GBP/USD remains volatile and declined by 1.1% last week. There are only three events in the upcoming week. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

The impressive pound rally ended last week, as the British parliament voted down a government bill over Brexit. Prime Minister Johnson responded by pulling the Brexit bill, and it remains unclear what happens next. The U.K. is scheduled to depart the EU on October 31, but it’s doubtful this will happen. The EU has granted another 3-month extension, and there is also the possibility of a snap election in December. British data disappointed last week, as the budget deficit rose to GBP 8.7 billion, while CBI Industrial Expectations slipped to -37, its lowest level since 2010.

In the U.S, manufacturing data continues to sputter. Core durable goods orders fell by 0.3%, the second decline in three months. The headline reading declined by 1.1%, its first decline in four months. The manufacturing PMI improved to 51.5, above the estimate of 50.7. This points to minimal expansion.

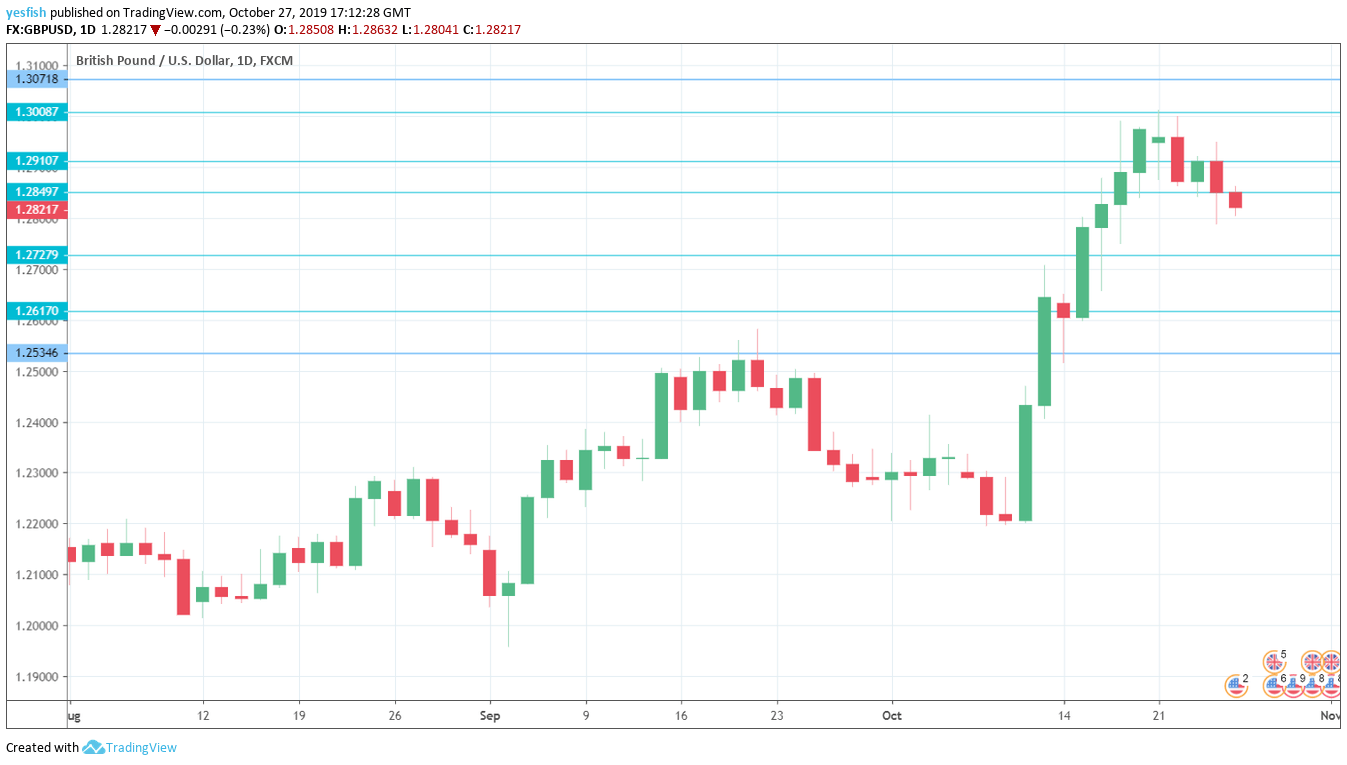

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Realized Sales: Monday, 11:00. Sales volumes improved to -16 in September, an improvement from the reading of -49 a month earlier. The October forecast stands at -20 points.

- Mortgage Approvals: Tuesday, 9:30. Mortgage approvals have been fairly steady, and the August release of 66 thousand was within expectations. Little change is expected in September, with an estimate of 65 thousand.

- Net Lending to Individuals: Tuesday, 9:30. Credit levels in the private sector slowed to GBP 4.8 billion in August, down from GBP 5.5 billion a month earlier. The downward trend is expected to continue in September, with a forecast of GBP 4.6 billion.

- BRC Shop Price Index: Wednesday, 0:01. This consumer spending indicator has sputtered, posting four successive declines. The indicator came in at -0.6% in September. Will we see an improvement in the upcoming release?

- GfK Consumer Confidence: Thursday, 0:01. The British consumer remains pessimistic about the economic outlook, and registered a reading of -12 in September. The forecast for October stands at -13 points.

- Manufacturing PMI: Friday, 9:30. The British manufacturing sector has contracted for five straight months, as weak global demand and the turmoil over Brexit has taken its toll on the British economy. The estimate for October stands at 48.2 points.

GBP/USD Technical analysis

Technical lines from top to bottom:

We begin with resistance at 1.3217. This line was the high point of the pound rally in late January.

1.3170 is next.

1.3070 was a high point in mid-November.

The round number of 1.3000 was tested this week for the first time since May.

1.2910 has switched to a resistance level after sharp losses by GBP/USD this week.

1.2850 is an immediate resistance line.

1.2728 is providing support. 1.2616 (mentioned last week) is next.

1.2535 is the final support level for now.

I am bearish on GBP/USD

Brexit developments continue to have a strong impact on the pound’s movement. With the October 31 deadline likely to pass and uncertainty as to whether a withdrawal deal can be reached, the pound might not be very attractive to investors this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!