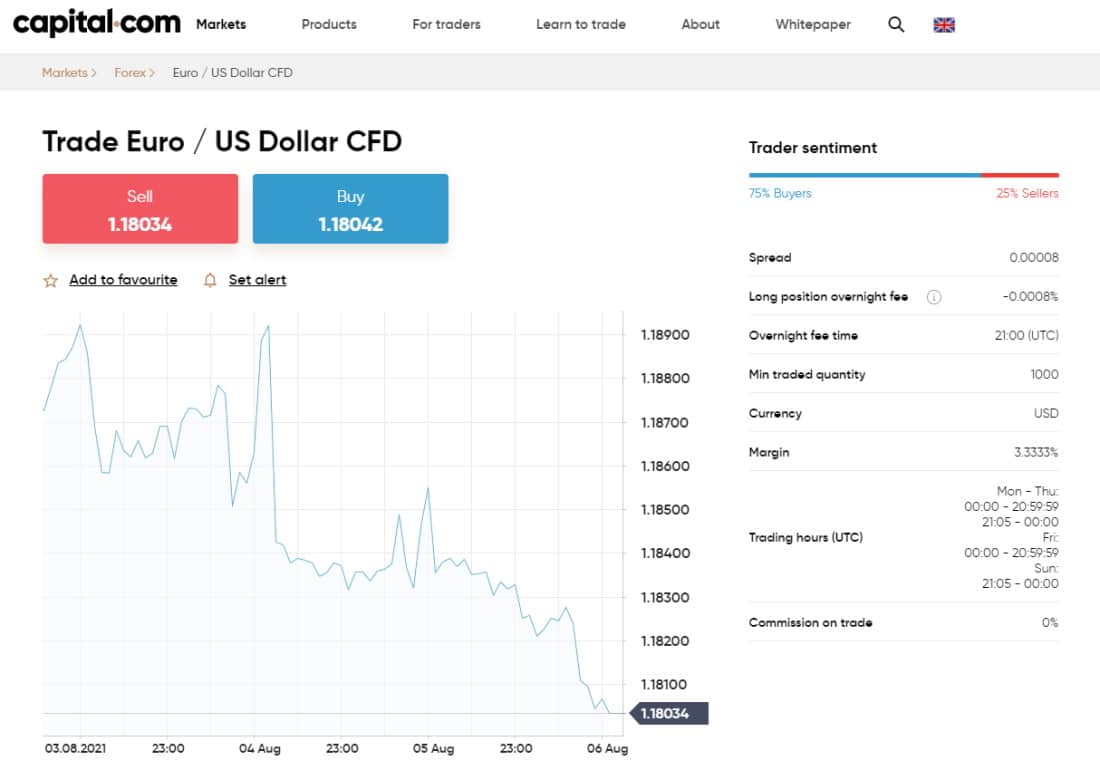

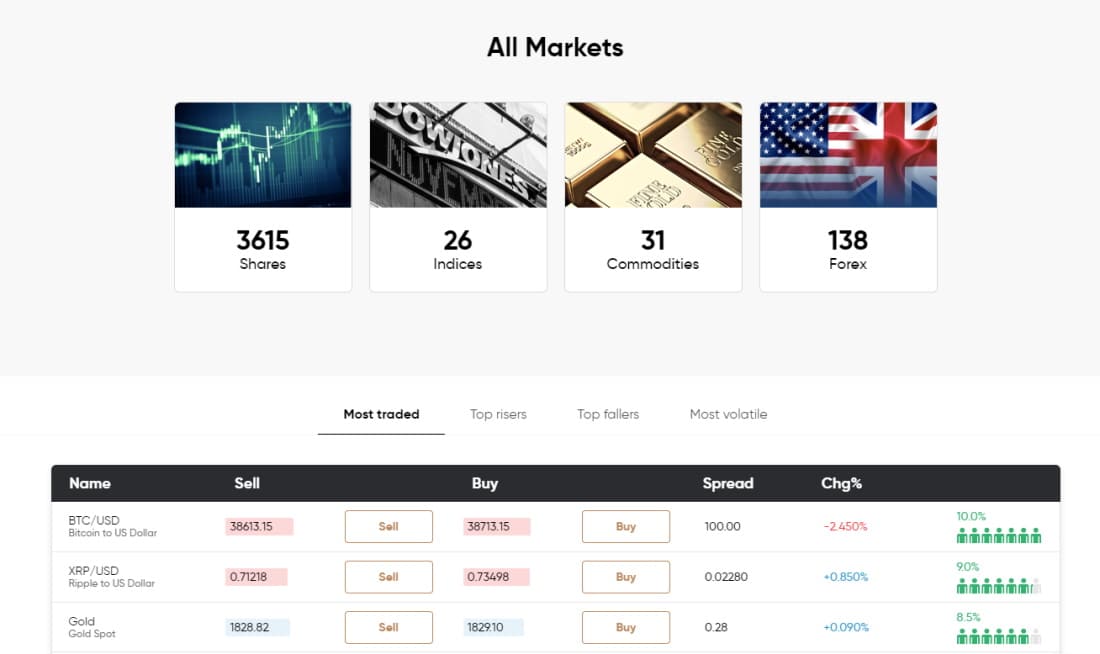

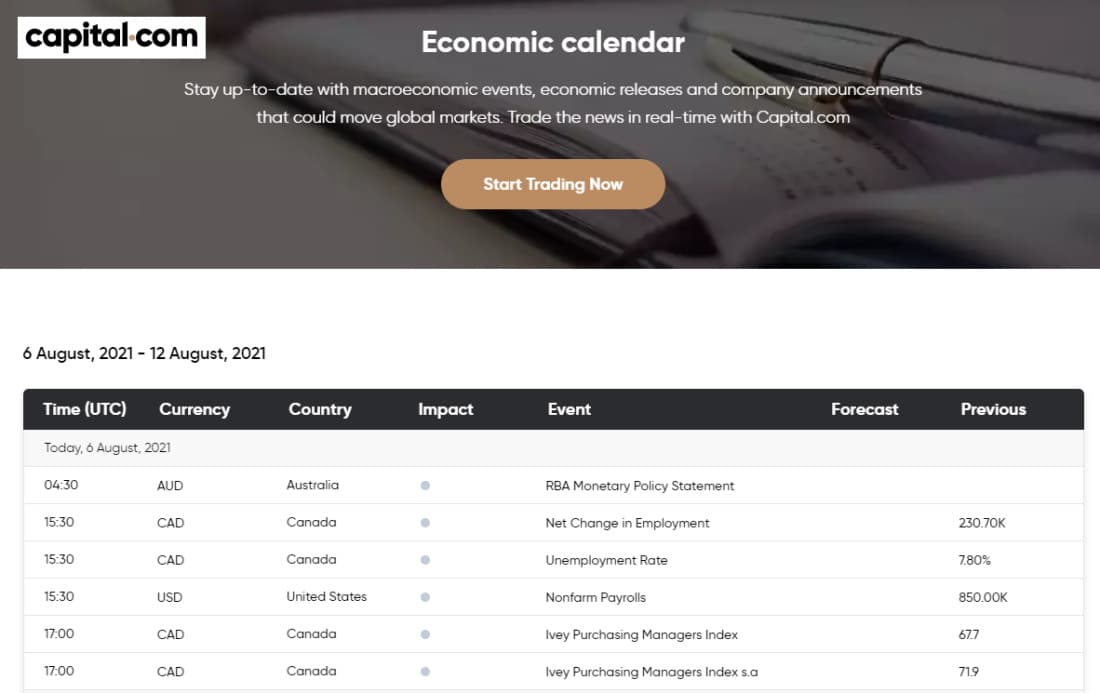

2. Capital.com – Low Spread Broker for Forex Trading

If you’re looking to gain exposure to the forex market and trade major forex pairs like EUR/USD but have little trading experience, Capital.com is a great option for beginners. Capital.com is a trusted CFD and forex trading platform that was established in 2016 and is heavily regulated by several financial market watchdogs including the UK’s FCA, and the Cyprus Securities and Exchange Commission (CySEC).

