- Employment Report: Tuesday, 7:00. Wage growth has been steadily climbing and reached 4.7% in December. The upswing is expected to continue, with an estimate of 4.9%. Unemployment claims fell by 20 thousand in January, but are forecast to rise by 9 thousand in February. The unemployment rate has been moving higher and is expected to rise from 5.1% to 5.2%.

- CBI Industrial Order Expectations: Tuesday, 11:00. Order volume expectations remain mired in negative territory, with February coming in at -24. A slight improvement is expected for March, with a forecast of -20.

- Inflation Report: Wednesday, 7:00. Headline CPI has been moving higher and is expected to hit 0.8% in February. Core CPI is expected to remain at 1.4% for a third straight month.

- PMIs: Wednesday, 7:00. Manufacturing PMI has been showing prolonged expansion. The index is expected in at 55.0, little changed from 54.9. The Services PMI has posted four straight readings below 50, which indicates contraction. However, the estimate for March stands at 50.7.

- Retail Sales: Friday, 7:00. Retail Sales plunged 8.2% in January, its worst showing since April. A turnaround is expected in February, with a forecast of 2.2%.

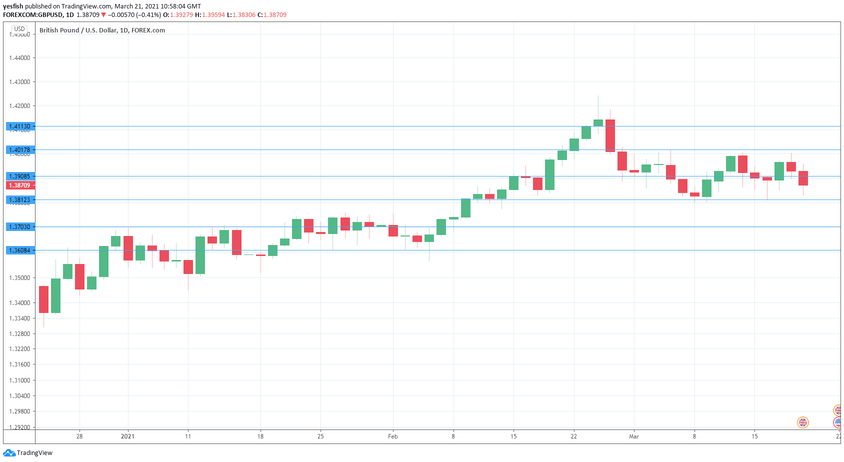

Technical lines from top to bottom:

We start with resistance at 1.4113 (mentioned last week).

1.4017 is next.

1.3908 has switched to resistance after GBP lost ground last week.

1.3812 is the first line of support.

1.3703 has held since the first week in February.

1.3636 is the final support level for now.

.

I remain neutral on GBP/USD

The pound has been relatively quiet since flirting with the symbolic 1.40 level in late February. This week’s key CPI and retail sales data could shake up the pound, with the currency’s direction dependent on the strength of these releases.

Further reading:

- EUR/USD forecast – for everything related to the euro

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!