After posting two winning weeks, GBP/USD reversed directions last week and posted small losses. The upcoming week has six events, including PMIs and retail sales. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

British GDP gained 1.8% in May, after plunging 20.2% beforehand. Analysts had expected a stronger gain or 5.5%. Industrial production and manufacturing production rebounded with gains in May, after suffering declines of over 20% a month earlier. CPI was stronger than expected, rising from 0.5% to 0.6%. The estimate stood at 0.4%. Employment numbers were mixed. Unemployed rolls dropped by 28.1 thousand, defying the forecast of a huge gain of 250 thousand. Wage growth declined by 0.3%, while the unemployment rate remained pegged for a third consecutive month.

In the US, industrial production jumped 5.4% in June, its largest monthly gain since 1959. Retail sales rose by 7.5%, while the core reading climbed by 7.3%. Both indicators beat the forecast of 5.0%. New unemployment claims dipped slightly to 1.3 million, but the total number of claims is above 32 million, as the employment situation remains grim. Finally, consumer confidence became more pessimistic, as UoM Consumer Sentiment fell to 73.2 in July, down from 78.9 beforehand.

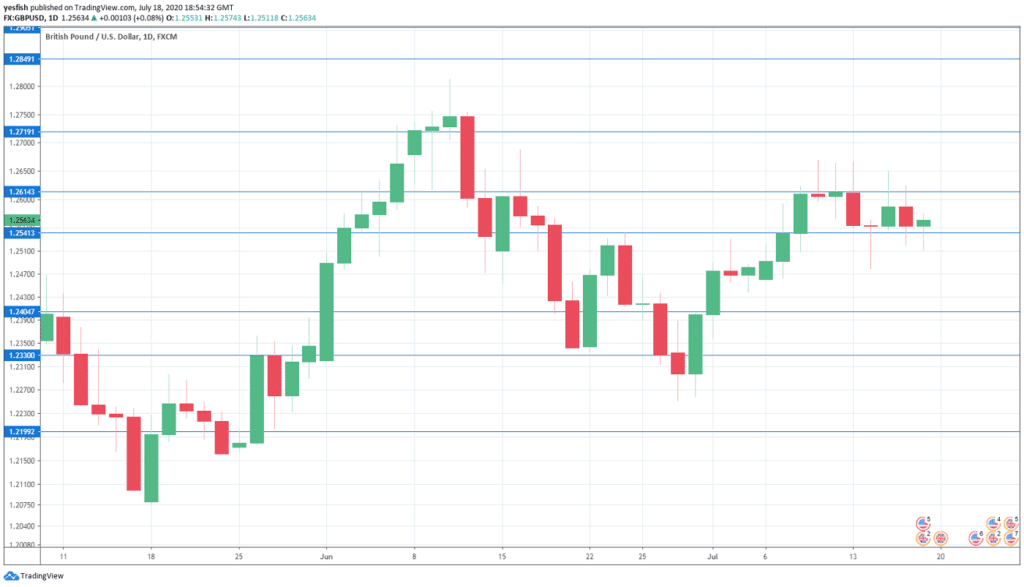

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Public Sector Net Borrowing: Tuesday, 6:00. The UK recorded another huge deficit in May, at GBP 54.5 billion. This follows an April deficit of GBP 61.4 billion. XX

- CBI Industrial Order Expectations: Thursday, 10:00. Manufacturers continue to forecast a sharp drop in orders. The June reading of -58 was only marginally better than the release of -62 beforehand. Analysts expect a better reading in July, with a forecast of -35.

- GfK Consumer Confidence: Thursday, 23:01. With the British economy in poor shape, it’s no surprise that the British consumer is deeply pessimistic about economic conditions. In June, the indicator came in at -27 and the forecast for July stands at -25.

- Retail Sales: Friday, 6:00. After an abysmal read of -18.1% in April, retail sales rebounded strongly in May, with a gain of 12.0%. Another strong gain is projected in July, with an estimate of 8.0%.

- Manufacturing PMI: Friday, 8:30. Manufacturing PMI came in at 50.1 in June, just above the 50.0 mark, which separates contraction from expansion. The initial estimate for July stands at 52.0.

- Services PMI: Friday, 8:30. After showing deep contraction in April, with a read of just 12.3, the index has recovered. In June, the index improved to 47.0 and the initial estimate for July stands at 51.1, which indicates slight expansion.

Technical lines from top to bottom:

We start with resistance at 1.2905.

1.2850 is next.

1.2718 has held as resistance since early June.

1.2616 has some breathing room in resistance after GBP/USD dipped lower last week.

1.2540 (mentioned last week) is an immediate support line.

1.2403 is protecting the 1.24 line.

1.2330 follows has held in support since the end of June.

The round number of 1.22 has held in support since late May. It is the final line for now.

I am bearish on GBP/USD

Economic conditions remain grim, and the Office for Budget Responsibility has projected a drop in growth of between 10.6% and 14.3%. This could mean a rough road ahead for the British pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!