- BRC Retail Sales Monitor: Tuesday, 00:01. The indicator pointed to a surge in retail sales in BRC shops in January, with a gain of 7.1%. Will we see another strong reading in February?

- RICS House Price Balance: Thursday, 00:01. The index has weakened in recent months, with the January release showing a 50-50 split of surveyors showing an increase in house prices and those showing a decrease. For February, the estimate is that 46% of surveyors expect an increase.

- GDP: Friday, 7:00. The monthly GDP report showed a gain of 1.2% in December, rebounding from -2.6% beforehand. We will now receive the January data.

- CB Leading Index: Friday, 14:30. The index is based on 7 economic indicators. In December the index showed a small decline of 0.5%. Will we see an improvement in the January release?

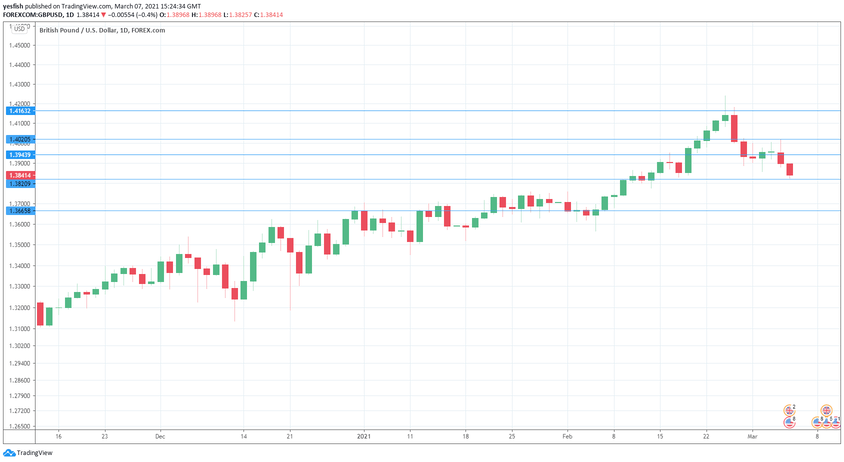

Technical lines from top to bottom:

We start with resistance at 1.4163.

1.4019 has been a resistance line since late February.

1.3943 (mentioned last week) is next.

1.3821 is an immediate support level.

1.3636 has held in support since the first week in February.

1.3514 is the final support level for now.

.

I am neutral on GBP/USD

The US economy is showing signs of recovery, such as the strong NFP report last week. However, the massive US stimulus program of $1.9 trillion could weigh on the US dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!