GBP/USD climbed close to 1 percent last week, its best weekly performance since early December. The upcoming week features the PMI reports. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

Mark Carney’s final meeting as Governor of the Bank of England was dramatic, as analysts were split as to whether the BoE would hold rates or trim rates from 0.75% to 0.50%. In the end, BoE members voted 7-2 to hold rates, compared to the 6-3 vote last month. This was a surprise, as many analysts and investors had expected a closer vote or even a rate cut. Carney noted that “although the global economy looks to be recovering, caution is warranted”. Investors gave a thumbs-up to the pound after the decision not to cut rates, as GBP/USD shot higher after the rate decision.

In the U.S., durable goods orders jumped 2.4%, which was a 9-month high. However, the core release declined by 0.1%, shy of the estimate of 0.4%. The Federal Reserve maintained the benchmark rate, and Fed Chair Jerome Powell said that the “Fed is determined to avoid inflation persistently running below 2%.” This could be a hint of a rate hike in the next few months, which would be bullish for the U.S. dollar. Advance GDP for the fourth quarter came in at 2.1%, as expected. This was unchanged from the third-quarter figure.

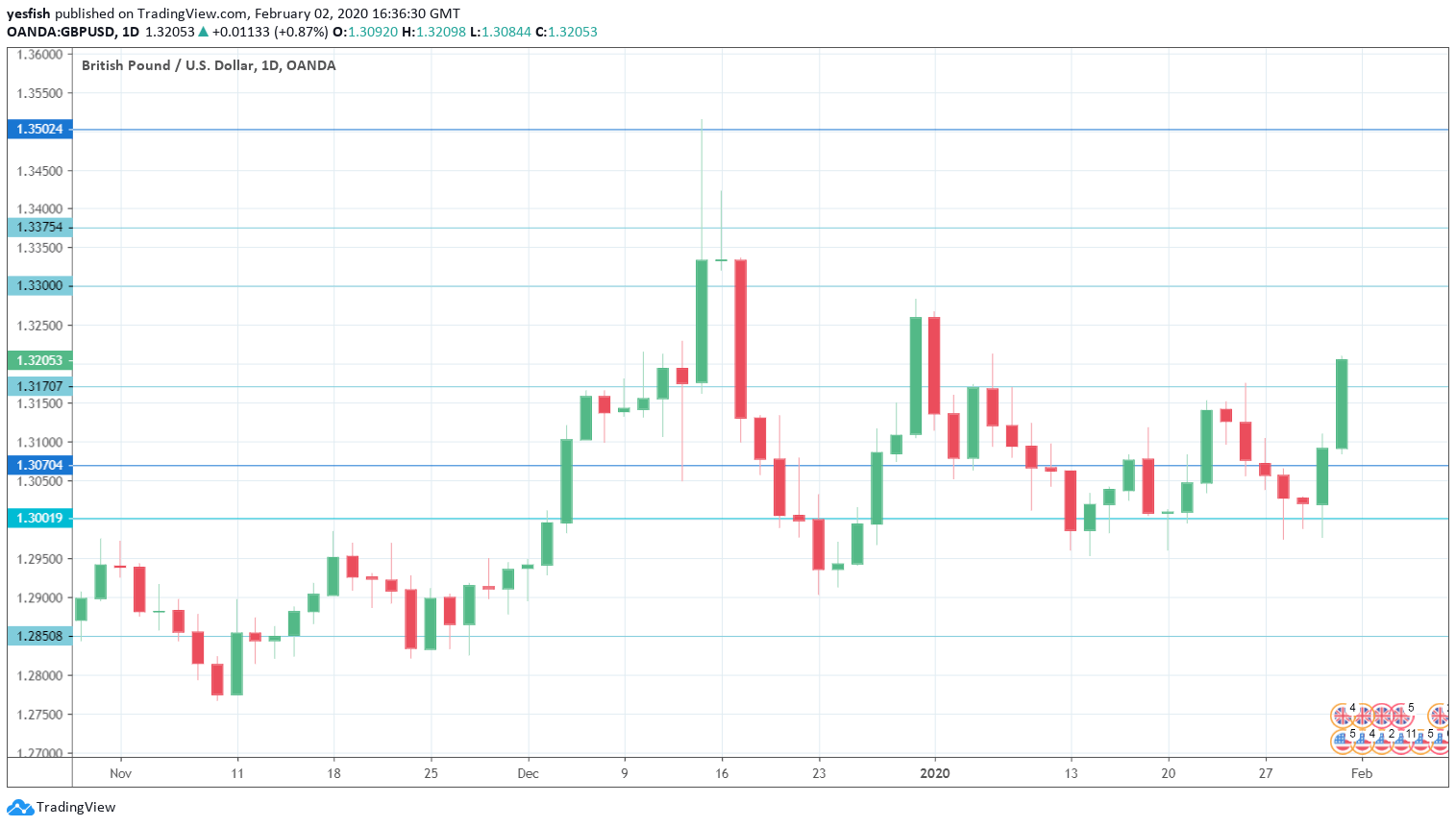

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Final Manufacturing PMI: Monday, 9:30. Manufacturing PMI dipped to 47.5 in December, down from 47.5 a month earlier. This marked a four-month low. Analysts expect an improvement in January, with an estimate of 49.8 points.

- Final Construction PMI: Tuesday, 9:30. The index remains mired in the mid-40 range, pointing to significant contraction in the construction sector. The indicator slipped to 44.4 in December, but is expected to rebound in January, with an estimate of 48.1 points.

- Final Services PMI: Wednesday, 9:30. The PMI improved to 50.0 in December, which is the separator between contraction and expansion. The upward trend is expected to continue, with an estimate of 52.9 points.

- Halifax HPI: Friday, 8:30. This housing price index gained 1.7% in December, crushing the estimate of 0.6%. This was up from the gain of 1.0% a month earlier.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at the round number of 1.3500.

1.3375 has held since mid-December, when the pound went on an extended slide. 1.3300 is next.

1.3170 has switched to a support role following GBP/USD posting gains last week. 1.3070 is next.

1.3000 (mentioned last week) was tested during the week.

1.2910 has held in support since early December.

1.2850 is the final support level for now.

I am neutral on GBP/USD

The pound enjoyed a strong week, pushing above the 1.32 line for the first time in a month. Can it continue the upswing? Much will depend on this week’s PMI reports. If the releases are better than expected, the rally could continue. However, soft PMIs could weigh on GBP/USD.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!