GBP/USD declined by 1.2% last week, suffering its worst week since late September. The upcoming week is busy, including GDP and inflation reports. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

British PMIs are pointing to an economy in trouble. Construction PMI came in at 44.2, which points to contraction. Services PMI improved to 50.0, which separates contraction from expansion. The Bank of England maintained rates at 0.75%, but what was notable was that two of the nine MPC members voted to lower rates. The BoE does not want to make any moves ahead of the December election, but analysts are predicting more rate cuts in 2020.

In the U.S., there was good news from the services sector, which continued to show expansion in October. Services PMI improved to 54.7, above the estimate of 53.5 points. The UoM Consumer Sentiment index dipped to 95.7, shy of the forecast of 97.0 points. There was a significant development on the trade front, as a Chinese report stated that the U.S. and China had agreed to phase out tariffs. However, no timetable was given.

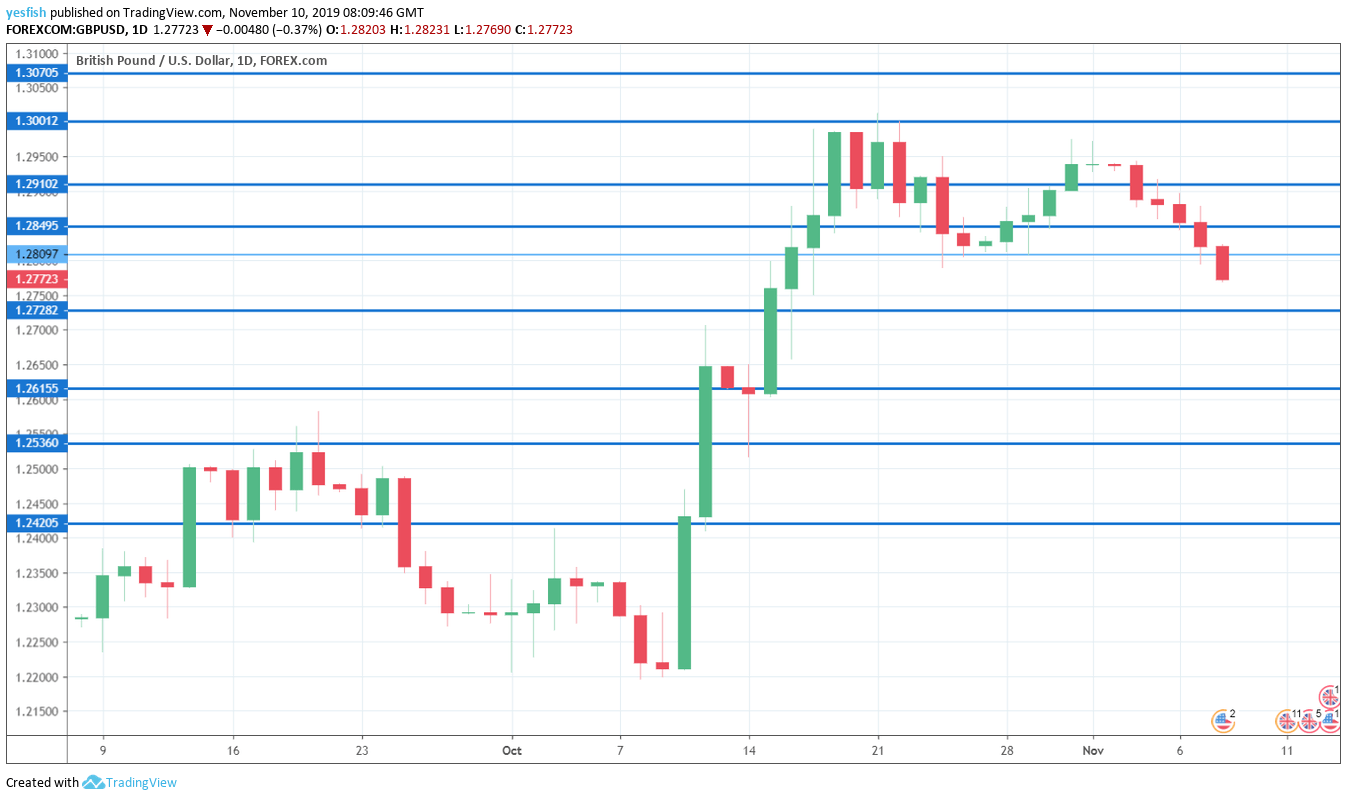

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Preliminary GDP: Monday, 9:30. The economy contracted by 0.2% in the second quarter, but a rebound is expected in Q3, with an estimate of +0.2%.

- Manufacturing Production: Monday, 9:30. The manufacturing sector has been struggling and manufacturing production fell by 0.7% in August, compared to a forecast of +0.1%. Another weak release is expected in September, with an estimate of -0.2%.

- UK Jobs Report: Tuesday, 9:30. Wage growth remains strong, but slipped to 3.8% in August, down from 4.0% a month earlier. No change is expected in the August release. Unemployment rolls slipped to 21.1 thousand in September, marking an 8-month low. The estimate for October stands at 24.2 thousand. The unemployment rate is projected to remain steady at 3.9%.

- UK inflation: Wednesday, 9:30. CPI was unchanged at 1.7% in September, shy of the BoE’s inflation target of 2.0%. The indicator is expected to tick lower to 1.6% in the upcoming release.

- Retail Sales: Thursday, 9:30. Retail sales have been soft in recent months. The indicator came at zero in September, pointing to a stall in consumer spending. The estimate for October stands at 0.2%.

- CB Leading Index: Thursday, 14:30. The index, which is based on 7 indicators, declined 0.5% in August. We will now receive the September release.

GBP/USD Technical analysis

Technical lines from top to bottom:

With GBP/USD dropping sharply last week, we start at lower levels.

We start with resistance at 1.3170.

1.3070 was a high point in November 2018.

The round number of 1.3000 has held since mid-October. This is followed by 1.2910.

1.2850 has some breathing room in resistance.

1.2728 has held in support since mid-October.

1.2616 (mentioned last week) is next.

1.2535 switched to support during a strong rally by GBP/USD in mid-October.

1.2420 is the final support line for now.

I am bearish on GBP/USD

A looming election and the shadow of Brexit means that sentiment towards cable is not particularly high at the moment. Any weak British numbers this week could cause the pound to lose more ground.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!