GBP/USD shot higher on hopes for a Brexit deal and as the market mood markedly improved. Can the rally continue? GDP and the services PMI stand out on the calendar and as the focus remains on Brexit. Here are the key events and an updated technical analysis for GBP/USD.

After preparations for a no-deal Brexit were ramped up and thinks looked gloomy, Brexit Secretary Dominic Raab sounded a higher level of optimism. Moreover, reports of an agreement on a post-Brexit arrangement for the financial services sector also pleased investors. Another report about an imminent deal further raises hopes.

On the other side of the pond, the turnaround in stocks, fueled in part by Trump’s positive turnaround on trade with China, pushed the US Dollar lower, but nothing is certain. The Bank of England’s Super Thursday was mostly about waiting for a Brexit result rather than anything else. US figures were OK with NFP beating expectations with 250K and wages finally topping 3%.

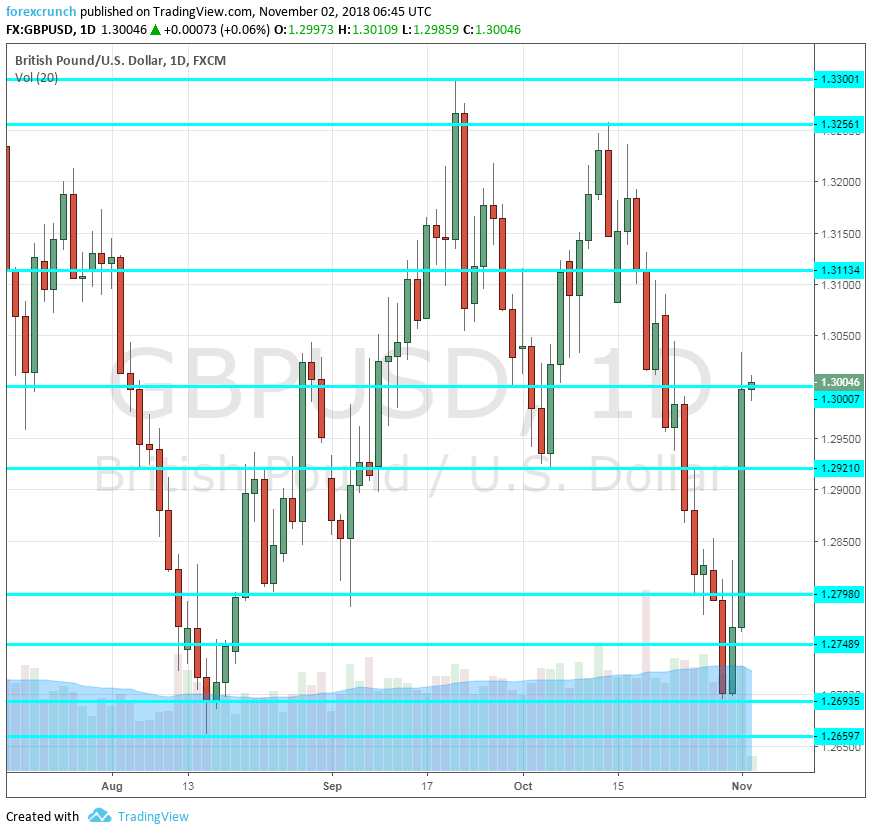

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Services PMI: Monday, 9:30. Markit’s forward-looking indices for the UK economy culminate in the publication for the services sector. The country’s largest sector has seen OK growth in September, with a score of 53.9 points. We may see a slide now as Brexit uncertainty increases. A score of 53.4 points is expected.

- BRC Retail Sales Monitor: Tuesday, 00:01. The British Retail Consortium’s measure of retail sales has not been that great lately. The year over year number dropped by 0.2% in September. We will now receive the data for October, coming out ahead of the official retail sales numbers. A rise of 0.6% is on the cards.

- Halifax HPI: Wednesday, 8:30. The Halifax Bank of Scotland’s measure of house prices is considered quite accurate due to the bank’s sheer size. A substantial drop of 1.4% was recorded in September. A bounce may be seen in October. An increase of 0.9% is forecast.

- RICS House Price Balance: Thursday, 00:01. The Royal Institution of Chartered Surveyors showed positive numbers for three consecutive months until it fell to -2% back in September. Another negative balance in this gauge of the housing sector cannot be ruled out. The same level is projected.

- GDP: Friday, 9:30. The UK moved to publish GDP data on a monthly basis, but this publication is not only for September but for all of the third quarter. The economy grew by 0.4% q/q in the second quarter. So far in Q3, the British economy expanded by 0.4% in July but stagnated in August. A similar growth rate of 0.4% q/q is likely for Q3. Uncertainty about the future weighs. GDP is expected to rise by 0.6% q/q.

- Manufacturing Production: Friday, 9:30. The UK publishes the manufacturing output data alongside the GDP figures. Production dropped by 0.2% in August, falling short of expectations. A rise of 0.1% is projected now. The broader industrial output gauge rose by 0.2% and a slide of 0.1% is on the cards this time.

- Goods Trade Balance: Friday, The UK suffers from a chronic trade deficit which slightly weighs on the pound. The deficit stood at 11.2 billion pounds back in August and a similar figure is on the cards now: 11.4 billion.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar began the week with a drop below the 1.2750 level (mentioned last week). It then made an impressive turnaround and topped 1.3000.

Technical lines from top to bottom:

1.3375 was a high point in July. It is followed by 1.3300 was the high point in September and also a psychologically important round number.

1.3255 was the high point in mid-October, ahead of the EU Summit on Brexit. 1.3115 was a swing low in early October.

The round number of 1.3000 is important after providing support to the pair in late September. 1.2920 was a low point in early October.

Further down, 1.2790 served as support late August and also beforehand. 1.2700 was the low point in late October.

The current 2018 trough at 1.2660 is the next level. 1.2590 was a swing low in September 2017.

Even lower, 1.25 is a round number and also worked as support in early 2017.

I am bullish on GBP/USD

A Brexit deal has not been agreed upon just yet but the contours of an accord are clear. The greenback may also come under pressure due to the Mid-Terms.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!