GBP/USD had yet another exciting week, with contradicting UK figures and high volatility in the US dollar. Will this continue? The pound faces public appearances by Carney, a revision of GDP and the all-important jobs report Here are the key events and an updated technical analysis for GBP/USD.

UK inflation remained stubbornly high at 3%, but retail sales badly disappointing by rising only 0.1% in January. The data rocked the pound. The moves in the US dollar were even wilder. US inflation beat expectations, but the dollar soon pared its gains and went into a free-fall. It later recovered, but cable close above 1.40.

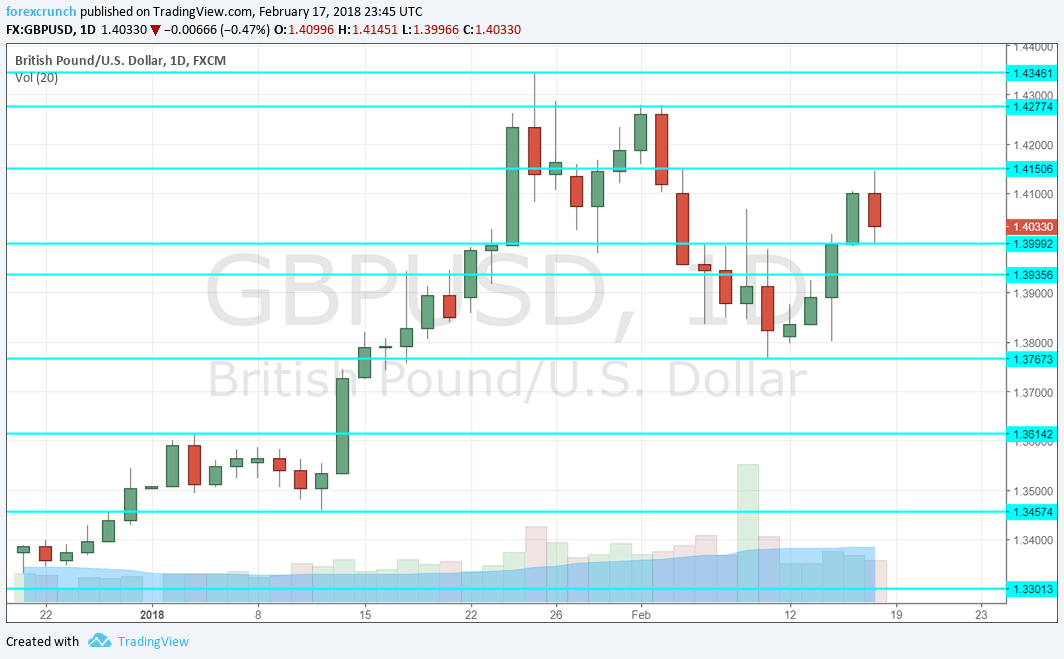

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Monday, 00:01. Rightmove’s House Price Index surprised with a rise of 0.7% in home prices in December. The report for January may be similar.

- Mark Carney talks: Monday, 18:45. The Governor of the Bank of England will deliver a speech at Regent’s University in London and will also answer questions. The focus will likely be on the Bank’s recent hawkish shift. Are they going to raise rates in May? This is a key question.

- CBI Industrial Order Expectations: The Confederation of British Industry’s 550-strong survey dropped in January to 14 points, still a positive score and slightly above early estimates. A drop to 12 is expected for February.

- UK jobs report: Wednesday, 9:30. The Bank of England has shifted to a hawkish stance, noting that rates may rise at a quicker pace than had been anticipated. Inflation has also remained stubbornly high at 3% y/y. But what about wages? The average hourly earnings component of the jobs report remains the primary detail. It is expected to remain at 2.5% y/y in December. The unemployment rate carries expectations for staying unchanged at 4.3% in December while the Claimant Count Change carries expectations for a small rise of 2.3K in January after 8.6K beforehand. A big jump in the latter figure may steal the show from wages if they remain unchanged.

- Public Sector Net Borrowing: Wednesday, 9:30. The government borrowed only 1 billion pounds from the public, better than had been expected in December. This time, net borrowing is expected to be negative, a surplus for the government, of around 11 billion pounds.

- Inflation Report Hearings: Wednesday, 14:15. Governor Carney and some of his colleagues will testify in parliament around the recent inflation report. This is an opportunity for them to spell out their views and perhaps hint about monetary policy. This comes on the day that the UK releases the jobs report, allowing them to respond and to be grilled about the data.

- UK GDP (second release): Thursday, 9:30. The British economy grew at a faster pace in Q4 2017: 0.5% q/q. However, the UK still lags behind its major peers. A confirmation of this read is likely now. Any deviation may rock the pound.

- CBI Realized Sales: Thursday, 11:00. The Distributive Trades Survey, as it is also known, is projected to bounce back from 12 to 15 points, indicating higher volume.

- David Ramsden talks: Friday, 12:00. The BOE Deputy Governor will appear at a panel in Cambridge and may also add his views on the economy and on inflation. He is a relatively new member.

BP/USD Technical Analysis

Pound/dollar made a quick dip under 1.3830 (mentioned last week) before turning upwards and closing above 1.40.

Technical lines from top to bottom:

1.4345 is the January 2018 swing high that is worth watching. 1.4280 was a top line in early February and it comes next.

1.4150 capped the pair in mid-February. It is followed by the round level of 1.40, which is eyed by many.

1.3935 temporarily held the pair back at the same time. 1.3765 was the low point in early February.

1.3620 capped the pair on its way up and then turned into support. 1.3550 was the November peak.

I remain bearish on GBP/USD

The UK economy is showing signs of weakness. If the jobs report falls short of expectations and we see more jitters in stocks, cable could crumble.

Our latest podcast is titled Volatility is back with a vengeance and the perky pound

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!