GBP/USD jumped 2.2% last week, as the pair enjoyed its strongest week since March. The upcoming week has five events, including the Bank of England rate decision. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, retail sales pushed into expansion territory for the first time in five months. according to the Conference Board monthly survey of sales volume. The indicator jumped from –37 to 4, easily surpassing the forecast of -27. Net lending to consumers improved to GBP 1.8 billion, up from -3.4 billion beforehand.

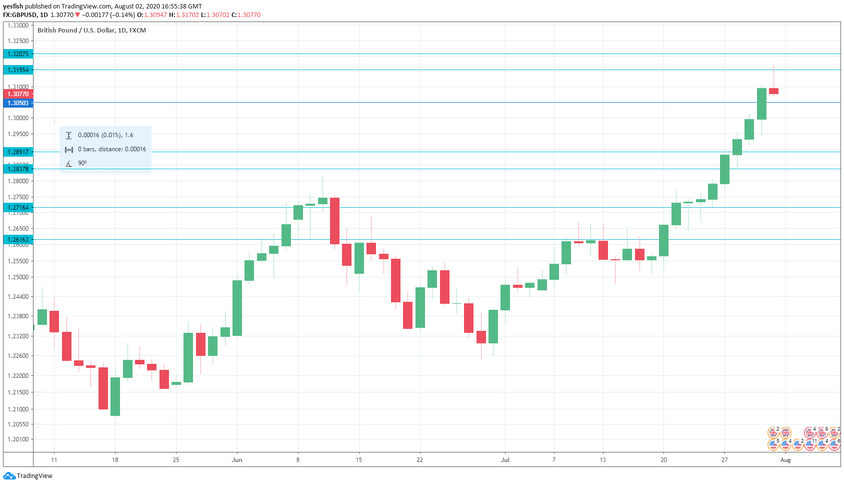

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Final Manufacturing PMI: Monday, 8:30. Manufacturing improved to 53.6 in June, up from 50.1 beforehand. The second reading is projected to confirm the initial read.

- Final Services PMI: Wednesday, 8:30. In April, the services sector slumped to 13.4 but has recovered nicely and posted a reading of 56.6 in June, which indicates expansion. The second release is expected to confirm the initial reading.

- BoE Financial Stability Report: Thursday, 6:00. The Bank of England publishes its thorough report on financial stability twice a year. Apart from the details on banks, the BOE also makes available some economic assessments which are relevant to monetary policy.

- Construction PMI: Thursday, 8:30. The PMI jumped to 55.3 in July, up sharply from 28.9 beforehand. The upswing is expected to continue, with an estimate of 57.0.

- BoE Rate Decision: Thursday, 11:00. With the British economy still grappling with the devastating effect of Covid-19, the BoE is expected to maintain the official bank rate at 0.10%. Investors will be keeping a close eye on the quarterly monetary policy report, which will include inflation and economic growth forecasts.

Technical lines from top to bottom:

With GBP/USD recording sharp gains, we start at higher levels:

1.3312 has held in resistance since December 2019.

1.3207 is next.

1.3154 was tested in resistance late in the week.

1.3049 is an immediate support level.

1.2891 has switched to a support role following sharp gains by GBP/USD last week. This is followed by 1.2838.

GBP/USD broke above 1.2718 (mentioned last week) in mid-July, when the pound started the current rally.

1.2616 is the final line for now.

I am bullish on GBP/USD

The UK economy is faltering, but the broad weakness of the US dollar has allowed the pound to jump on the bandwagon and climb to multi-month highs. With the US economy struggling with Covid-19, it could be another good week for the British pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!