Tradable assets

Capital.com has a vast collection of CFD, forex, and crypto assets in comparison to other CFD trading platforms. On the flip side, it lacks popular securities such as real ETFs, stocks, and funds. At Capital.com you can gain exposure to the forex markets by trading over 140 currency pairs.

By picking a forex trading strategy with Capital.com, you will be speculating on the continuously fluctuating currency exchange rates. For example, if the EUR/USD currency pair is priced at 1.18459, you will need to forecast whether this price will either drop or rise in the short term. Furthermore, with a 0% commission on the trade, you will be paying a competitive spread of 0.00008 pips.

Fees and Commissions

| Fee | Charge |

| Stock trading fee | 0% Commission, Spread on AMZN stock = 27.17 pips |

| Forex trading fee | 0% commission, Spread of 0.00008 pips for EUR/USD |

| Crypto trading fee | Spread, 0.00060 pips for ETH/BTC CFD |

| Inactivity fee | None |

| Withdrawal fee | None |

| Deposit fee | None |

| Account fee | None |

| Platforms | Web trading platform, Mobile trading apps, MetaTrader 4, Investmate, Spread betting, TradingView |

In terms of payment methods, Capital.com supports credit cards, debit cards, bank wire transfer, Sofort, iDeal, Giropay, Multibanko, Przelewy24, QIWI, Webmoney, ApplePay, Trustly, 2c2p, or AstropayTEF.

All payment methods have a $20 minimum deposit, except for wire transfers, which have a $250 minimum deposit. There are also no deposit or withdrawal fees, as previously stated. Withdrawals can take up to 24 business hours, while deposits made with credit/debit cards and e-wallets are processed instantly.

Regulations

Capital.com is authorized by top-tier financial institutions such as the UK’s Financial Conduct Authority and CySEC. Should the broker go bankrupt, UK-based clients are covered up to £85,000, while EU-based clients are covered up to €20,000.

