GBP/USD showed little movement last week, closing the week at the 1.25 level. There are seven events in the upcoming week, including employment data and retail sales. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, there were no major events last week. Retail sales in BRC shops declined by 3.5% in March, its weakest release in four months. Still, this beat the forecast of -5.5 percent. There are bleak forecasts about the economy, with budget analysts saying that the economy could contract by as staggering 35% in the second quarter.

In the U.S., consumer spending plunged in March. Retail sales declined by a staggering 8.7%, worse than the estimate of an 8.0% contraction. The core reading fell by 4.5%, beating the forecast of 4.9 percent. The employment market remains in disarray, as employment claims topped the 5-million mark. On the manufacturing front, the Philly Manufacturing Index plunged to -56.6, compared to -12.7 a month earlier. This was weaker than the estimate of -30.0 points.

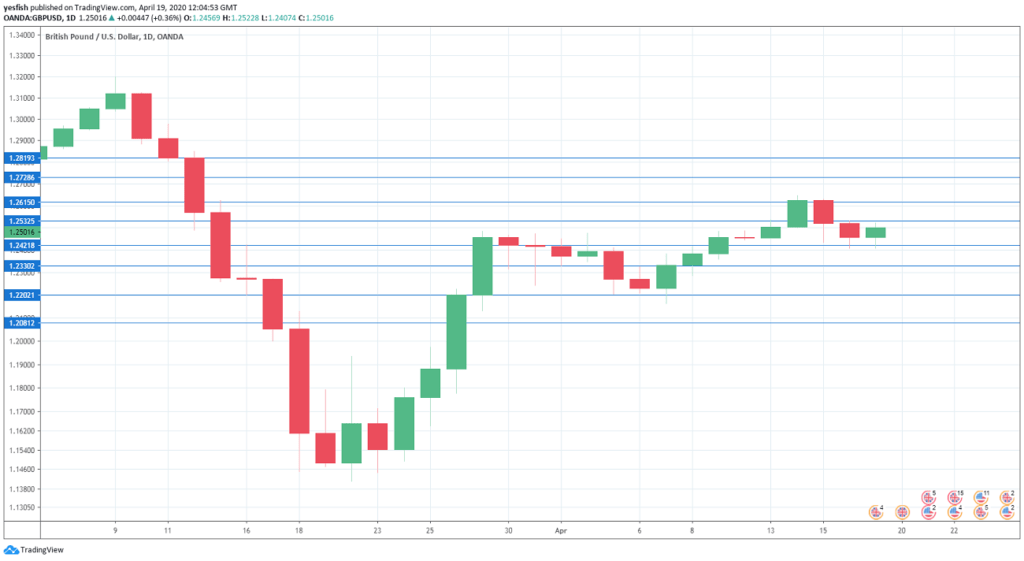

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Employment Reports: Tuesday, 6:00. The outlook for the job market is bleak, as the COVID-19 outbreak has paralyzed the UK economy. Wage growth improved to 3.1% in January, up from 2.9% a month earlier. The estimate for February stands at 3.0%. Unemployment claims jumped to 17.3 thousand in February, up from 5.5 thousand and much higher than the estimate of 6.2 thousand. The unemployment rate in January edged up to 3.9% from 3.8%, its highest level since June. No change is expected in the unemployment rate.

- Inflation: Wednesday, 6:00. With economic activity sharply lower, inflation levels are expected to fall. CPI edged lower to 1.7% in February, down from 1.8%. The estimate for March stands at 1.5%. Core CPI rose to 1.7%, up from 1.6%, The March forecast is 1.6%.

- Manufacturing PMI: Thursday, 8:30. The manufacturing sector remains in contraction territory, with readings below the 50-level. The Final Manufacturing PMI for March came in at 47.8, above the estimate of 47.1 points. Analysts are braced for the PMI to fall to 42.5 in April.

- Services PMI: Thursday, 8:30. The services sector is in deep contraction, as most businesses remain under lockdown. The Final Services PMI came in at 34.5 and analysts are bracing for a drop to 29.6 points.

- CBI Industrial Order Expectations: Thursday, 10:00. The indicator fell to -29 points in March, down from -18 a month earlier. The indicator is expected to slide to -50 in April.

- GfK Consumer Confidence: Thursday, 23:01. The indicator came in at -9 points in March, and an interim release in early April plunged to -34, due to the impact of COVID-19. Will we see an improvement in the upcoming release?

- Retail Sales: Friday, 6:00. Retail sales has sputtered, with only one gain since July. In February, the indicator declined by 0.3%, missing the estimate of +0.2%. Another decline could weigh on the British pound.

GBP/USD Technical analysis

Technical lines from top to bottom:

1.2820 has held in resistance since early March. 1.2728 is next.

1.2616 switched to resistance in early March, after providing support since October.

1.2535 is an immediate resistance line. It could see action early in the week.

1.2420 (mentioned last week) is providing support. This is followed by 1.2330.

The round number of 1.22 has provided support since the first week in April.

1.2080 is protecting the symbolic 1.20 level. It is the final support line for now.

I remain bearish on GBP/USD

The U.S. economy is showing serious signs of strain, but the British economy is in even worse shape. The dollar remains the currency of choice in the current crisis, and the pound will be hard-pressed to hold its own against the greenback.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!