GBP/USD showed losses for a second successive week. The upcoming week has five releases, including inflation and retail sales reports. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, wage growth improved from 4.7% to 4.8%, but unemployment claims rose unexpectedly, with a huge gain of 86.6 thousand, compared to the forecast of 9.0 thousand. Inflation also disappointed, with CPI slowing from 0.7% to 0.4%. Manufacturing and Services PMI showed an acceleration in growth, and retail sales bounced back from a sharp decline, with a gain of 2.1%.

In the US, Fed Chair Powell and Treasury Secretary Yellen testified before Congress, with the duo reiterating a dovish stance. Yellen spoke about the follow-up stimulus, which she said will be paid by higher taxes. Fed Chair Powell acknowledged that inflation would likely increase but that it would be temporary, and that the Fed would not raise interest rates.

- Net Lending to Individuals: Monday, 9:30. Credit levels fell from GBP 4.6 billion to GBP 2.8 billion in January, its lowest level in seven months. The February estimate stands at GBP 3.6 billion.

- BRC Shop Price Index: Wednesday, 0:01. This inflation gauge continues to point to a sharper inflation amongst shops belonging to the BRC. The indicator fell from -2.2% to -2.4% in February.

- GDP: Wednesday, 7:00. First estimate for GDP in Q4 came in at 1.0%, but we could see a sharp loss in the second estimate, which could lead to volatility from GBP/USD.

- Manufacturing PMI: Thursday, 9:30. Manufacturing continues to show strong expansion, with readings well above the neutral 50-level. The final reading for February PMI is expected to confirm the initial reading of 57.9.

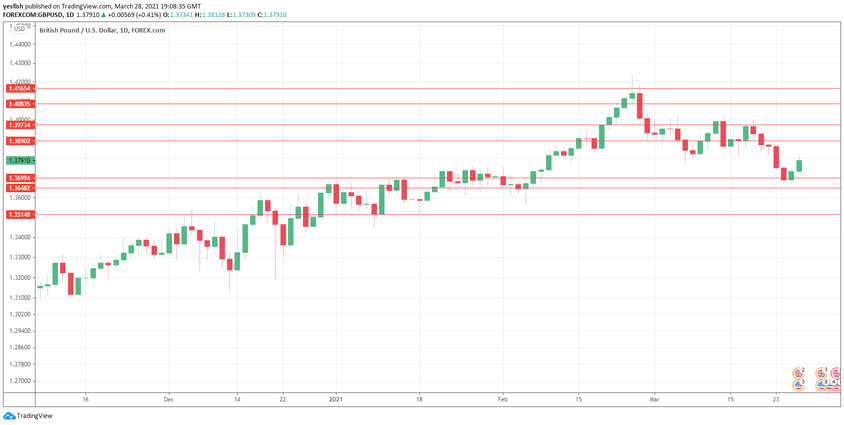

Technical lines from top to bottom:

We start with resistance at 1.4166.

1.4083 is next.

1.3974 was under pressure in mid-March, when GDP started an extended slide.

1.3891 is protecting the 1.39 level.

1.3699 (mentioned last week) is the first line of support.

1.3649 remains relevant.

1.3514 is the final support level for now.

.

I remain neutral on GBP/USD

The UK continues to remove health restrictions as the vaccine rollout has been performing well. In the US, the recovery continues to deepen.

Further reading:

- EUR/USD forecast – for everything related to the euro

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!