- Access 140+ currency pairs with 0% commission and tight spreads

- Fully regulated by the FCA and CySEC

- Low forex market spreads

- Uncover unique trading opportunities with 75+ technical indicators

- Huge range of payment options including debit/credit cards, Apple Pay

Cons

- Cannot set price alerts on the web platform

76.25% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

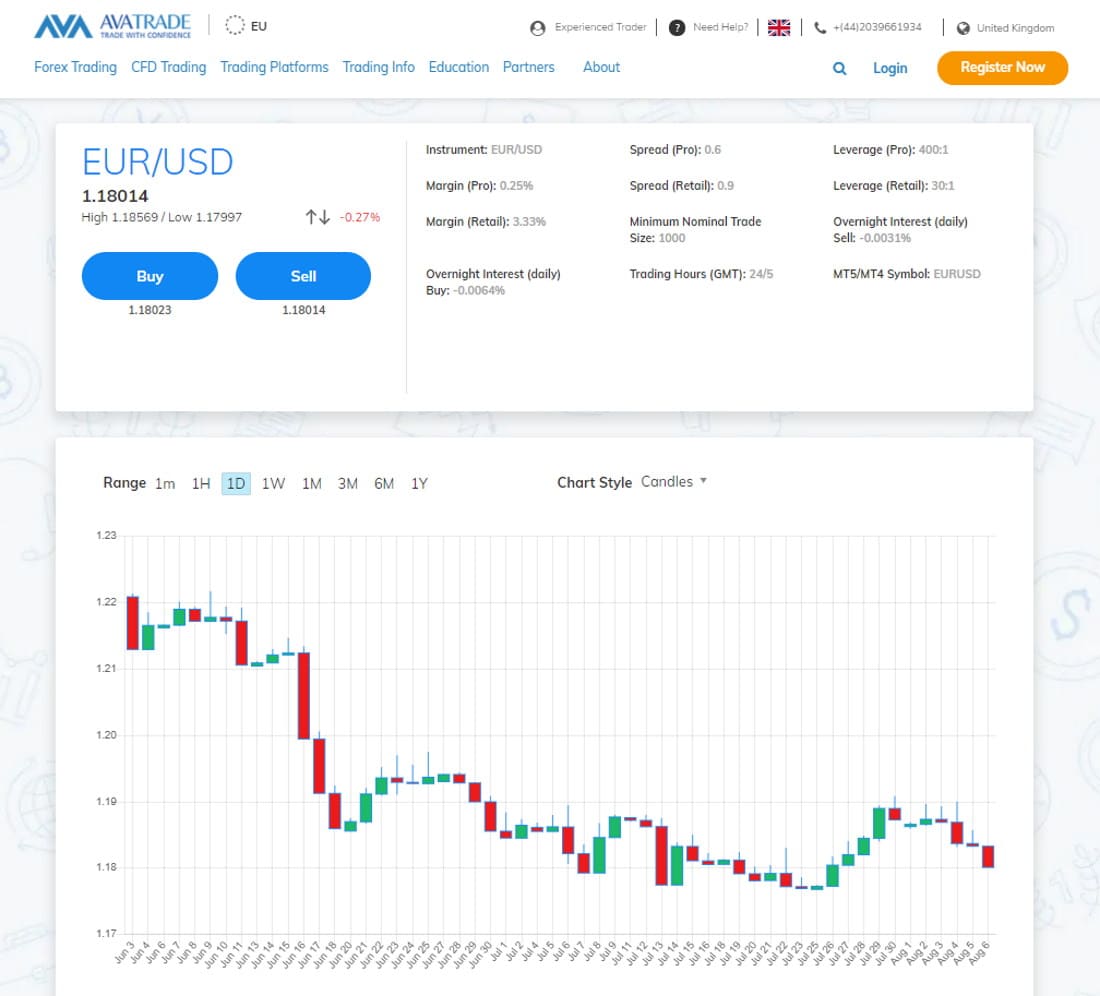

3. AvaTrade – Best Forex Broker with Low Fees

Tradable assets

With an average daily trading volume of over $6.5 trillion, the forex market is the world’s largest financial market. Currencies are traded for a variety of reasons, including the exchange of goods and services, hedging, and speculative trading.

With this in mind, you can buy and sell the most popular major currency pairs such as EUR/USD, GBP/USD, EUR/CHF, USD/CHF, AUD/USD, AUD/CAD, AUD/NZD, AUD/JPY and USD/JPY with 0% commission as AvaTrade is a free trading platform and is compensated through the market spread. Furthermore, all financial instruments are traded on margin which allows investors to use leverage.

For example, when trading the EUR/USD FX pair with a standard account, the overnight financing rate for long positions is -0.0008%, the spread is 0.00008 pips, the margin rate is 3.3333%, and you can use up to 30:1 leverage, which means you can start trading with as little as $100 to manage a position of $3,000.

Fees & Commissions

AvaTrade does not charge commissions on any trade, from forex to CFDs, the only trading fees you will have to pay are the tight bid-ask spreads, as well as the overnight financing fees if you keep long positions open after the market closes.

When it comes to non-trading fees these are very minimal as there are no deposit, withdrawal, or account fees. There is, however, a hefty $50 inactivity fee after 3 months of non-use as well as a $100 administrative fee after one year.

| Type of Fee | Charge |

| Forex Fee | 0% Commission, typical spread for EUR/USD is 0.0008 pips and leverage up to 30:1 |

| CFD Fee | 0% Commission, typical spread for Amazon Stocks is 0.13% and leverage up to 5:1 |

| Cryptocurrency Fee | 0% Commission, typical spread for Ethereum is 0.28% and leverage up to 2:1 |

| Overnight Financing Fee | Trade Amount * Daily Overnight Interest = Daily overnight interest charged/paid. For example, for a 1,000 EUR/USD trade with a daily overnight interest buy rate of -0.0064% and subject to a one day charge, the calculation is 1,000 * -0.000064 = -0.064 = -$0.06 |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Account Fee | None |

| Inactivity Fee | $50 after 3 months of inactivity and a $100 administration fee after one year. |

Regulations

AvaTrade is heavily regulated by the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority in South Africa, Japan’s Financial Services Agency and the Financial Futures Association of Japan, the Abu Dhabi Global Markets Financial Regulatory Services Authority, CySEC, the Central Bank of Ireland, the B.V.I (British Virgin Islands) Financial Services Commission, and the Israel Securities Authority.

