GBP/USD declined 2.4%, its worst week since mid-December. The upcoming week features GBP and Manufacturing Production. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

British PMIs showed improvement across the economy in January, but it wasn’t enough to prevent the pound from crashing last week. Final Manufacturing improved to 50.0, up from the initial reading of 49.8 points. Construction PMI climbed to 48.4, up sharply from 44.4 a month earlier. Final Services PMI was revised upwards to 53.9, up from 52.9 in the initial release.

In the U.S. there was good news from the manufacturing sector, as ISM Manufacturing PMI rose to 50.9 in January, up from 47.2 a month earlier. This figure beat the forecast of 48.5 points. This marked the first showing expansion since July. The week wrapped up with employment data, which was mixed. Wage growth came in at 0.2%, shy of the estimate of 0.3%. Nonfarm payrolls sparkled with a gain of 225 thousand. This was much stronger than the forecast of 163 thousand.

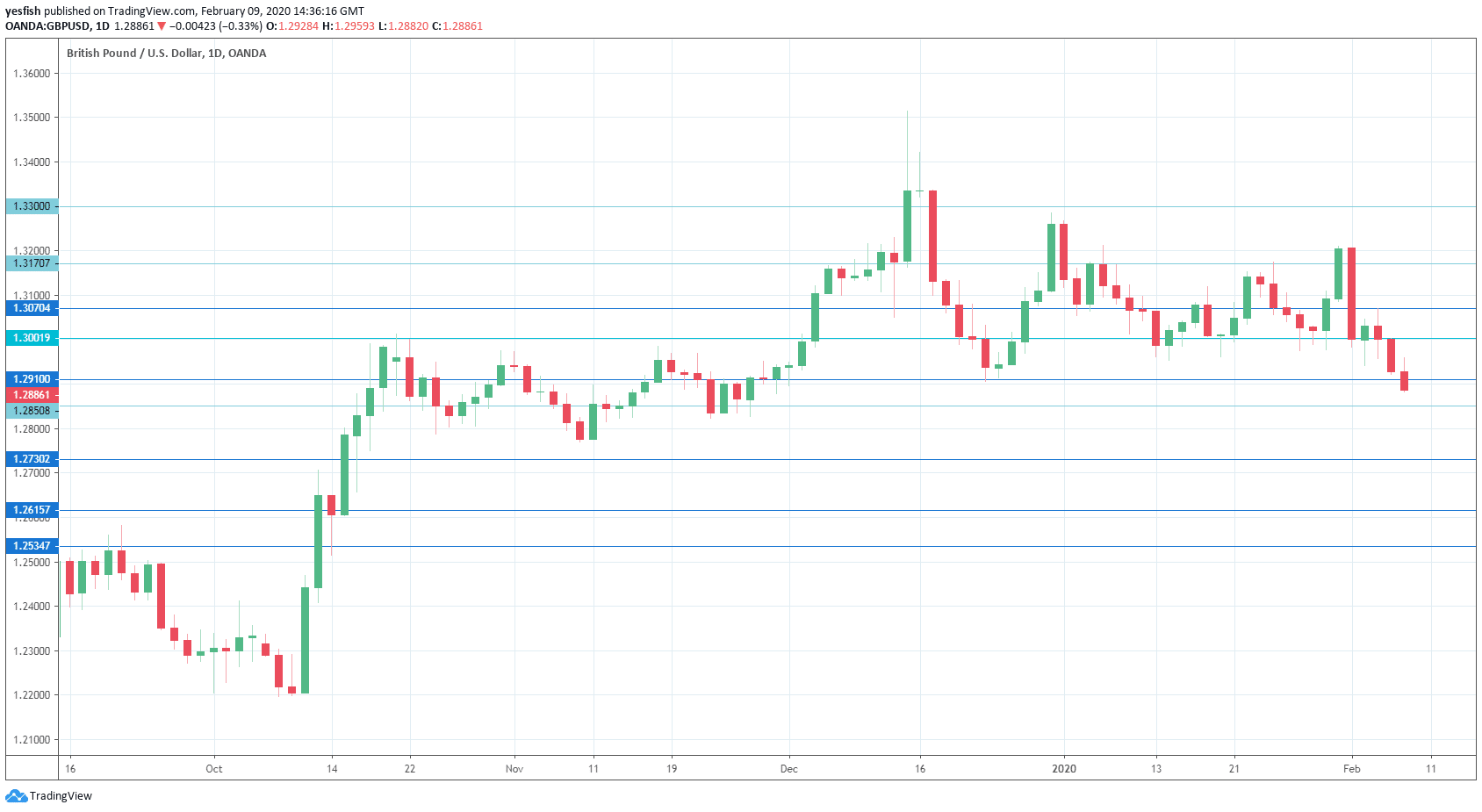

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Tuesday, 0:01. The British Retail Consortium indicator bounced back in December with a gain of 1.7%, up from -4.9%. This was much stronger than expected, as the estimate stood at -0.5%. Another gain is expected in January, with a forecast of 0.6%.

- GDP: Tuesday, 9:30. Preliminary GDP rose 0.3% in Q3, shy of the forecast of 0.4%. Still, this was higher than the Q2 release of -0.2%. The estimate for the fourth quarter stands at a flat 0.0%. The monthly GDP report came in at -0.3% in November, short of the forecast of 0.0%. This indicator has not shown a gain since July, but the forecast for December is 0.2%.

- Manufacturing Production: Tuesday, 9:30. This is a key indicator which should be treated as a market-mover. The indicator has struggled, with only one gain in the past four months. In November, manufacturing production fell by 1.7%, its sharpest decline since April 2019. Analysts expect better news in December, with an estimate of 0.5%.

- CB Leading Index: Wednesday, 14:30. The Conference Board index includes 7 economic indicators. In November, the indicator declined by 0.2%. Will we see an improvement in the December release?

- RICS House Price Balance: Thursday, 0:01. In December, 2% more surveyors reported a price decrease than those that reported an increase in prices. Better news is expected in January, as the forecast is that 3% more surveyors will report a price increase.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at the round number of 1.3300.

1.3170 has switched to a support role following GBP/USD posting gains last week. 1.3070 is next.

1.3000 (mentioned last week) was tested during the week.

1.2910 has held in support since early December. This is followed by support at 1.2850.

1.2728 is providing support. 1.2616 is next.

1.2535 has held since mid-October. It is the final support level for now.

I am neutral on GBP/USD

The pound enjoyed a strong week, pushing above the 1.32 line for the first time in a month. Can it continue the upswing? Much will depend on this week’s PMI reports. If the releases are better than expected, the rally could continue. However, soft PMIs could weigh on GBP/USD.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!