- GBP/USD has reacted positively to a leap in inflation after weak wage data beforehand.

- Brexit, coronavirus, and the Fed’s minutes are set to move cable.

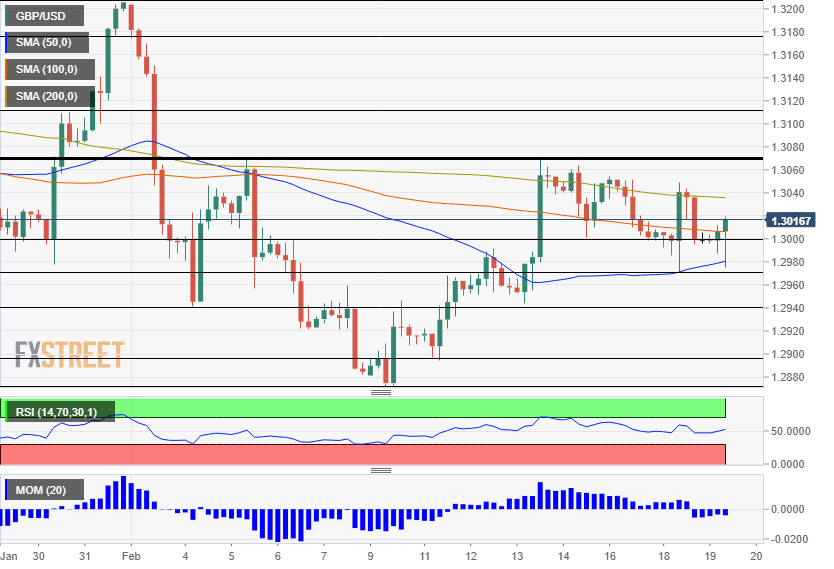

- Wednesday’s four-hour chart is showing that the double-top of 1.3070 is the next critical line.

Another “buy the dip” reaction has proved profitable for pound traders. GBP/USD has been on the rise after the Consumer Price Index jumped from 1.3% yearly to 1.8% in January – leaping over expectations, which stood at 1.6%. At around 1.3020, sterling is extending its gains.

Beforehand, it swiftly recovered from a slide it suffered after the UK reported that wage growth decelerated in December. The drop to 2.9% yearly when including bonuses and 3.2% when excluding them is seen by many as a stale figure dating the turbulent fourth quarter of 2019 – when political uncertainty peaked.

Sterling also weathered rhetoric regarding Brexit. The EU continues insisting on regulatory alignment and playing by its rules in return for easy market access. On the other hand, the UK stressed that the whole point of Brexit was that Britain would be able to set its own rules. Many expect both sides to tone down when they enter official talks in March.

Can it reach even higher ground?

The coronavirus outbreak continues taking its human and economic toll. Over 2,000 people have died, and the number of cases has topped 75,000. However, the Chinese government is encouraged by the deceleration in the infection rate and has sought to soothe markets with further stimulus, including aid to airlines and waiving social security taxes from firms.

The market mood is relatively calm on Wednesday, a significant change to Tuesday’s fears that followed Apple’s earnings warning. Further developments are awaited.

Later in the day, the Federal Reserve’s Meeting Minutes release is set to shed some light on January’s decision. Back then, the Fed left interest rates unchanged and signaled a long pause. On the other hand, markets foresee a reduction in borrowing costs later this year. The coronavirus outbreak was still in its infancy, but the document is revised and edited until the last minute, with policymakers minded of the market reaction.

See: January FOMC Minutes Preview: The economic comparisons accumulate

Ahead of the publication, Robert Kaplan, President of the Dallas branch of the Federal Reserve, supported the current policy of leaving rates unchanged. Neel Kashkari of the Minnesota Fed will speak later in the day. US Housing Starts and Building Permits are also of interest, and they will likely show that the construction sector remained robust in January.

Overall, reaction to UK figures, coronavirus headlines, and the Fed’s minutes are of interest.

GBP/USD Technical Analysis

The 50, 100, and 200 Simple Moving Averages are converging toward 1.30, which has become a central line for the pair. Momentum is not robust, but its turn to the downside serves as a bearish factor. The Relative Strength Index is balanced.

Overall, the picture is mixed with a marginal advantage for the bears.

Some support awaits at 1.2970, a swing high hit earlier this week. It is followed by 1.2940, a stepping stone on the way up. Next, we find 1.2990, another temporary low from February and 1.2875 – the 2020 trough.

Resistance awaits at the critical double-top of 1.3040. It is followed by 1.3110, a high point in late January. The next lines are 1.3175 and 1.3220.