- Low trading and non-trading fees

- Heavily regulated by multiple financial regulators

- Wide range of payment methods accepted

- Access to 50+ major, minor and exotic currency pairs

- Competitive fixed spreads and 0% commissions

- Use up to 30:1 leverage for forex

Cons

- High $50 inactivity fee

71% of retail investor accounts lose money when trading CFDs with this provider.

4. Vantage FX – Top-rated Forex Broker with Market-Leading Spreads

Tradable assets

Vantage FX gives you access to over 40 forex pairs, commodities, indices, and share CFDs. When it comes to forex trading, Vantage FX traders have access to over 40 currency pairs with spreads starting from 0 pips when using a RAW ECN brokerage account. For instance, the minimum spread for the major EUR/USD pair is 0.1 pips. Furthermore, you can choose leverage of up to 500:1.

Pricing

The trading fees vary depending on the type of account you choose. For a Standard STP account, you can access the financial markets with 0% commissions. On the other hand, RAW ECN account holders can trade on a zero-spread basis but the commission starts from $3 per lot per side. In terms of non-trading fees, these are also very competitive with zero account, deposit, withdrawal, and inactivity fees to worry about.

| Fee | Charge |

| Stock trading fee | 0% Commission and spreads from 1.4 pips with Standard STP account and leverage of up to 500:1. |

| Forex trading fee | 0% Commission, typical spread for EUR/USD is 0.0 pips and leverage up to 500:1 for RAW ECN account holders. The spread for EUR/USD with a Standard STP account starts from 1.4 pips |

| Inactivity fee | None |

| Withdrawal fee | None |

| Deposit fee | None |

| Account fee | None |

| Platforms | Vantage FX App, MT4, MT5, Webtrader, Metaquotes Apps, social trading: ZuluTrade, MyFXBook Autotrade, DupliTrade |

- Day Trade with MetaTrader 4 and MetaTrader 5

- Regulated by FCA, CIMA, VFSC, and ASIC

- Leverage of up to 500:1

- Spreads from 0.0 pips and commission from $0 depending on the account type

- Wide range of funding methods

Cons

- Product selection limited to CFDs

Trading Forex and CFDs involves significant risk and can result in the loss of your invested capital.

5. Pepperstone – Best CFD Broker with Zero Spread Offering

While many CFD traders will elect to use MT4, other third-party platforms are worth considering. For example, the likes of MT5 and cTrader both come packed with notable tools – such as technical indicators, copy trading, and live forex news.

Perhaps the best CFD broker that supported MT4 and cTrader is Pepperstone. In choosing this provider, you can trade hundreds of CFDs – which include indices, forex, shares, and commodities. We like the fact that Pepperstone offers two core account types to cover both casual and experienced traders. Regarding the former, the Standard account offers 0% commission trading and spreads that start from just 0.6 pips.

And the latter – the Raw account offers ECN-like spreads that start from 0.0 pips alongside a commission of $3. Pepperstone offers leverage on all markets as well as the option to go long or short. The broker is regulated by several reputable bodies – such as ASIC and the FCA. There is no minimum deposit to get started and you can easily deposit funds with a debit/credit card or e-wallet.

| Fee | Charge |

| Stock trading fee | $0.02 per US stock |

| Forex trading fee | Spread, 1.59 pips for GBP/USD |

| Crypto trading fee | Spread, 50 pips for Bitcoin |

| Inactivity fee | N/A |

| Withdrawal fee | Free |

| Deposit fee | None |

| Platforms | MetaTrader 4 and MetaTrader 5 for desktop, web, and mobile |

- Highly suitable for professional clients

- Raw Spread account offers 0 pips on major forex pairs

- 0% commission accounts also available

- More than 800+ financial instruments

- Compatible with MT4, MT5, and cTrader

- Regulated by the FCA, ASIC, and DFSA

Cons

- No traditional investment assets supported

Your capital is at risk when trading financial instruments at this provider

Lowest EUR/USD Spread Brokers Fees Comparison

| Broker | EUR/USD Spread | GBP/USD Spread | USD/JPY Spread |

| eToro | 1 pip | 2 pips | 1 pip |

| Capital.com | 0.8 pips | 1.3 pips | 0.01 pips |

| AvaTrade | 0.9 pips | 1.6 pips | 1.1 pips |

| Vantage FX | 1.4 pips | 1.6 pips | 1.5 pips |

| Pepperstone | Commission -0.005 % | Commission -0.008 % | Commission -0.013 % |

What is a Low Spread in Forex?

