- Manufacturing PMI: Monday, 9:30. Manufacturing remains in expansionary territory, but the PMI slowed to 52.9 in January, its lowest level since June. The final reading is expected to confirm the initial estimate.

- Services PMI: Wednesday, 9:30. The Services PMI slowed sharply to 38.8, down from 49.4 previously. This points to sharp contraction. The final release is expected to confirm the initial estimate.

- Construction PMI: Thursday, 9:30. The Construction PMI is expected to dip to 53.0, down from 54.6 beforehand. This would be its lowest level since May.

- BoE Rate Decision: Thursday, 12:00. The Bank of England is expected to stand pat and maintain interest rates at 0.10%. Investors will be interested in the MPC quarterly report, which will provide a close look at the health of the UK economy.

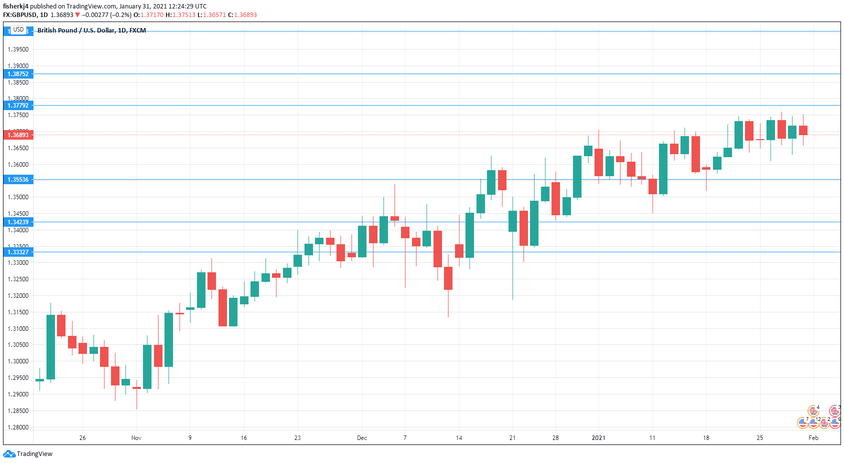

Top to bottom:

We start with resistance at 1.4005.

1.3875 is next.

1.3779 has held in resistance since May 2018.

1.3666 (mentioned last week) is an immediate support line.

1.3553 is next.

1.3423 has held in support since late December.

1.3327 is the final support level for now.

.

I am neutral GBP/USD

The US dollar has shown some improvement in the month of January, after the pound registered sharp gains late in 2020. The UK economy is being hampered by Covid lockdowns, while in the US a dovish Fed and more stimulus could be bearish for the US dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!