GBP/USD suffered further losses with no help from the Bank of England. Where is the bottom? The jobs report is the primary event of the week. Here are the key events and an updated technical analysis for GBP/USD.

The Bank of England left the rates unchanged and sent a cautious message. GBP/USD dropped below 1.3500 at one point on speculation that the BOE will stay pat for a long time. In the US, the dollar initially continued higher but eventually began retreating after inflation came out at 2.1% y/y against 2.2% expected. Has the dollar peaked?

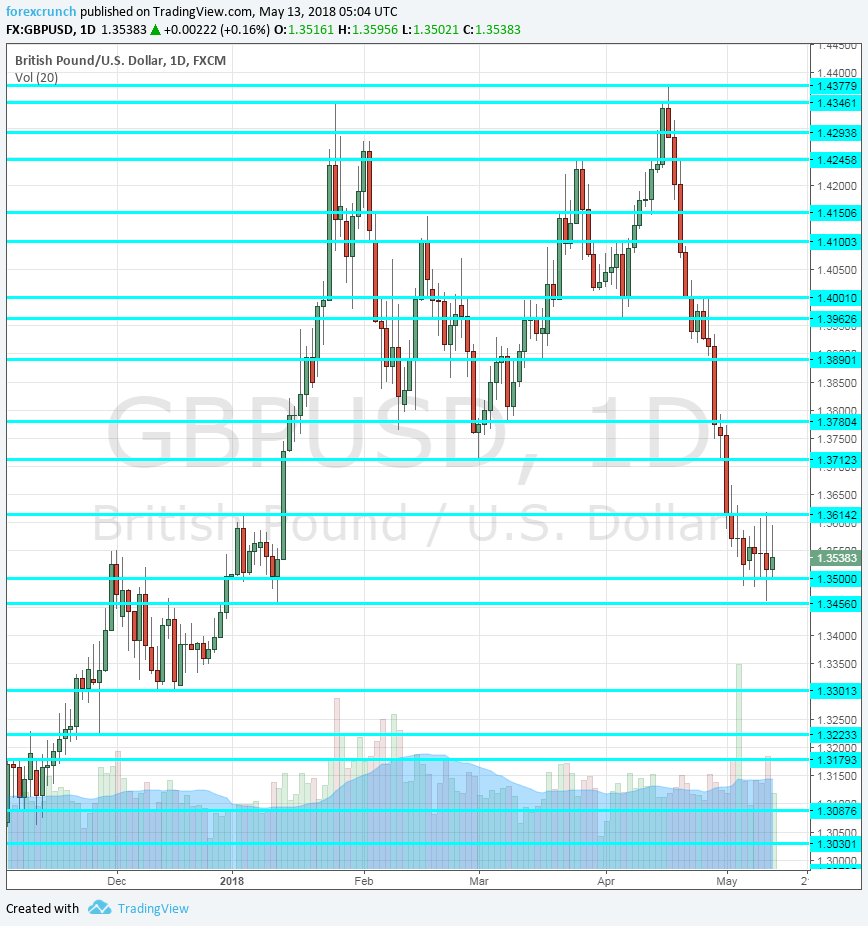

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- UK jobs report Tuesday, 8:30. The recent jobs report was disappointing on many fronts. Jobless claims rose by 11.6K, worse than expected in March. And while the unemployment rate dropped to 4.2% in February, wages remained stuck at 2.8% and did not rise to 3% as expected. While the BOE is not set to raise rates anytime soon, another disappointing report, especially on wages, could push a potential rate hike well into the future. Wages are expected to decelerate to 2.7% in March while jobless claims carry expectations for a rise of 13.3K in April. The unemployment rate is projected to remain at the lows of 4.2%.

- Inflation Report Hearings: Tuesday, 9:00. Shortly after the jobs report, BOE Governor Mark Carney and his colleagues go to Parliament and will discuss the findings of the Inflation Report recently published. Carney will likely be grilled on anything related to Brexit but also on the path of inflation and the interest rates. Carney will try not to say anything he did not already say, but the fresh jobs report could provide a basis for comments.

- CB Leading Index: Wednesday, 13:30. The Conference Board’s composite measure of the economy dropped by 0.4% in February and a similar figure is likely for March.

- Andy Haldane talks Thursday, 16:00. The BOE’s Chief Economist will be speaking in London and may provide some insights about the next steps of the Bank. Haldane is a known dove.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar fell to new lows, reaching a total loss of 900 pips from the peak at 1.3460 (mentioned last week) before stabilizing. The pair then recovered

Technical lines from top to bottom:

1.4150 capped the pair in mid-February. 1.41 capped the pair in early April and also in mid-March. It is followed by the round level of 1.40, which is eyed by many. 1.3960 was a swing low in early April.

1.3890 served as support in mid-March and maintains its role. 1.3790 was a swing low in mid-March.

Further below,1.3780 was a line of support in March and 1.3710 was the lowest point since early in the year.

Even lower, 1.3615 capped the pair in late 2018 and the next level to watch is 1.3460.

Further down, only 1.33 works as a significant line of support. These are levels dating back to 2017.

I remain bearish on GBP/USD

The UK economy does not look good and the BOE is in a “wait and see” mode. Adding frictions around Brexit negotiations, and it is hard to see a viable recovery even though the US Dollar has problems of its own.

Our latest podcast is titled Stormy times ahead or just a moderation?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!