The swings continue for GBP/USD. The pair gained 1.0% last week, erasing most of the losses seen in the previous week. The upcoming week has just two events. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

British GDP declined by 0.1% for a second straight month in September. Despite this weak reading, second-quarter GDP posted a gain of 0.3%, just shy of the forecast of 0.4%. Employment numbers were weaker than expected, as wage growth dipped to 3.6% and unemployment rolls jumped to 33.0 thousand. CPI slipped to 1.5%, its lowest level since November 2018. Finally, retail sales declined by 0.1% in October, shy of the forecast of 0.2%.

In the U.S., last week’s highlights were consumer inflation and spending reports. CPI improved to 0.4%, above the estimate of 0.3%. This was the strongest monthly gain since March. The core reading ticked higher to 0.2%, up from 0.1%. This matched the estimate. Retail sales reports were mixed. Retail sales rebounded with a gain of 0.3%, up from -0.3% a month earlier. This beat the estimate of 0.1%. The core reading improved to 0.2%, up from -0.1%. However, it missed the forecast of 0.3%.

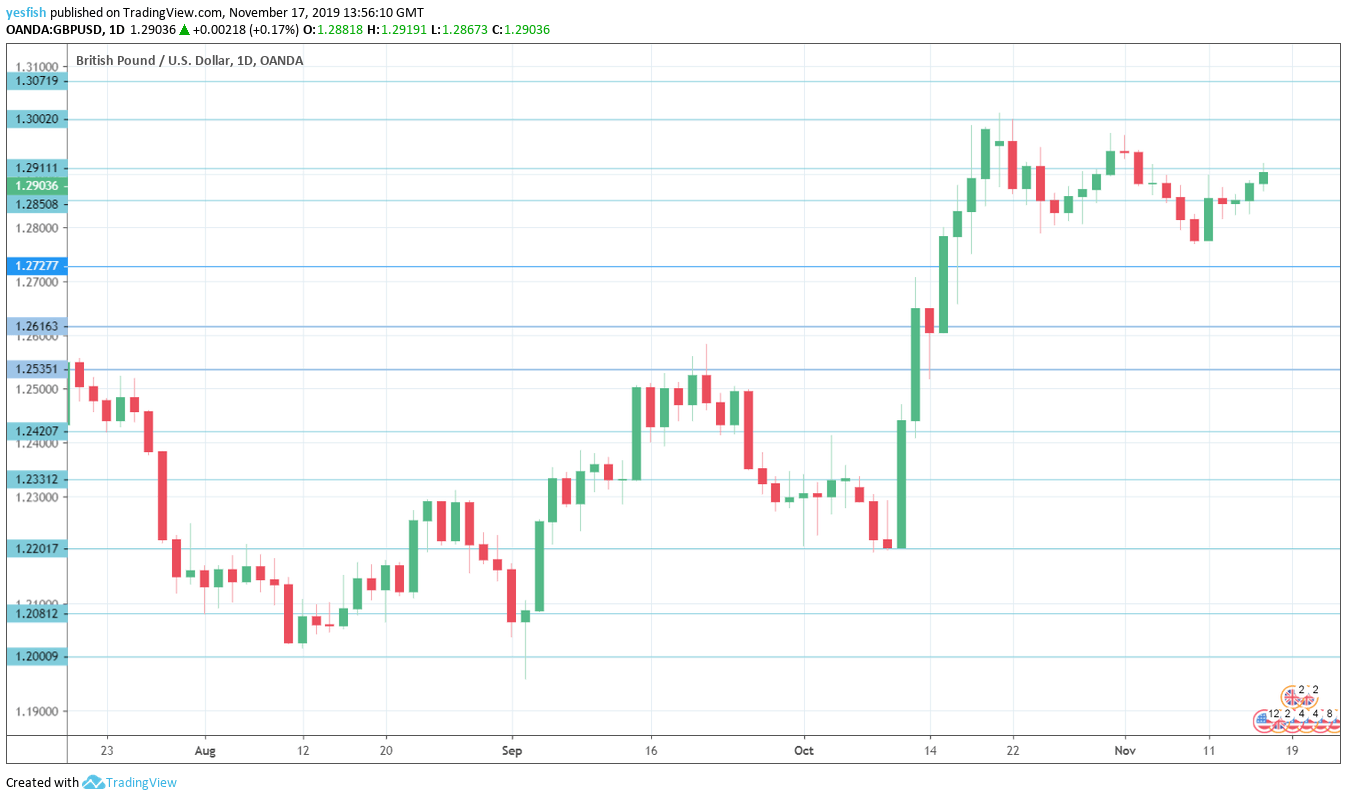

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Tuesday, 11:00. Manufacturers remain pessimistic about economic conditions in the U.K. The indicator dropped to -37 in October, its lowest level since 2010. The estimate for November stands at -30 pts.

- Public Sector Net Borrowing: Thursday, 9:30. The U.K. deficit jumped to GBP 8.7 billion in September, its highest level since April 2017. Little change is expected in October, with an estimate of GBP 8.5 billion.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.3217. Close by, there is resistance at 1.3170.

1.3070 was a high point in November 2018.

The round number of 1.3000 has held since mid-October.

1.2910 was tested during the week and is a weak resistance line.

1.2850 has switched to a support role after sharp gains by GBP/USD.

1.2728 has held in support since mid-October.

1.2616 (mentioned last week) is next.

1.2535 is the final support level for now.

I am neutral on GBP/USD

After posting gains of more than 5% in October, the pound has been swinging in both directions in November. There is plenty of uncertainty in the air, with Brits going to the polls in December and the Brexit saga still unresolved.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!