GBP/USD gained close to 1.0% last week, erasing most of the losses seen a week earlier. This week features construction and services PMIs and the Bank of England rate decision. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

The Brexit saga will be on hold for a short while, as Prime Minister Johnson announced a snap election for December 12. The Conservatives hold a lead in the polls, but we’re likely to see plenty of developments in the election campaign, which could mean volatility for the British pound. Manufacturing PMI remained in contraction mode, with a reading of 49.6 points. Still, this was the strongest reading in six months.

In the U.S, there was positive news from the GDP report for the third quarter. The initial GDP release was stronger than expected. The economy gained 1.9%, beating the forecast of 1.6%. Employment numbers were mixed. Wage growth improved to 0.2%, up from 0.0%. However, this fell short of the forecast of 0.3%. Nonfarm payrolls slipped to 128 thousand, but this beat the forecast of 90 thousand. As expected, the Federal Reserve trimmed rates for a third straight time, and this helped boost the British pound.

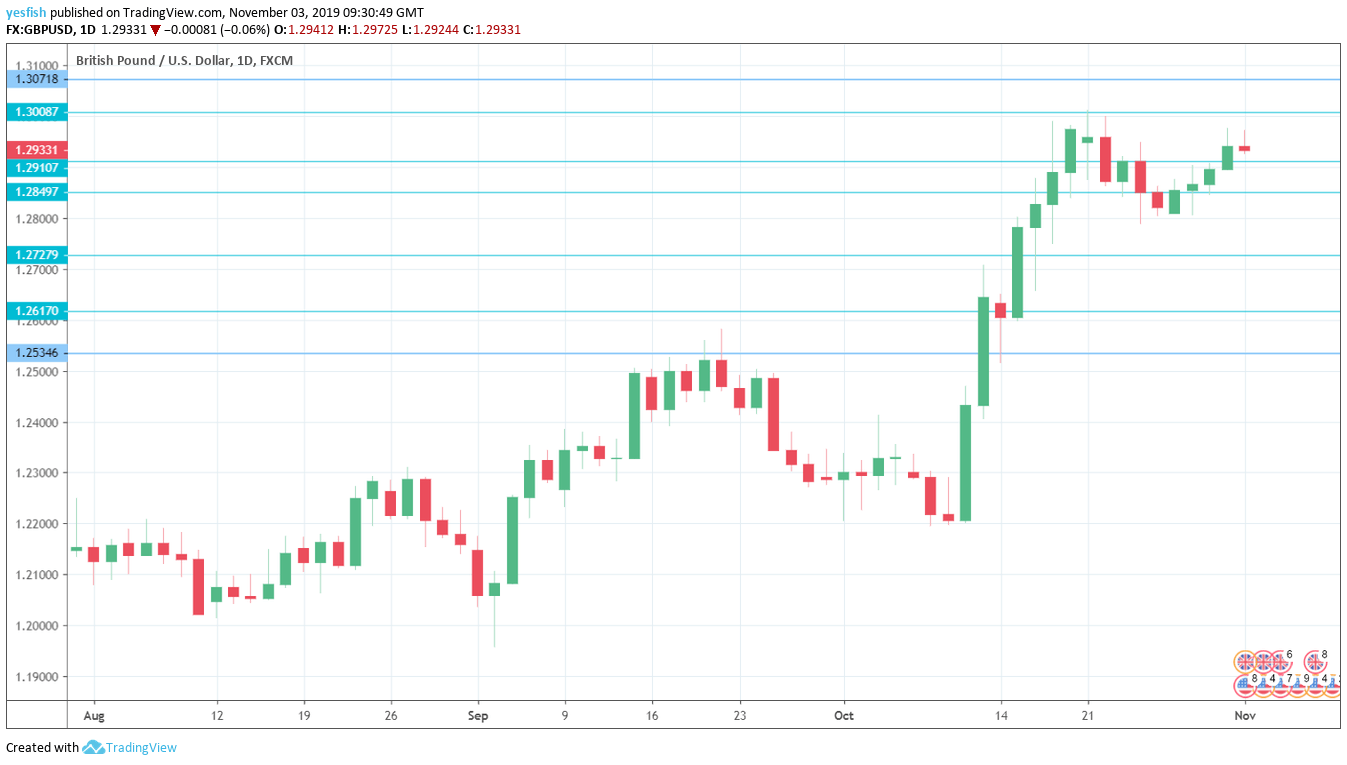

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Construction PMI: Monday, 9:30. The construction sector continues to sputter, with ongoing readings below 50, which separates expansion from contraction. The index slipped to 43.3 in September, down from 45.0 a month earlier. The estimate for October stands at 44.3 points.

- BRC Retail Sales Monitor: Tuesday, 0:01. This consumer spending indicator declined 1.7% in September, its fourth decline in five months. Another weak reading is projected for October, with an estimate of -1.4%.

- Services PMI: Tuesday, 9:30. The PMI continues to hover around the 50-level, but the September reading dipped into negative territory, dropping to 49.5. Little change is expected in October.

- Halifax HPI: Thursday, 8:30. This housing inflation index declined by -0.4% in September, its third decline in four releases. The markets are expecting a rebound in October, with an estimate of a 0.3% gain.

- BoE Rate Decision: Thursday, 12:00. No surprises are expected from the BoE at the upcoming policy meeting. The BOE is projected to maintain the benchmark rate at 0.75% and the QE program at 435 billion pounds. The Monetary Policy Committee (MPC) voted unanimously to maintain this policy in the previous meeting and the same voting pattern will likely be repeated. Investors will also be interested in the BoE’s quarterly inflation report, which will provide inflation and growth forecasts.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.3375, which was a high point in July. It is followed by the round number of 1.3300.

1.3217 was the high point of the pound rally in late January.

1.3170 is next.

1.3070 was a high point in November 2018.

The round number of 1.3000 was tested last week and remains relevant.

1.2910 has switched to a support role after sharp gains by GBP/USD this week.

1.2850 is next.

1.2728 has held in support since mid-October.

1.2616 (mentioned last week) is next.

1.2535 is the final support level for now.

I am neutral on GBP/USD

The pound enjoyed a superb October, with gains above 5.0%. Traders can expect the volatility to continue, with the U.K. in a short election campaign that will have huge ramifications on what happens with Brexit.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!