All financial markets have a spread, which is the main trading fee. But what is a forex spread and how is it measured?

Spread in forex trading is the small cost included in the bid and ask price of all currency pair trades. When you examine the quoted price for a forex pair, you will notice that there is a gap between the bid and ask pieces – this is known as the spread or the bid-ask spread.

Fluctuations in the spread are measured in pips – which is any price movement in the fourth decimal place of a foreign exchange pair. The overall cost of the forex trade is determined not only by the spread but also by the lot size.

Keep in mind that all forex trading works by purchasing one currency pair and selling another. The currency quoted on the left of the forex pair is known as the base currency, whereas the currency on the right is referred to as the quote currency. When you trade forex, the bid price represents the amount it would cost to buy the base currency, and the ask price stands for the cost of selling it.

How to calculate bid-ask spread

To calculate the bid-ask spread in forex, you need to find the difference in pips between the bid and ask prices. You can do this easily by subtracting the bid price from the ask price. Let’s say that you’re trading the EUR/USD pair at 1.18339/1.18330, the spread is then calculated by 1.18339 – 1.18330 = 0.00008 or 0.8 pips.

Spreads are either wide or tight; in other words, they can be high or low. The more pips that result from the bid-ask spread calculation, the wider the spread. Professional forex traders prefer tighter spreads because it means that the trades are cheaper.

Spreads are typically wide when a market is volatile with low levels of liquidity. The opposite runs true when the markets are stable with high levels of liquidity the spreads are usually tight. Major forex pairs like EUR/USD have a tight spread when compared to an exotic currency pair such as the USD/ZAR pair.

Trading EUR/USD

The US Dollar and the Euro are the two most popular and highly traded currencies in the world. The Euro versus US Dollar forex pair has the largest trading volume in the forex market. As such, if you find this asset simple or complicated to trade on, it’s not a major currency pair that most forex traders ignore, because of its high liquidity and constant price movements.

The Euro Dollar (EUR/USD) is the top forex pair with the highest trading volume in the forex market, and its value represents the exchange rate of the Euro against the United States Dollar. For example, a EUR/USD price of 1.4 means that if you wanted to purchase one Euro you would need to pay $1.4. Simply put, one Euro carries the same value as 1.4 US Dollars.

The EUR/USD can also be used for real economic trading as well as a financial derivative in the form of a contract for difference (CFDs) to speculate on the market price of the underlying currency pair.

Best Times to Trade EUR/USD

The Forex market is open 24 hours a day, 5 days a week, and includes the Euro/Dollar pair. The market is closed for only two non-trading days every week or 48 hours.

The optimum time to trade the Euro Dollar, like any other currency pair, is when the market is busy, which means there is enough price volatility and movement to make the highest possible profits.

Forex pairs are typically more active when one or both the base and quoted currencies are trading in normal business hours and during the stock market hours of that country or economic zone. Here’s a quick breakdown:

- The US Dollar and the Euro are fiat currencies that are most active between the hours of 08:00 – 16:00 EET.

- There is a brief two to three-hour window when both the US and EU markets are active and therefore offer the highest peak of liquidity and volatility.

According to most forex market analysts, the best times to trade the EUR/USD pair seems to be between 12 pm GMT and 3 pm GMT when the American, European and British market hours overlap.

Periods of heightened volatility and liquidity are particularly important for forex enthusiasts that tend to trade both with the trend, and with intraday EUR/USD trading strategies.

What Drives EUR/USD Price Movements?

The volatility of the EUR/USD price moves on a daily, weekly, and monthly basis. However, there are scenarios when the Euro-Dollar pair will fluctuate higher or lower because of changes in factors that affect both the currency pair and the forex market in general.

