Our free forex signals pick for today is the USDCHF pair and we have the entry, stop and take profits levels for you. But before we get to that, let’s take a look at the wider economic and trading context for the pair.

The dominating the narrative this week is what is to be divined from the FOMC minutes out today at 11am eastern time (16:00 British Summer Time).

During the Asia session the pair has been been bid up after hitting lows at around 0.9193 yesterday and is currently trading at 0.9237, up 0.06%

The US Dollar Index is flat at 92.54% but that is slightly off the highs of 92.62% reached yesterday.

US ISM data weaker than forecast

Forex traders were surprised by the US ISM data coming in much weaker than expected, which may have encouraged some safe haven buying interest. Investors rushed to the safe haven asset after weaker-than-expected US ISM data a day ahead of the FOMC minutes.

Non-Manufacturing PMI dropped to 60.1 in June from 64 in the previous month, although that was an all-time high. Nevertheless, the reading was significantly below the market consensus view of 63.5.

US 10-year Treasury at February lows in bets against tightening

If yesterday’s fall in yields is anything to go by, then traders may be making bets that the FOMC minutes will show that the Fed is not minded to tighten anytime soon. All things being equal, that should weaken the greenback, but as mentioned, that could be countered by safe haven sentiment.

For now, the dollar looks strong against the Swiss Franc in the immediate term, so let’s get to our USDCHF free forex signals.

By the way, if you are interested in getting into automated forex trading you may wish to read our guide as an introduction.

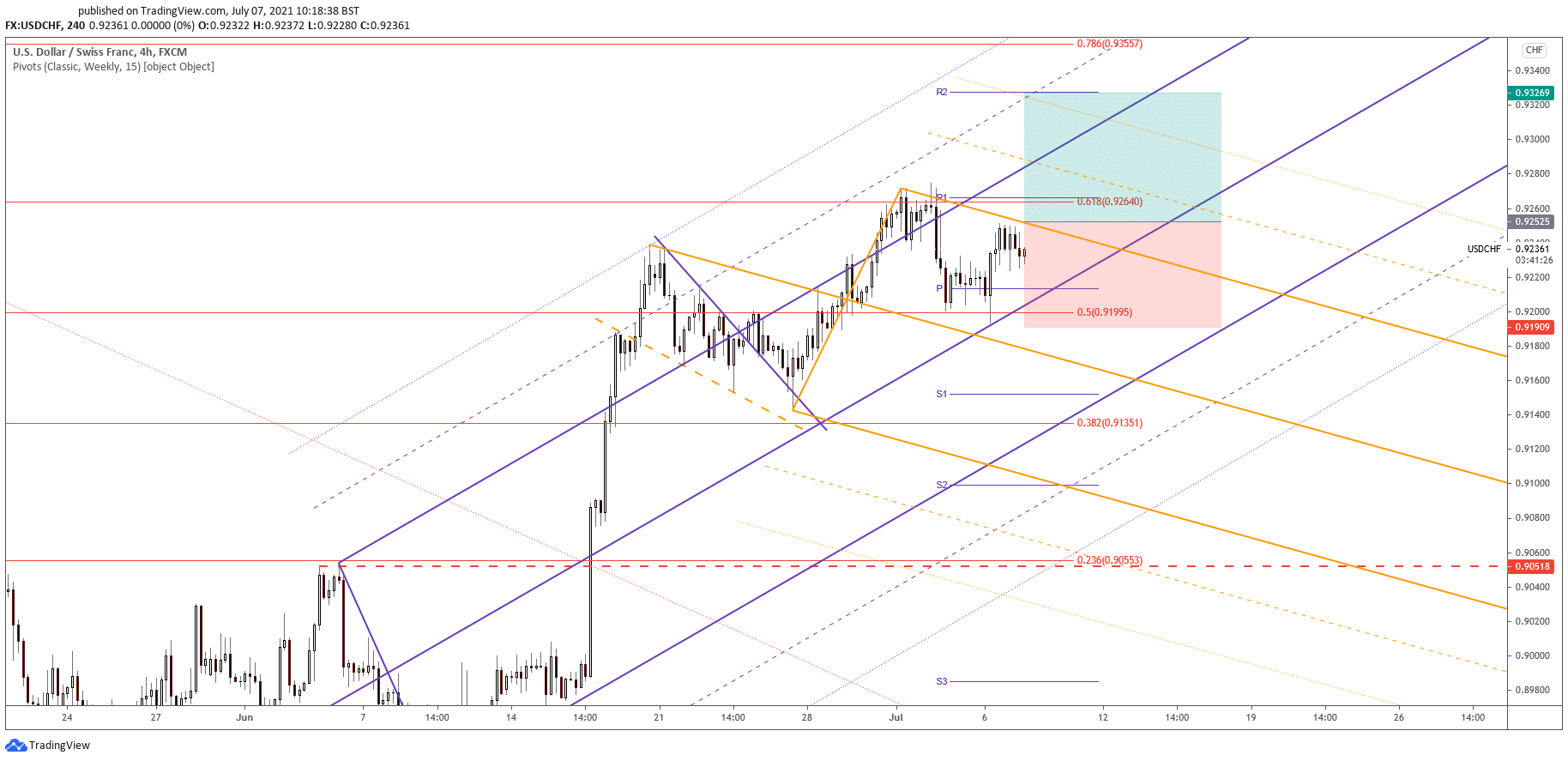

Free forex signals – Buy USDCHF

Instrument: USD/CHF

Order: BUY STOP

Entry price: 0.9252

Stop Loss: 0.9190

TP1: 0.9326

Recommended Risk: 1%

Risk / Reward Ratio: 1:1.1

Signal validity period: Good until cancelled

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.