Best Forex Mini Accounts – Find the Right Account For You

Trading forex might be a great way to make a passive or direct income, but like any other business, sometimes you need to start small in order the understand the dynamics of the market and to establish a successful trading strategy. For that matter, some forex brokers that offer mini accounts could be a great way to enter the trading arena.

So, in this guide, we’ll suggest the best forex mini accounts, and explain everything you need to know about a mini forex account.

Best Forex Mini Accounts List 2021

There are plenty of forex brokers out there that offer forex trading mini account. But in order to find the best forex mini account for your trading needs, you need to take some crucial factors into account such as the pricing structure, regulation, the range of financial instruments and platforms, and tools and features. Below, we suggest the top forex brokers that offer mini accounts for this year and beyond.

- AvaTrade – Overall best mini account forex broker

- VantageFX – Best ECN forex broker that offers a mini forex account

- IG Markets – Trade over 17,000 markets with a mini forex account

Top Forex Managed Accounts Reviewed

1. AvaTrade – Overall Best Mini Account Forex Broker

Based on our analysis, AvaTrade is the best forex broker that offers a mini forex trading account with a minimum deposit requirement of just $100 and lots of trading tools and features. At AvaTrade, users can open positions of a mini lot (10,000 units) that is equal to $1 per pip, and a micro lot (1,000 units) that is worth $0.1 per pip.

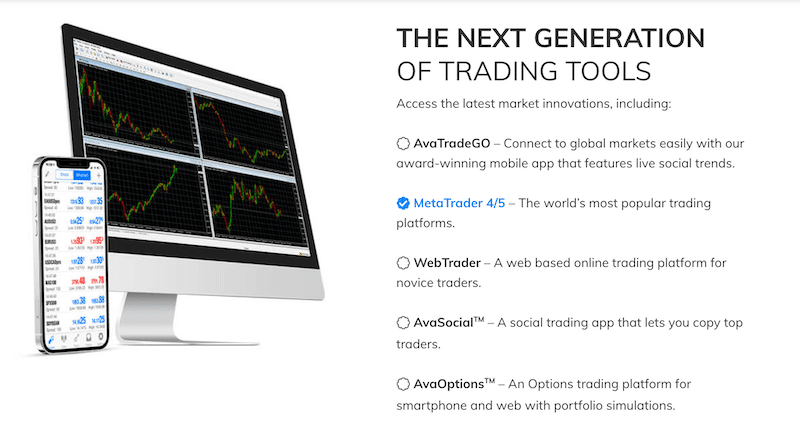

Furthermore, AvaTrade offers a range of trading platforms and trading tools that include the MetaTrade4, MetaTrader5, AvaOptions (for trading FX options), and AvaTradeGo mobile app. Also, you’ll get access to social trading tools and automated trading tools such as the AvaTradeSocial, ZuluTrade, and DupliTrade.

Overall, AvaTrade offers over 1250 financial assets including 55 FX currency pairs and options trading on over 40 pairs. Also, AvaTrade is considered a cost-effective trading platform with very tight spreads and low management fees. For example, the spread for the EUR/USD is as low as 0.9 for retail clients (mini account) and 0.6 for professional forex traders. Crucially, AvaTrade also provides a leverage ratio of up to 400:1 for FX currency pairs.

In terms of the safety of your funds, AvaTrade is one of the most heavily regulated brokers in the market. The broker holds licenses from 7 top-tier regulators including CySEC, ASIC, FCA, FSA, etc.

- Heavily regulated forex and CFD broker

- Offers a range of 1250 assets including 55 FX currency pairs

- Very competitive spreads and low management fees

- Supports a wide range of trading platforms – MT4, MT5, AvaOptions, AvaTradeGo, etc

- Great broker for beginners and for professional traders

- For a mini account – AvaTrade require a minimum deposit requirement of just $100

