GBP/USD Technical Analysis

GBP/USD suffered its worst week in three months, falling 1.5%. The upcoming week has six events, including GDP. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, the monthly GDP report continues to slow, and fell to 0.4% in October, its lowest level in six months. Manufacturing numbers were strong, as Industrial Production and Manufacturing Production rose 1.3% and 1.7%, respectively.

In the US, headline and core inflation both rose slightly, from 0.0% to 0.2%. PPI was also weak, with the headlined and core releases coming in at a negligible 0.1%. Unemployment claims surged to 853 thousand last week, up from 712 thousand. This points to weakness in the labor market, as the economy continues to struggle. The week wrapped up on a positive note, as UoM Consumer Sentiment improved to 81.4 in December, up from 77.0 beforehand.

.

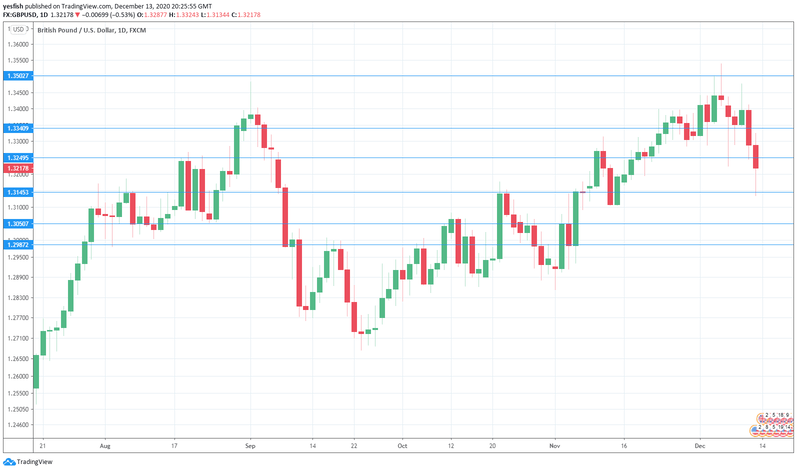

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Employment Report: Tuesday, 7:00. Wage growth has been steadily improving and posted a gain of 1.3% in September, its first gain in five months. The upswing is expected to continue in October, with an estimate of 2.2%. Claimant Count fell by 29.8 thousand in October but is expected to rise by 10.5 thousand in November. The unemployment rate is forecast to rise to 5.2%, up from 4.8%.

- Inflation Report: Wednesday, 7:00. Inflation has been moving higher and reached 0.7% in October. The estimate for November is 0.6%. The core reading is expected at 1.4%, little changed from the previous read of 1.5%.

- PMIs: Wednesday, 9:30. Manufacturing continues to show growth, as the October PMI came in at 55.6. We now await the November release. The Services PMI came in at 47.6, which points to contraction. The estimate for November is 50.5.

- BoE Rate Decision: Thursday, 12:00. The last policy meeting of the year could be a quiet one for the BoE. Policymakers are expected to keep the Official Bank Rate at 0.10% and maintain the current level of QE at GBP895 billion.

- GfK Consumer Confidence: Friday, 12:01. Consumer confidence remains mired in negative territory, and another weak reading of -30 is expected.

- Retail Sales: Friday, 7:00. After a string of solid gains, retail sales is expected to drop sharply in October, with a forecast of -4.0%.

Technical lines from top to bottom:

We start with resistance at 1.3502 (mentioned last week).

1.3340 is next.

1.3249 is a weak resistance line.

1.3145 is the first support level.

1.3051 is next.

1.2987 is the final support level for now.

I am neutral on GBP/USD

The markets had priced in a Brexit deal, but with no agreement yet in place, investors showed their concern and the pound tumbled. If the impasse continues, GBP/USD could fall below the 1.30 level.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!