After the Brexit, we had a sharp fall of the pound with a significant bounce. More falls may come, say the people at Goldman Sachs:

Here is their view, courtesy of eFXnews:

Given the potential global ramifications of the UK vote and its effect on central banks’ policies, we also place our FX forecasts under review. We will reassess our medium-term views on G10 FX as our economists revise their economic and policy outlook for major developed markets.

G10 currency moves are likely to be sharp over the next few days, after sharp moves overnight. Even though net short positions in GBP were still sizeable ahead of the referendum, they had been reduced in the past week as investors became more confident that a ‘Remain’ vote was more likely than not. We expect both Sterling and the Euro to continue to depreciate from current levels.

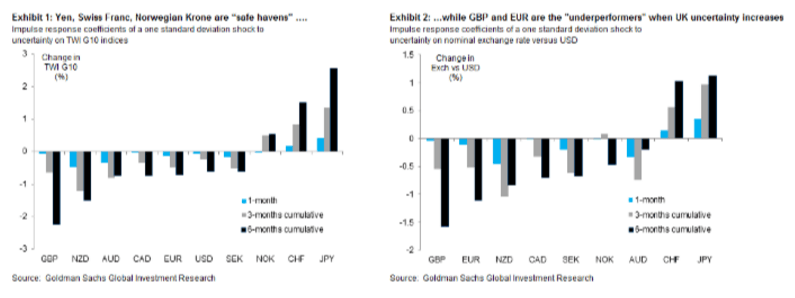

Looking ahead, we let our tactical views be guided by the analysis we published in our recent FX Views, where we estimated the impact of an uncertainty shock in the UK on G10 currencies. Based on our analysis, the risk-reward is for further downside in Sterling.

Also, our conclusion fits well with the notion that some currencies (such as the Swiss Franc and Japanese Yen) are ‘safe havens’ and tend to outperform when uncertainty increases in the UK, while others (the Euro, for example) tend to underperform.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.