The pound is one of the only currencies that managed to stay tough to Trump, but it is still a “pain trade”.

Here is their view, courtesy of eFXnews:

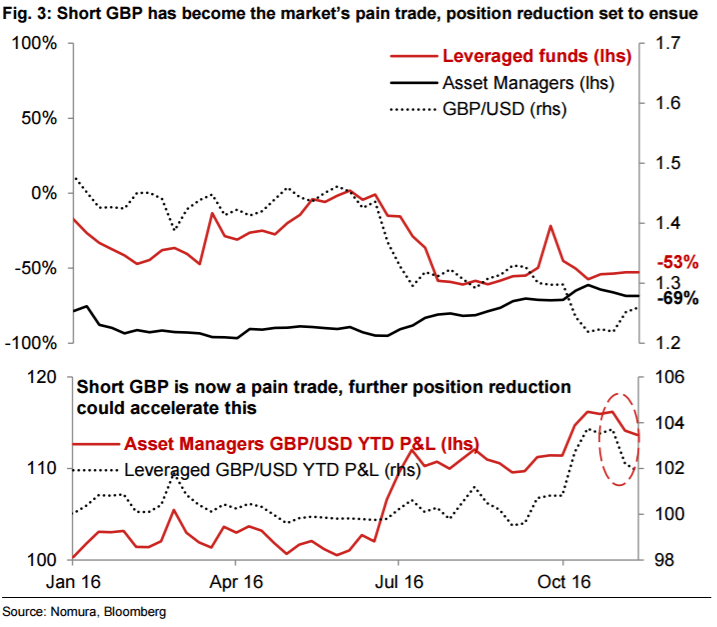

GBP’s pain trade dynamic looks set to become a self-fulfilling position reduction.

Over the next few sessions what matters from these levels is how much the position reduction/reflation trade continues. For some time now GBP has expressed EM currency characteristics, with higher yields leading to a weaker currency. However, this correlation has reverted back towards that of a reserve currency in the short term, which combined with the market’s pain trade in GBP could further express a position-reduction dynamic (see Figure 3)

Due to this being more about position reduction than hopes that the UK might get a better deal, we still expect GBP to approach the “Hard Brexit equilibrium levels” in the medium term.

But for now this pain trade cycle could see GBP/USD at 1.30 and EUR/GBP at 0.84 unless the politics give the market another wake-up call.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.