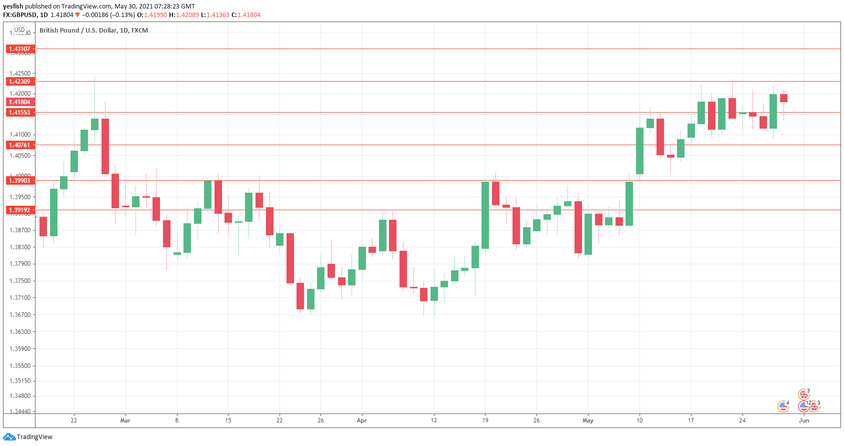

GBP/USD posted slight gains last week, as the pair rose for a fourth consecutive week. The upcoming week has four releases. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, Public Sector Net Borrowing rose to GBP 31.0 billion in May, up from GBP 27.3 billion. The Confederation of British Industry Realized Sales index posted a second straight gain after a long streak of declines. The May reading of 18 was slightly down from the previous read of 20.

BoE member Gertjan Vlieghe suggested that a rate hike could be on the table as soon as early next year. This sent the pound sharply higher on Thursday.

In the US, Conference Board Consumer Confidence Consumer Confidence held steady in May, at 117.2. This was down marginally from 117.5 in April. Second-estimate GDP for the first quarter came in unchanged at 6.4%, confirming the initial reading.

Unemployment claims fell to a new post-Covid low of 406 thousand, down from 444 thousand. Durable goods orders disappointed with a read of -1.3% in April, its second decline in three months. The PCE index, the Fed’s preferred inflation gauge, jumped to 3.6% in April, up from 2.2%. This could lift the US dollar if investors believe that the Fed will re-evaluate whether to taper QE sooner rather than later.