GBP/USD traded up on rumors that a Brexit deal is imminent and down on worries that it could all break up. What’s next? Apart from Brexit, the UK releases three top-tier figures. Here are the key events and an updated technical analysis for GBP/USD.

Rumors of a decisive cabinet meeting to approve a Brexit deal proved premature. The question of the Irish backstop is negotiated within the government, between the government and the supporting DUP part, and also with the European Union. Comments by British, Irish and EU officials can be summed up by Michel Barnier’s “we’re not there yet.” However, with 95% of the deal sealed, a breakthrough could come at any moment. In the US, the Mid-Terms resulted in a split government as expected while the Fed maintained an open door to hiking in December.

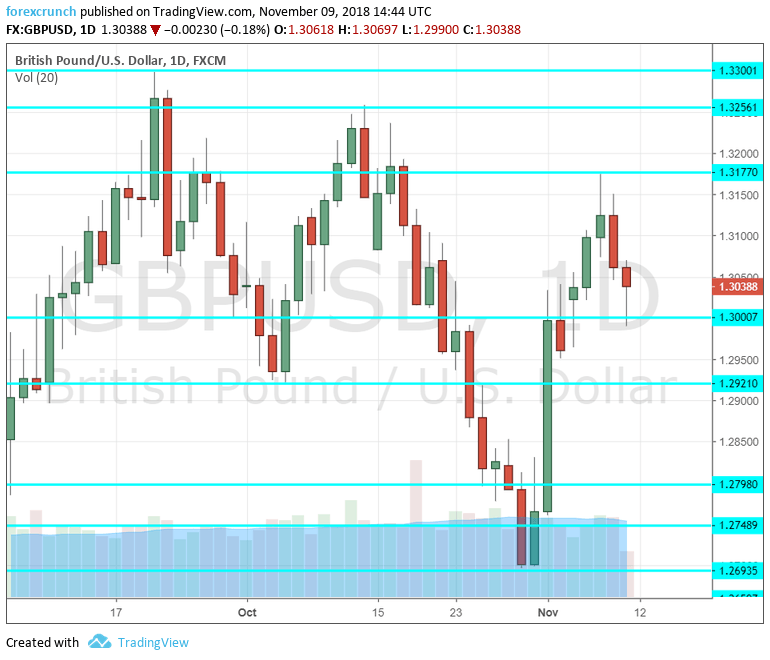

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- UK jobs report :Tuesday, 9:30. Britain enjoyed an acceleration in wage growth back in August: 2.7% y/y. Salaries have the most significant impact in the UK employment report as the unemployment rate is at a low of 4% as of September. Wages carry expectations for an acceleration to 3% y/y while no change is forecast in the jobless rate. The Claimant Count Change, or jobless claims, rose by 18.5K in September, a disappointment. A more moderate rise of 4.3K is projected for October.

- UK inflation: Wednesday, 9:30. Inflation has cooled down and decelerated in recent months. Higher wages and a slower pace of price rises have resulted in growth in real wages. The Consumer Price Index stood at 2.4% in September. A small acceleration is projected now: 2.5% y/y. Core CPI was at 1.9% wand the same number is on the cards now. The Retail Price Index (RPI) stood at 3.3% and 3.4% is on the cards for October.

- Retail Sales: Thursday, 9:30. Shoppers fell short of expectations in September, and the volume of sales dropped by 0.8%. A small increase is on the cards now: a rise of 0.1%. The pound usually reacts quite swiftly to the data, but the impact is not a lasting one.

- CB Leading Index: Friday, 14:30. The Conference Board’s leading index uses data from various economic indicators. A slide of 0.2% was seen last time.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar began the week with a Sunday gap to the upside but gradually drifted lower and struggled with the 1.3000 level (mentioned last week).

Technical lines from top to bottom:

1.3375 was a high point in July. It is followed by 1.3300 was the high point in September and also a psychologically important round number.

1.3255 was the high point in mid-October, ahead of the EU Summit on Brexit. 1.3170 was a swing high in early November.

1.3115 was a swing low in early October. The round number of 1.3000 is important after providing support to the pair in late September. 1.2920 was a low point in early October.

Further down, 1.2790 served as support late August and also beforehand. 1.2700 was the low point in late October.

The current 2018 trough at 1.2660 is the next level. 1.2590 was a swing low in September 2017.

Even lower, 1.25 is a round number and also worked as support in early 2017.

I am bullish on GBP/USD

A no-deal Brexit is still priced into the pound, and it seems a bit pessimistic. Even if a happy announcement isn’t made, the direction is clear and the pound has room to rise.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!