Our free forex signals service today looks at the USD/JPY and we have the entry, stop and take profits levels for you.

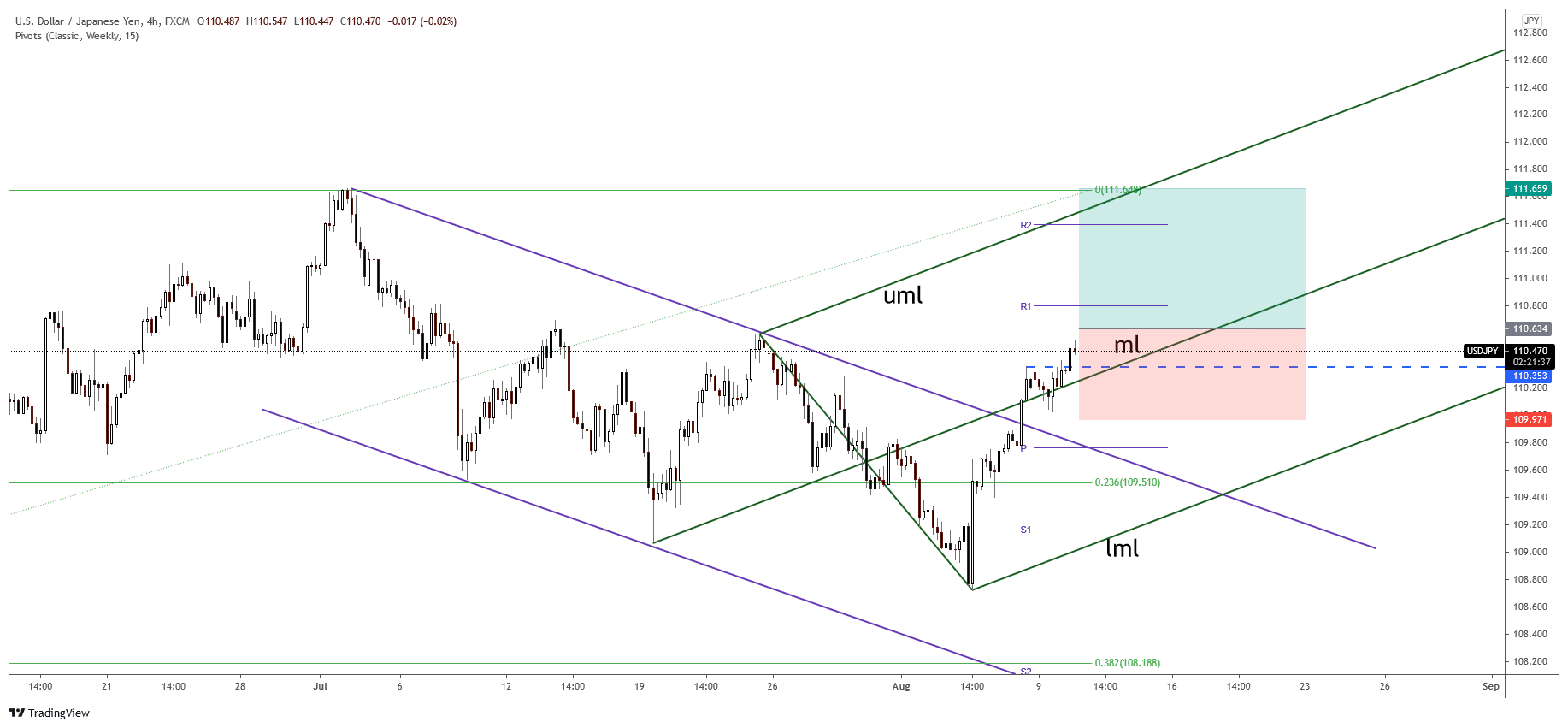

The USD/JPY pair surged to new two-week highs in the first half of the European session, and bulls are now aiming for a steady move beyond the 110.60 supply zone.

The USD/JPY pair saw several new orders on Tuesday after defending the key psychological level of 110.00 on Monday, continuing to rise from its lows in late May near 108.70. Thus, the US dollar was the main driver of yesterday’s positive trend, and it was the fourth of five days of bullish momentum.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

In the near term, investors welcomed the prospect of the Fed cutting back its monetary stimulus since the labor market is showing signs of further strengthening. However, Fed officials also began to steer the market towards early contraction, which, in turn, was seen as a key factor in the dollar’s deceleration.

Job openings reached a record 10.1 million on Monday, according to the US Bureau of Labor Statistics. The move was based on the NFP blockbuster, which forced investors to react at a point when monetary tightening is most likely to occur.

According to Atlanta Fed President Rafael Bostic, the Fed could start cutting rates between October and December or earlier if job growth continues for another month or two. In addition, Boston Fed President Eric Rosengren noted that the US Federal Reserve is due to announce in September a cut of $120 billion in monthly purchases of Treasury and mortgage bonds starting this fall.

On Tuesday, the yield on 10-year US Treasuries increased to a three-week high, surpassing 1.31% due to the revaluation of the Fed’s emissions reduction plan. However, the overall weaker risk tone and the benefits that the Japanese Yen garner from being a safe haven have done more to offset each other.

An investor’s perspective has been affected by the spread of a highly contagious Coronavirus variant called Delta that is highly contagious. However, the weakening sentiment in equity markets did little to prevent the USD/JPY price from rising to its highest level since July 26.

Data from the US economy is expected to move the market. As such, the yield on US bonds can significantly impact the dynamics of US dollar prices. As a result, the USD/JPY pair presents short-term opportunities to traders who take a broader view of market risk.

USD/JPY free forex signals

Instrument: USD/JPY

Order: BUY STOP

Entry price: 110.63

Stop Loss: 109.97

TP1: 111.65

Recommended Risk: 1%

Risk / Reward Ratio: 1:1.5

Signal validity period: Good until cancelled

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.