These influential factors include:

- Economic indicators such as the NFP (Non-farm payrolls) and Unemployment reports

- Political and economic events

- Central Bank press conferences

- Governmental monetary policy announcements

- Technical analysis

- Bullish and bearish trends

- Investor and business sentiment

- Consumer sentiment

- Chart patterns and wave trends

- Interest rates set by the US Federal Reserve Bank, and the European Central Bank

- Inflation rates

- GDP growth rates

- Natural disasters and pandemics

As you can see from the list, the macroeconomic data related to the European Union and the United States of America give market analysts, investors, economists and politicians an accurate indication of the long-term trajectory of their economies. These macroeconomic reports directly impact how the EUR/USD price fluctuates.

You can find these economic indicators via any economic calendar if you are interested in monitoring each announcement and report as they are published.

Economic reports affect forex prices because they typically provide accurate insights and data as to whether the US and European economies are performing better or worse than before. This is why decisions from the Federal Reserve and the European Central Bank are so important since they express the views of the leading monetary decision-makers on the current and future economic forecasts in the Eurozone and the US.

Additionally, there are forecast figures that are set before the economic reports are published so that market analysts and forex traders can compare previous, forecasted and actual figures to conclude as to whether the economy has been expanding or contracting.

Fundamental analysis focuses on these figures and reports and attempts to gauge the direction of the market, as well as the influence they are likely to have on the EUR/USD pair.

Strategies for Trading EUR/USD

There are three key trading strategies that forex traders use to trade the EUR/USD pair, which include:

- Intraday trading

- Swing trading

- Scalping

Intraday trading

In this case, the forex trader uses a strategy that involves opening and closing positions inside a single trading day or trading session. In contrast to scalpers, who open and close trades every few minutes, intraday traders typically make trades lasting a few hours.

Because all positions need to be closed before the market closes, the main aim is to generate the highest profit in only one trading session.

Swing trading

With swing trading, the trader takes on the role of a long-term investor, in that he/she tries to profit from a weekly or monthly trend of the EUR/USD pair without having to be glued to the trading screen.

It is worth noting here that professional EUR/USD traders often adopt all three of these trading strategies to increase potential profits.

Scalping

Scalping involves opening and closing positions in a short amount of time – typically within minutes. As such, with the trades being so brief the main aim is to make a few pips of profit per position. This is a very advanced trading strategy that demands high volumes, often achieved with leverage, to make large profits.

EUR/USD Trading Strategies

The price of the Euro Dollar fluctuates continuously throughout the trading day, providing possibilities for traders to profit from these price changes and market volatility. Here’s how traders try to profit from such price fluctuations.

If traders believe the EUR/USD price is likely to rise, they might open a long position and try to sell at a higher price.

Forex traders may enter a short position if their analysis suggests that the Euro Dollar is likely to fall, and attempt to buy at a lower price.

Some traders prefer to avoid entering the market altogether and wait to see if their technical analysis signals a mix of both bearish and bullish sentiments.

There are a bunch of trading strategies out there for each analytical group. If you prefer to base your trading strategies on fundamental analysis, technical analysis, price analysis, or economic data, there are several angles you can use to participate in the forex market in general, and the EUR/USD pair in particular.

Aside from the conventional trading strategies, forex traders also have the flexibility to create their own trading methods that are suited to their trading goals and financial needs. You can test your trading strategies via a paper trading account.

Conclusion

The EUR/USD is the most traded currency pair with the highest daily volatility and liquidity levels. With so many trading opportunities available 24/5 you can trade this major pair whenever you want. Professional forex traders use a combination of trading strategies, as discussed in this article, to make the most profits from trading the EUR/USD.

To summarize, we’ve covered the lowest EUR/USD spread forex brokers in 2021 along with all the basics from the best times to trade to strategies for trading the Euro Dollar. We found that eToro is the best trading platform to trade the EUR/USD with copy trading tools, tight spreads, 0% commission, and a user-friendly interface. Find out more by clicking the link below!

eToro – Broker with Lowest EUR/USD Spread & 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider.