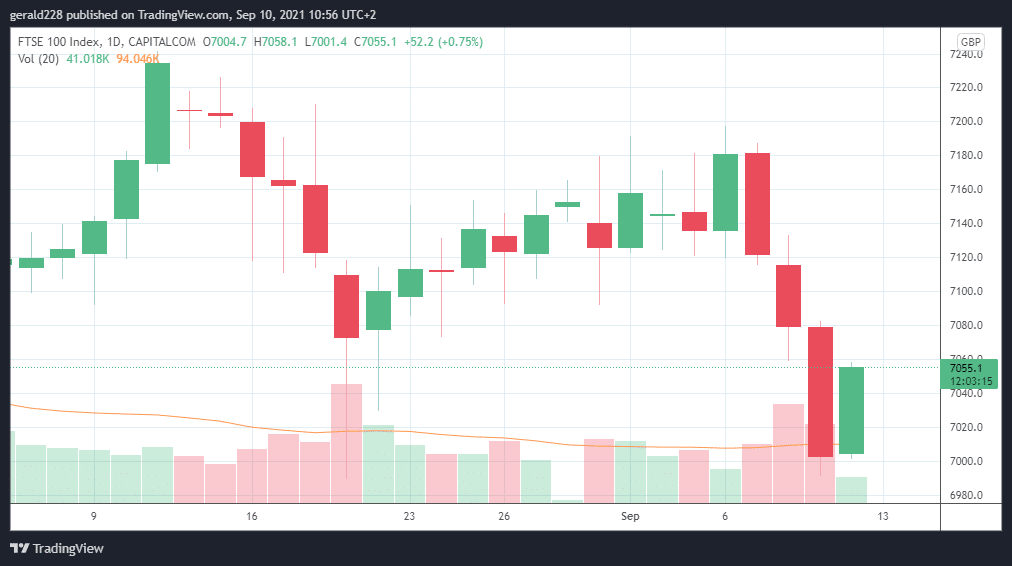

- FTSE price in positive territory after three consecutive heavy negative sessions

- High inflation, a weak jobs market and recent Social Care plan/NI raise causes havoc in FTSE stocks

- Investors cautious ahead of the weekend as much weaker than expected July growth puts a damper on economic recovery hopes.

The FTSE price has regained some positive movement forward after it experienced three sessions of heavy drops. At present the UK100 is trading at the 7046 level or an increase of 0.6%. However, inflation worries and a continually alarming job vacancy market with over 1.2 million workers still on furlough have given the FTSE the jitters this week.

Today’s announcement of a practically stationary GDP growth in July for the UK has set alarm bells ringing in economic circles. And according to the Financial Times, the UK economy would have experienced a contraction in July barring an exceptional 22% increase in mining and quarrying which added fuel to an otherwise empty tank.

Several analysts and economists are also predicting that the recent NI increase to fund the NHS and Boris Johnson’s controversial social care programme will hit growth and this would correspondingly spook investors. Today’s rise in the FTSE price is somewhat strange with all this doom and gloom around.

If you wish to begin trading forex then you should have a look at this Trading Forex For Beginner’s Guide.

Short Term Prediction For FTSE Price: More Volatility Expected As Weak Growth Numbers Suggest Recovery Muted

Although stocks are up this morning before the weekend, the FTSE price is expected to experience considerably more volatility in the short term.

It’s clear that the economic recovery has hit a brick wall for the time being as the Delta variant takes hold. With just 0.1% growth in July, sharply lower than economist’s 0.6% predictions, the services sector is practically at a standstill.

However, if a bullish trend takes over the markets, we can expect to see the FTSE price regain the 7100 level.

Investors could see the current weak figures as an opportunity to pick u stocks on the cheap although they are more likely to play a waiting game.

If the bearish trend continues, the FTSE would likely once again slip below the 7000 level. That could precipitate a major sell of more falls as Covid19 concerns, inflation worries and uncertainty over economic tapering continue to spook the markets.

If you’re interested in forex trading you should take a look at these Top Forex brokers

Long Term Price Prediction For UK100: More Uncertainty As Covid continues To Bite

With inflation expected to continue rising and a continually weakening jobs market, the long-term prospects for the FTSE price appear to be quite dark, to say the least. The implications of a rise in National insurance to fund health and social care will also have an effect on economic growth according to some analysts. This will undoubtedly have a negative effect on the long-term FTSE price.

One of these analysts is Emma Mogford, fund manager at Premier Miton Monthly Income Fund. She warns that increasing NI to fund NHS and Social Care spending could have a bad effect on growth figures.

“As the UK adjusts to a new post lock-down normal, GDP growth has slowed. The key question will be how the recent income tax hike will impact growth in the future. This week the market voted that the impact would be negative, as the share price of economically sensitive companies such as house-builders fell”, Mogford commented

It remains to be seen how the other factors such as inflation and rising Covid19 cases will continue to affect stocks but presently the outlook appears negative.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.