- Leverage of up to 400:1

Cons

- The range of assets is limited when compared to other brokers

71% of retail investor accounts lose money when trading CFDs with this provider

2. VantageFX – Best ECN Broker That Offers a Mini Forex Account

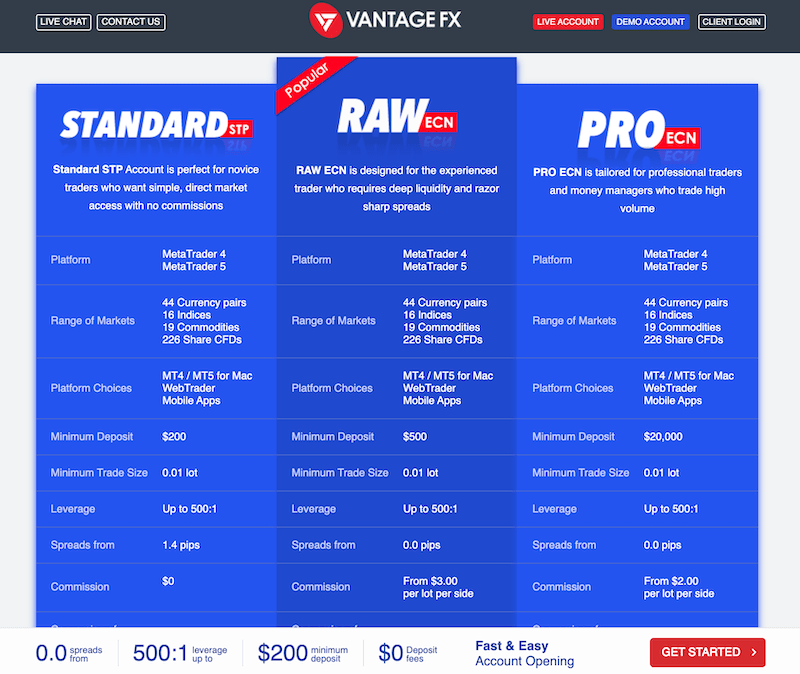

Crucially, one of the main attractions of VantageFX in comparison to other forex brokers in the market is its pricing structure. Being an ECN forex broker, VantageFX can offer users zero spreads and a fixed trading commission of 0.008% for each trade you make, which is the ideal trading environment for active traders. Additionally, VantageFX offers a generous rebate program for active traders who trade frequently and reach a certain trading volume.

However, you should take note that if you decide to use a Standard STP account (a minimum deposit requirement of $200), you are required to pay a spread that starts from 1.4 pips without any trading commissions. Otherwise, if you prefer using the zero spread pricing structure, you can meet the minimum higher deposit requirement of $500.

All things considered, VantageFX is the ideal choice if you wish to actively trade the markets with a forex mini account.

- An ECN/STP market execution that provides a transparent trading environment

- Zero spreads and low fees

- Supports the MetaTrader4 and the MetaTrader5, and its proprietary web trader trading platform

- A high leverage ratio of up to 500:1

- Fast market execution

- A range of accounts, including mini account

- Offer cash rebate program

Cons

- High spreads for the Standard STP account

- No social trading tools

There is no guarantee you will make money when trading CFDs with this provider.

3. IG Markets – Trade Over 17,000 Markets with a Mini Forex Account

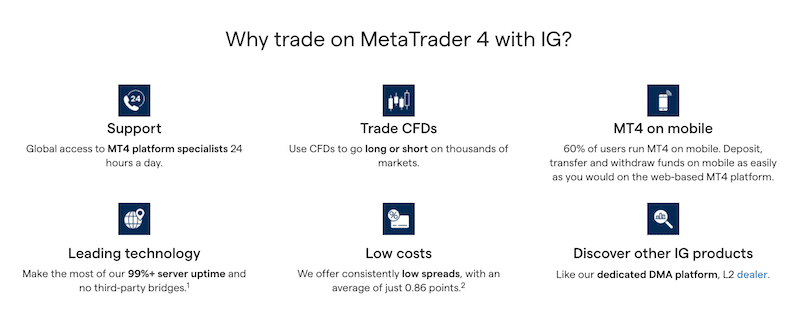

Much like AvaTrade and VantageFX, IG Markets offers users to trade with a minimum lot size of 0.01 lots on the MetaTrader4 account. And, obviously, the great advantage of using IG Markets is the huge selection of over 17,000 assets, including 80 FX currency pairs, over 13,000 shares, indices, commodities, cryptocurrencies, bonds, interest rates, and ETFs. Also, you can trade FX options and knock out contracts, which are essentially CFDs with an expiry date.

To get started, IG markets has a minimum deposit requirement of $300 for the mini account if using a credit card or PayPal as payment methods. However, if you decide to use a bank transfer, there’s no minimum deposit requirement.

- Founded in 1974 and listed on the London Stock Exchange

- Offers over 17,000 markets, including 80 FX currency pairs

- Very competitive fees and spreads

- MetaTrader4 is available

- Lots of trading tools and unique derivatives like FX options and knock out contracts

Cons

- More suited for experienced traders

- Relatively high minimum deposit requirement

71% of retail investor accounts lose money when trading CFDs with this provider

Forex Mini Accounts Fees Comparison

To help make you the right choice from the brokers above, below you can find a comparison table of the best forex mini accounts.

| Number of FX Currency Pairs | Spread for EUR/USD | Spread for GBP/USD | Trading Platforms | |

| Avatrade | 55 | 0.09 spread | 1.6 ouos | MetaTrader4/MetaTrader5, AvaSocial, AvaTradeGo, AvaOptions, and Ava WebTrader |

| VantageFX | 44 | 0.008% comission | 0.008% commission | MetaTrader4/MetaTrader5, VantageFX WebTrader |

What is a Forex Mini Account?

