Our free forex signals service today looks at the USD/CHF and we have the entry, stop and take profits levels for you.

Thursday’s European session sees the USD/CHF pair gaining momentum. In the first trading session, the pair pulled back to a low of 0.9127 from a high of 0.9158 in the previous session.

–Are you interested to learn more about forex signals? Check our detailed guide-

At the time of writing, the USD/CHF pair is trading at 0.9160, up 0.36% on the day.

Treasury yields rose to 0.38 percent from 1.34%. However, in contrast to the benchmark’s 10-year yield, the US dollar index (DXY) traded below 93.00, which limited USD / CHF’s gains.

In July, orders for durable goods in the US fell 0.1%, below the market expectation of a 0.3% decline.

Moreover, the Swiss franc has been under pressure after the Credit Suisse sentiment index declined by about 51 points to -7.8 in August, signaling that the pandemic outbreak in the US and China is nearing an end. An export-oriented economy would experience disruptions in its supply chain as a result.

During the US session, the S&P 500 futures were trading at 4,496, an increase of 0.22 percent, a record high.

For now, traders are waiting for US gross domestic product (GDP), corporate income, and initial claims for unemployment benefits.

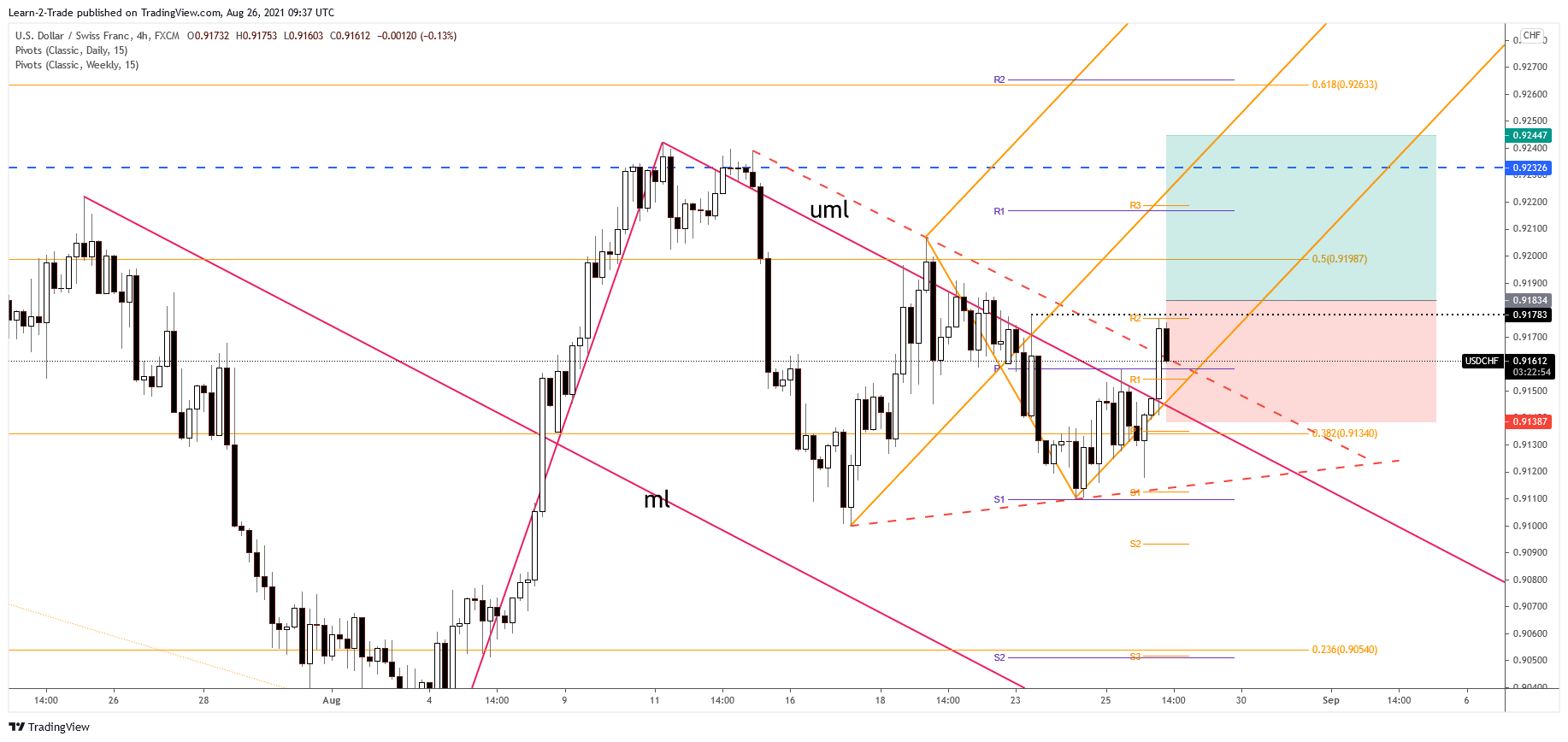

USD/CHF free forex signals

Instrument: USD/CHF

Order Type: BUY STOP

Entry price: 0.9183

Stop Loss: 0.9138

TP1: 0.9244

Our Risk Setting: 1%

Risk / Reward Ratio: 1:1.37

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.