Economic data from the week ahead is relatively quiet. Dominating the news wires will, of course, be the OPEC meetings scheduled this week. The OPEC member nations and Russia are expected to further extend the production cuts in a bid to send oil prices higher. On the economic front, the data ahead will focus on the second revised GDP estimates for the third quarter in the U.S. GDP is forecast to rise slightly higher. Elsewhere, Canada will be reporting on the monthly GDP figures. Later in the week, data from the U.S. will include the core PCE data as well as the ISM manufacturing PMI data for the month of November.

OPEC meetings to set the tone for oil prices

Member nations of the OPEC will be convening in Vienna, Austria this week. The OPEC meetings will also be joined by Russia, one of the largest non-OPEC oil-producing nations. At the agenda, the main focus will be on whether the production cuts on oil supply from OPEC and Russia will be extended.

Recent data showed that the member nations were serious about curbing the oil output which sent crude oil prices plunging. The move, led by Saudi Arabia was seen as a measure to squeeze out the U.S. shale oil producers. However, the production supply glut came at a hefty prize for the OPEC nations. Following the decision to start curbing oil output, the nations managed to stabilize oil prices.

In October, data showed that both OPEC and non-OPEC members honored their commitment to cutting production. This combined effort from the 21 nations was an attempt to cut oil supply by 1.8 million barrels per day. So far, Iran has been exempt from the production cuts. November’s OPEC meeting will no doubt bring some volatility to the oil markets but by and large, the wider speculation is that the OPEC members will continue to extend the production cuts for the near future.

U.S. GDP and Core PCE data in focus

Economic data from the U.S. this week will be dominated by the second revised GDP for the third quarter and the core PCE data. These two data points will be important for the U.S. dollar as the markets head closer to the December FOMC meeting. Economic data from the U.S. has remained broadly positive supporting the expectations of a rate hike from the Federal Reserve this December.

The second revised estimate on the GDP is forecast to show that the U.S. economy might have increased at a pace of 3.2% during the third quarter. During the first revision, economists were expecting to see growth slowing. However, the 3.0% increase was a surprise with the data showing that the U.S. economy remained resilient despite the hurricanes that impacted the economy briefly in September.

Later in the week, the U.S. core PCE data and the monthly ISM manufacturing index data will be released. The core PCE data, which is a measure of inflation, will stand out as the final data point for the Fed. A broadly stable inflation figures will cement expectations for a December rate hike.

TECHNICAL CORNER

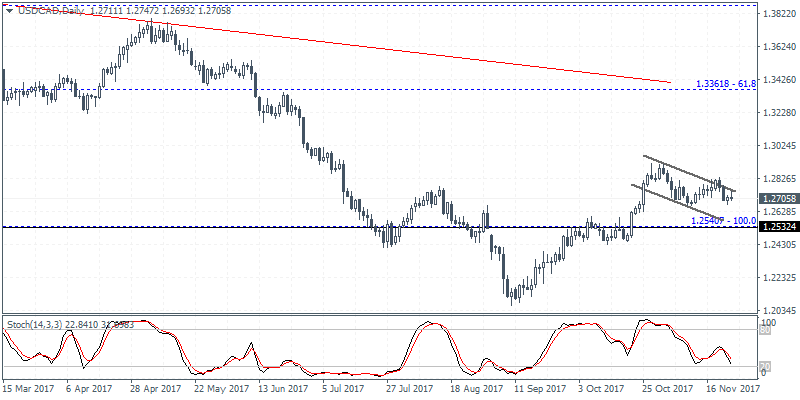

USDCAD – Bullish Flag on the weekly chart

The Canadian dollar was seen reversing the gains a few weeks ago. What started off a strong rally in the Canadian dollar, marked by two rate hikes this year saw a reversal as economic data showed a flat pace of growth. This led the Canadian dollar weaker as the U.S. dollar quickly managed to emerge strong. The recent rally in oil prices have also failed to keep the momentum going for the Canadian dollar. While the initial signs showed that the USDCAD could fall towards the 1.1956 level, price action reversed near 1.2050 region.

USDCAD (1.2705) – Weekly Chart

The bullish momentum in the Canadian dollar is seen to be clearly slipping. Economic data released over the past few weeks showed that inflation was easing back after initially posting strong gains. Likewise, the Canadian GDP was also hit after Canada’s export businesses felt the pinch of a stronger Canadian dollar in the first half of the year.

Adding to the above, the Bank of Canada took a cautious turn after hiking interest rates earlier this year. Initially, the BoC was expected to hike interest rates in December. However, the uncertainty due to the NAFTA trade talks alongside a weakening in the economy largely due to the stronger exchange rate of the loonie has now put aside the prospects of a BoC rate hike into next year.

As a result, we can expect to see some continued strength in the USDCAD. The bullish flag pattern on the weekly chart suggests a bullish rally in the making if it is validated to the upside.