GBP/USD extends its sharp falls, dipping under the 1.35 level at one point as data continued disappointing. Sterling now faces the Bank of England’s decision among other events. Here are the key events and an updated technical analysis for GBP/USD.

PMI data added to the misery with manufacturing dropping to 53.9 and services, the largest sector, coming out at 52.8 points. These forward-looking figures joined previous disappointing data points. The plummet of GBP/USD was exacerbated by the US Dollar’s strength. The greenback extends its rises even as the data was not all that great: the Non-Farm Payrolls showed an increase of only 164K and wage growth slowed down to 2.6% y/y. What’s next?

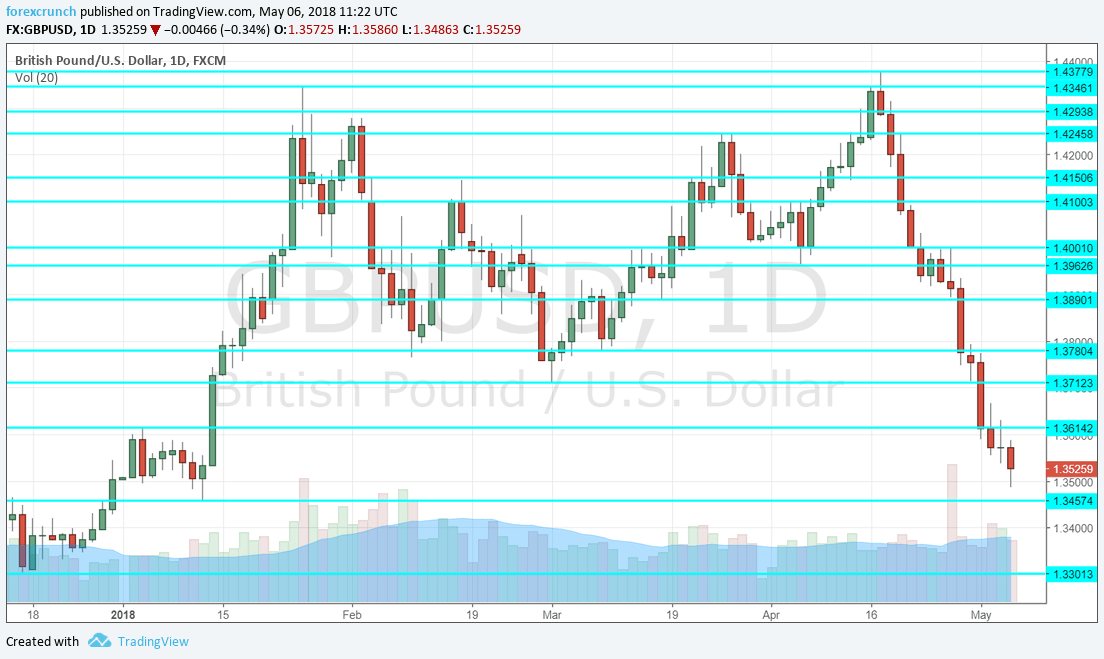

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Halifax HPI: Tuesday, 7:30. This leading indicator of house prices by the Halifax Bank of Scotland has surprised with a jump of 1.5% in March, far better than expected. The report for April is expected to show a correction with a drop of 0.3%.

- BRC Retail Sales Monitor: Tuesday, 23:01. The British Retail Consortium’s early indicator of retail sales has finally shown an improvement with an annual rise of 1.4% in March. This may have been skewed by the early Easter holiday and a drop of 0.7% is predicted now.

- RICS House Price Balance: Wednesday, 23:01. This gauge of the housing sector disappointed in the past two months by showing a perfect balance between price increases and decreases. A further deterioration is on the cards now: a negative balance of -1%

- Manufacturing Production: Thursday, 8:30. Manufacturing output is a significant economic indicator but it may be slightly overshadowed by the BOE decision. Production fell by 0.2% in February after remaining flat in January. Another fall of 0.2% is on the cards. Industrial output is projected to rise by 0.1% m/m, repeating the previous gain. Note that revisions are quite common in both measures.

- Goods Trade Balance: Thursday, 8:30. Britain has a chronic trade deficit with a negative balance of 10.2 billion pounds in February. A wider deficit of 11.4 billion is projected for March. It would take an “as expected” result in the manufacturing production outcome and a considerable surprise in the trade balance in order to see this figure having a significant impact on the pound.

- Construction Output: Thursday, 8:30. The last release at this time is for the construction sector. Output dropped by 1.6% in February and yet another drop of 2.1% is on the cards for March. The construction sector is impacted by the weather, which was quite bad in March.

- Rate decision: Thursday, 11:00. This is one of the Bank of England’s “Super Thursday” events as, in addition to the rate decision and the MPC Meeting Minutes, the BOE also publishes its all-important Quarterly Inflation Report. Until a few weeks ago, the BOE was expected to raise rates in this May decision. The BOE laid down thick hints it was coming. Yet recent data have been very disappointing: GDP grew by only 0.1% q/q in Q1, PMI figures point to an upcoming slowdown and Governor Mark Carney hinted that rates are not coming so soon. This accumulation of events resulted in expectations that the BOE leaves rates unchanged at 0.50% at this occasion. The focus will be on the forecasts for inflation (that also slowed down to 2.5%) and the messages about raising rates in the remainder of the year. If Carney and co. convey a message that the situation has worsened and that no hike is expected this year, the pound could extend its plunge. If they see the recent slowdown as temporary, like Draghi did when referring to the euro-zone, Sterling could recover.

- NIESR GDP Estimate: Thursday, during early European afternoon. The National Institute of Economic and Social Research foresaw the slowdown in the UK economy in its previous release, which fully coincided with Q1 2018. The institution now publishes its report for the three months ending in April. A similar figure to the 0.2% growth rate reported last time is expected.

Pound/dollar extended its downfall. An attempt to break above the 1.3780 level (mentioned last week) failed and the pair even dipped below 1.35 before recovering.

Technical lines from top to bottom:

1.4376 is the new post-Brexit high and looms above. 1.4345 is the January 2018 swing high that is worth watching. 1.4300 capped the pair in mid-April. 1/4260 was the high point in March and provides another line of defense.

1.4150 capped the pair in mid-February. 1.41 capped the pair in early April and also in mid-March. It is followed by the round level of 1.40, which is eyed by many. 1.3960 was a swing low in early April.

1.3890 served as support in mid-March and maintains its role. 1.3790 was a swing low in mid-March.

Further below,1.3780 was a line of support in March and 1.3710 was the lowest point since early in the year.

Even lower, 1.3615 capped the pair in late 2018 and the next level to watch is 1.3460.

Further down, only 1.33 works as a significant line of support. These are lines dating back to 2017.

I remain bearish on GBP/USD

Despite oversold conditions, there are no reasons to be constructive on the pair. A slowing economy, a cautious central bank and Brexit woes all weigh on the pound. In the US, things are not perfect, but the direction remains positive.

Our latest podcast is titled Is inflation rearing its ugly head? Oil is on fire

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!