- USD firmness limits the upside for the GBP/USD pair.

- EU demands Brexit minister to stop ‘political posturing’ over NI protocol.

- Inflation worries downplayed by Bailey, risk trends, Brexit in focus.

The GBP/USD price forecast remains rangebound as the attempt to correct higher is capped by a stronger Greenback and Brexit woes.

–Are you interested to learn more about forex signals? Check our detailed guide-

As risk sentiment improves, the GBP/USD pair attempts a moderate rebound to 1.3450 ahead of the European open. Despite this, further upside potential appears elusive given a strengthening US dollar and Brexit concerns.

After hitting an intraday low of 1.3428, the pair is now recovering from losses of around 1.3445.

S&P 500 futures, which have gained 0.31% so far, rebounded from a negative open amid improving market sentiment.

The markets seemed unaware of renewed concerns over COVID-19 in Europe as expectations of faster spending cuts by the Fed amid a stronger US economy buoyed sentiment. However, despite the recent gains in the US dollar and a rebound in government bond yields, further recovery seems elusive.

On Friday, the US dollar retested its 16-month highs against its major counterparts after a wave of risk mitigation hit financial markets amid renewed fears of a possible lockdown in Europe amid the Coronavirus outbreak. As a result, dollar demand caused the major currency to drop to 1.3408.

The Vice President of the European Commission, Maros Sefcovic, accused British Brexit Secretary David Frost of “political posturing” about the Northern Ireland Protocol (NI) and called for increased urgency in the Brexit negotiations.

Investors digest Bank of England Governor Andrew Bailey’s remarks from the weekend. Bailey said inflation may continue to rise for longer, but it will likely be less stable than expected.

Thanks to some new trade incentives, there is no sign of a slowdown in existing home sales in the US. However, general market sentiment, Brexit headlines, and the strength of the US dollar will continue to drive cable prices up.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

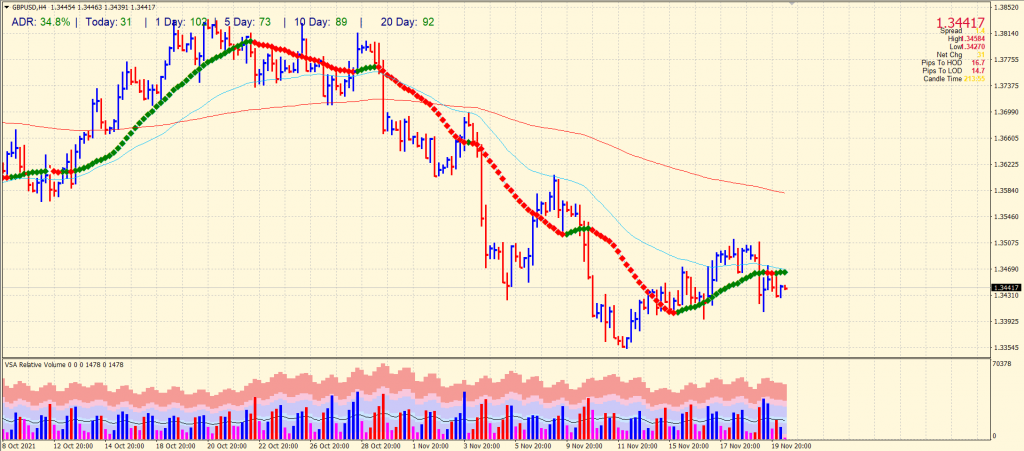

GBP/USD price technical forecast: Bulls find no respite

The GBP/USD price remains consolidative after finding a strong rejection near the 1.3500 handle. The pair is depressed below the 20-period and 50-period SMA on the 4-hour chart. Volume is favoring the bearish bias for now. The probability of testing the lows of 1.3330 cannot be ruled out. Any upside attempt will find hurdles at 1.3460 ahead of 1.3500.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.