GBP/USD advanced in the final week of 2017, taking advantage of the weakness of the US dollar and closing just above 1.35. Will this continue into 2018? Apart from the return of liquidity, we have lots of economic indicators, with the PMIs standing out. Here are the key events and an updated technical analysis for GBP/USD.

High street lending missed expectations by sliding below 40K to 39.5K. Nevertheless, with few economic releases nor meaningful political developments, cable mostly moved on the weakness of the US dollar. End-of-year adjustments to portfolios and some weak data kept the greenback under pressure.

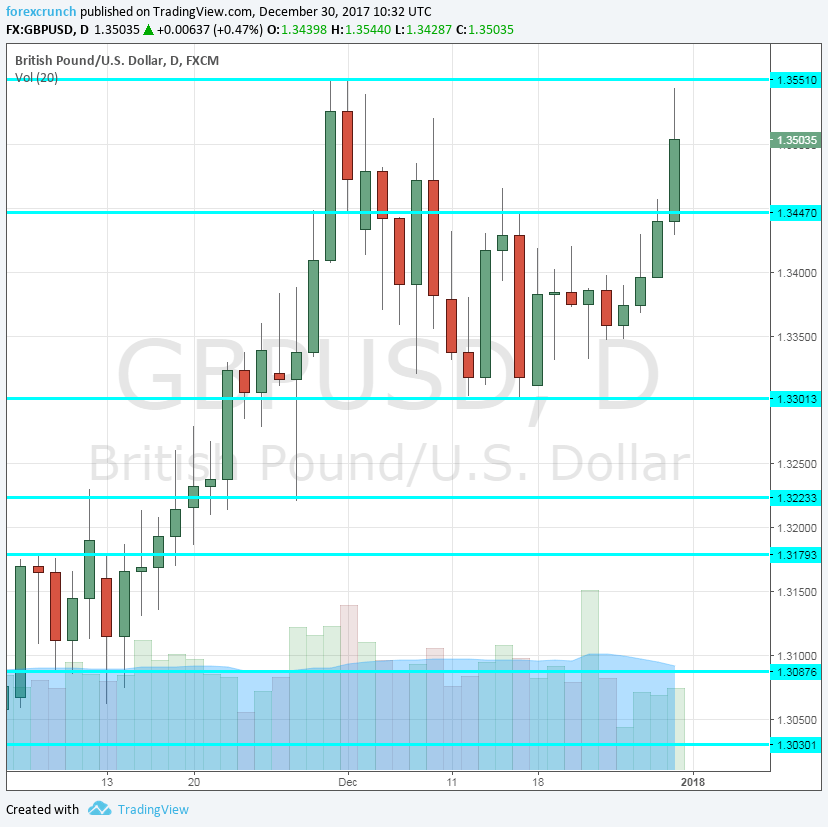

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Tuesday, 9:30. The manufacturing sector opens the series of three purchasing managers’ indices and is also the first economic indicator of 2018. According to Markit’s survey, this small yet important sector has been doing well in November, with a score of 58.2 points. The weaker pound made exports of manufactured goods more attractive. A score of 58 points is expected for December.

- Construction PMI: Wednesday, 9:30. The construction sector lagged behind and the PMI even dipped into contraction territory a few months ago. In November, things were looking slightly better with 53.1 points. A tick up to 53.2 is predicted.

- Nationwide HPI: Thursday, 7:00. The House Price Index provided by Nationwide is released very early. In November, it showed a rise of 0.1% in prices, slower than the previous two months. A repeat of a 0.1% rise is projected.

- UK Services PMI: Thursday, 9:30. Services is by far the largest sector of the British economy and the PMI usually triggers quite a bit of volatility. In November, Markit’s measure disappointed by returning back down to 53.8 points, reflecting moderate growth and showing that October’s rise was a one-off. Expectations of managers about Brexit will undoubtedly shape the result and the prospects going forward. A small increase to 54.1 points is forecast.

- Net Lending to Individuals: Thursday, 9:30. Net lending squeezed in October to 4.8 billion, but it still beat expectations. Higher levels of lending imply enhanced economic activity later on. A similar level of 4.9 billion is on the cards.

- M4 Money Supply: Thursday, 9:30. The amount of money in circulation surprised with a big bounce in October: 0.6%. We will now get the data for November, the month when the BOE raised rates. A rise of 0.4% is estimated.

- Mortgage Approvals: Thursday, 9:30. The official number of mortgage approvals lags the High Street Lending report, but still provides a wider picture of the housing sector. In October it showed yet another small slide of 1K to 65K. Yet another drop to 64K is expected.

- BRC Shop Price Index: Friday, 00:01. The British Retail Consortium showed a minor drop in prices in its member stores: 0.1% in November. We may see a bump up for December.

- Andy Haldane talks: Friday, 19:30. The chief economist of the Bank of England is considered a dove. In his speech in Philadelphia, Haldane could have a meaningful impact if makes hawkish noises.

BP/USD Technical Analysis

Pound/dollar woke up from its Christmas slumber by rising gradually, tackling the 1.3450 level (mentioned last week).

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.3550 was the November peak.

1.3450 capped the pair in mid-December and serves as resistance. The round level of 1.33 is a key level of support, working as such around the same period of time.

1.3225 was the high point of September. It is followed by 1.3180, which capped the pair in July.

1.3080 worked as support in mid-October and also was weak support during November. 1.3030 is the bottom of the range, cushioning cable in October and also in early November.

I am bearish on GBP/USD

End of year adjustments and thin liquidity will now make way to full-throttled trading and the picture is not bright for Britain: Brexit reality is set to bite and send the pound lower, especially on potential difficulties to reach a trade agreement. The US dollar could bounce back after the profit-taking.

Our latest podcast is titled What does 2018 have in store for financial markets?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!