It was a relatively calm week for GBP/USD, which declined by 1.5 percent. There are six events in the upcoming week, including GDP and Manufacturing Production. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

The UK’s current account deficit narrowed significantly to 5.6 billion pounds in Q4, down from 15.9 billion in Q3. This reading beat the estimate of -7.0 billion. Final GDP for Q4 came in at 0.0%, confirming the initial reading. The Manufacturing PMI slowed to 47.8 in March, pointing to contraction. This was down from 51.7, and missed the forecast of 47.1 points. The Services PMI plunged to 34.5, down from 53.2 points. The reading was close to the estimate of 34.7 and indicates deep contraction in the services sector.

In the U.S. employment numbers were dismal, as the COVID-19 virus has paralyzed much of the U.S. economy. Jobless claims soared to 6.6 million, more than double to 3.2 million a week earlier. Nonfarm payrolls fell by 701 thousand, much worse than the estimate of -100 thousand. The unemployment rate shot up to 4.4% up from 3.5 percent. The estimate stood at 3.8 percent. On the manufacturing front, ISM Manufacturing PMI slowed to 49.1 down from 50.1 a month earlier. A reading below the 50-level indicates contraction. Still, the reading easily beat the estimate of 44.9 points.

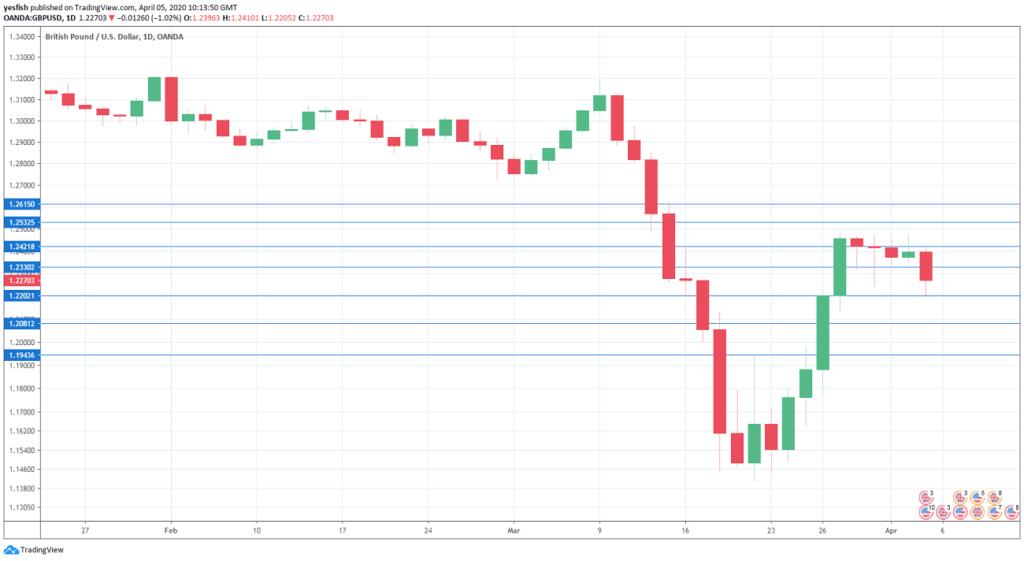

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Construction PMI: Monday, 8:30. There was positive news from the construction sector in February, as the PMI improved to 52.6, which pointed to expansion after a long streak of readings below the 50-level, which points to contraction. Analysts are bracing for a weak reading of 44.0, which points to contraction.

- Halifax HPI: Tuesday, 7:30. This housing inflation indicator edged down to 0.3% in February, down from 0.4%. This marked a 4-month low. The downtrend is expected to continue, with an estimate of 0.2%.

- RICS House Price Balance: Wednesday, 23:01. This housing indicator has been steadily improving. In February, 29% more surveyors reported a price increase than those that reported a decline. This was up from the reading of 17% a month earlier. The estimate for the upcoming release stands at 11%.

- GDP: Thursday, 8:30. The monthly GDP release came in at 0.0% in January, pointing to stagnation. The February estimate is a weak gain of 0.1%.

- Manufacturing Production: Thursday, 8:30. Manufacturing production slowed to 0.2% in January, down slightly from 0.3%. Another gain of 0.2% is expected in February.

- CB Leading Index: Friday, 13:30. This minor event recorded a weak gain of 0.1% in January. We now await the February data.

GBP/USD Technical analysis

Technical lines from top to bottom:

1.2616 switched to resistance in early March, after providing support since October.

1.2535 is next.

1.2420 (mentioned last week) has switched to a resistance role after GBP/USD broke below this line last week. This is followed by 1.2330.

The round number of 1.22 is providing support.

1.2080 is protecting the symbolic 1.20 level.

1.1944 is the final support line for now.

I remain bearish on GBP/USD

Despite awful employment data out of the U.S., the dollar remains the currency of choice for jittery investors. The British economy is struggling, and the outlook for the pound remains bearish.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!