GBP/USD gained 1.5% last week, recovering the losses seen a week earlier. There are only two events in the upcoming week. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

Most of the U.K. has come to a grinding halt, as the economy has been paralyzed by the Corvid-19 outbreak. The GfK consumer confidence survey plunged to -39 points, as consumers remain deeply pessimistic about the economy. Construction PMI slowed to 39.3, pointing to deep contraction. This was sharply lower than the previous reading of 52.6 points. The economy continues to struggle, as GDP declined by 0.1% in February, after a reading of zero a month earlier. Manufacturing production was unexpectedly strong in February, with a gain of 0.5%. This beat the estimate of 0.2% as well as the previous release of 0.2 percent.

In the U.S., employment numbers were dismal, as the COVID-19 virus has paralyzed much of the U.S. economy. Jobless claims soared to 6.6 million, more than double to 3.2 million a week earlier. Nonfarm payrolls fell by 701 thousand, much worse than the estimate of -100 thousand. The unemployment rate shot up to 4.4% up from 3.5 percent. The estimate stood at 3.8 percent. On the manufacturing front, ISM Manufacturing PMI slowed to 49.1 down from 50.1 a month earlier. A reading below the 50-level indicates contraction. Still, the reading easily beat the estimate of 44.9 points.

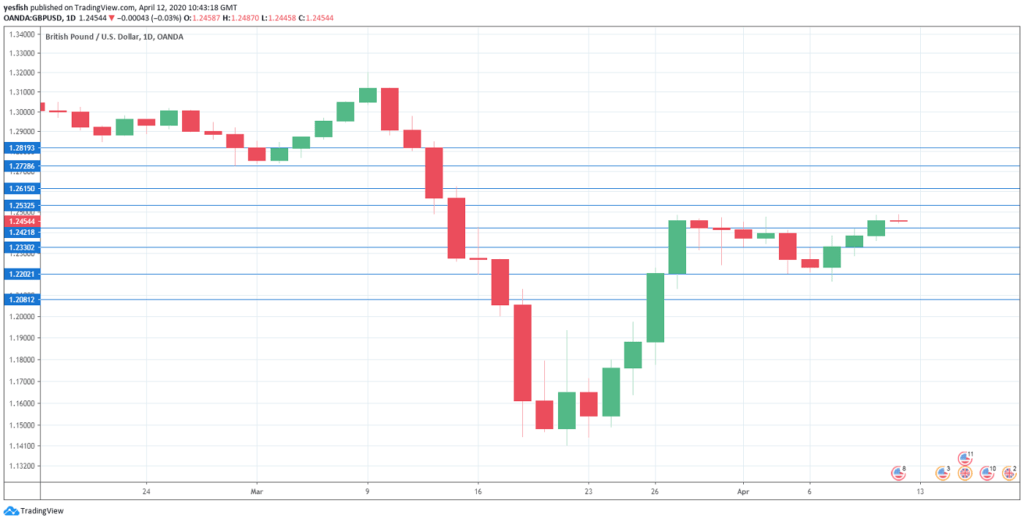

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Wednesday, 23:01. This indicator gauges consumer inflation in BRC shops. In February, the indicator fell 0.4%, down from zero a month earlier. This reading missed the estimate of +0.2%. Analysts are braced for a sharp decline of 5.5% in March, as consumer spending has plunged, with much of the economy on lockdown.

- BOE Credit Conditions Survey: Thursday, 8:30. The Bank of England’s quarterly report details lending conditions. Higher levels of debt may pose a risk but also imply confidence in the growth of the economy. The survey provides projections for the next three months.

GBP/USD Technical analysis

Technical lines from top to bottom:

1.2820 has held in resistance since early March. 1.2728 is next.

1.2616 switched to resistance in early March, after providing support since October.

1.2535 is next.

1.2420 (mentioned last week) remains relevant. It switched to a support role last week after strong gains by GBP/USD. This is followed by 1.2330.

The round number of 1.22 is providing support.

1.2080 is protecting the symbolic 1.20 level. It is the final support line for now.

I remain bearish on GBP/USD

There is plenty of volatility in the currency markets, but the dollar remains the currency of choice for jittery investors. The British economy is struggling, and the outlook for the pound remains bearish.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!