In order to understand better what is a forex mini account, it is first important to understand the difference between a standard forex account and a mini/micro forex account. Basically, while on a Standard forex accounts users can open a position size of 100,000 base units (meaning $10 per pip), a mini account lets you open a position at a size of 10,000 base units ($1 per pip), and micro forex account allows you to open a position size of 1,000 base unit trades ($0.1 per pip).

In other words, a forex mini account is a trading account that enables users to trade with smaller size positions, and thus, it is the ideal forex account for newbie traders or for experienced who want to test a certain trading strategy in a live market environment without risking real money.

Forex Mini Accounts Lot Sizes

With forex mini accounts, users can trade with a mini lot size of 10,000 units, which is one-tenth of the position size of a standard lot account of 100,000 units. This means that when you open a trade on a forex mini account, every pip is worth $1 in comparison to $10 on a Standard account.

Forex Mini Account Pips

Before you decide to trade on a forex mini account, it is crucial to understand the value of one pip movement. Generally, forex brokers typically offer three account types – Standard, Mini, and Micro. While there are some differences between each version, the main distinction is the value of a pip. So, when you trade a forex currency pair on a Standard account that comprises the US dollar as a base currency, each pip is worth $10. On the other hand, on a mini account, each pip is $1 per pip movement, and on a micro account, a pip movement is worth just $0.1. For example, if are trading on the EUR/USD on a forex mini account and it moves from 1.1700 to 1.1701, then you’ll have a profit of $1.

Using Leverage with Mini Forex Lots

Forex brokers that offer mini accounts typically allow users to use leverage on all account types, which means that even if you use a mini forex account, your capital is worth much more. Leverage, for those who are not familiar, is a tool in trading that gives you the ability to borrow funds from your brokerage firm and use a larger amount of money than you initially deposited. For example, if you open a forex mini account at AvaTrade with a deposit of $100, that means you can control $3000 if you are a beginner trader as you get a leverage ratio of 30:1. If you are a professional trader, you’ll get a leverage ratio of 400:1.

On a side note, you do need to understand that the higher the leverage the higher the risk as the value of each pip movement increases. With that in mind, leverage is known as a double-edged sword as it has the potential to increase your profits but at the same time, it increases the chances of losing your money.

Example of a Mini Forex Trade

Given that the US dollar is the base currency, a mini lot forex position is 10,000 units, and therefore, one pip is valued at $1. So, if, for example, you decide to buy the EUR/USD at a rate of 1.1700 and the pair rises to 1.1800, then you’ll make a profit of $100 with an investment of $100 (this is a cost to open the position). Just for comparison, with a Standard account, you would make a profit of $1000 with a cost to enter the position of $1000.

Benefits of Mini Forex Accounts

As we mentioned several times in this review, there are many benefits of choosing forex brokers that offer mini accounts. Some of these include:

A Low Minimum Deposit

In most cases, the deposit amount required to open a forex mini account is significantly lower than a Standard account and typically ranges between $100-$500. This makes a mini forex trading experience ideal for beginner investors or for experienced traders that want to test the broker and the platform before making a larger investment.

A Great Way to Test Trading Strategies

Clearly, if you want to test various trading strategies without risking too much money, a forex mini account is the best solution. As opposed to a demo account, trading with real money has a huge impact on your confidence and allows you to control your emotions. Therefore, it is an effective way to establish a risk management strategy before you add more money to your live account and increase the size of the positions.

Diversification

Another important factor to consider when using a forex mini account is the ability to diversify your trading. Instead of opening one trade on a Standard account that requires 1 lot for a trade, you can open 10 positions at a size of 0.01 forex mini lot.

Conclusion

To sum up, for some people trading with one of the best forex mini account is a must-have either because they don’t have enough funds or they just want to test the platform before adding more funds to their account balance. Further, some people prefer trading small size positions of forex mini lots as it removes the tension of losing a large amount of money, and thus, provide more rational decision-making.

From our research, AvaTrade offers the best forex mini account due to the wide range of FX currency pairs, the selection of platforms, low spreads, and the low minimum deposit requirement.

67% of retail investor accounts lose money when trading CFDs with this provider.