GBP/USD continued suffering as the British government was unable to decide how it wants to proceed with Brexit negotiations and as the USD pushed forward alongside the drop in stocks. What’s next? The BOE’s Super Thursday decision stands out in the upcoming week. Here are the key events and an updated technical analysis for GBP/USD.

After the EU Summit failed in the previous week, there was no breakthrough in the following one. Moreover, the UK government is busy with infighting, unable to reach an agreement on the path forward regarding the Irish border and the customs union. Reports about ousting PM Theresa May have proved premature but her position is certainly vulnerable.

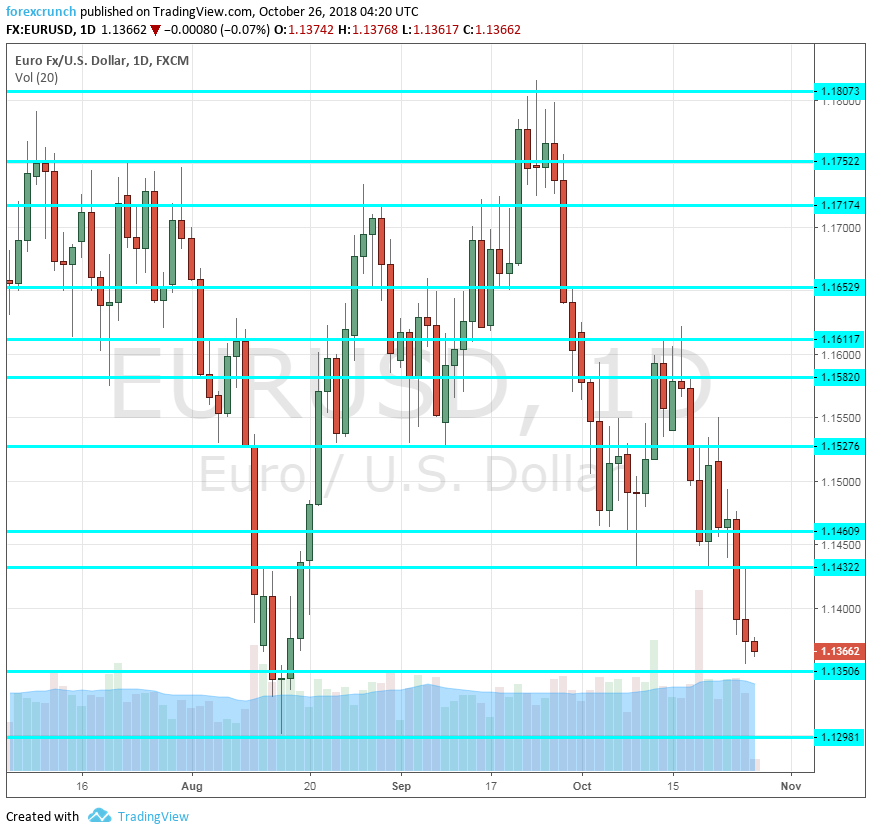

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Net Lending to Individuals: Monday, 9:30. Increased lending implies enhanced economic activity. Back in August, lending stood at 4 billion pounds, short of expectations. We will now get the data for September. A level of 4.1 billion is projected.

- M4 Money Supply: Monday, 9:30. The amount of money in circulation rose by only 0.2% in August. A faster growth rate may be seen now. The BOE publishes and monitors this data point. An increase of 0.3% is predicted.

- Mortgage Approvals: Monday, 9:30. After High Street Lending fell short of expectations, we can expect the official number of mortgage approvals to drop as well. The figure stood at 66K in September. 65K is on the cards.

- CBI Realized Sales: Monday, 11:00. The Confederation of British Industry showed upbeat figures in its monthly survey of retail and wholesale companies. The score stood at 23 points in September. An increase to 27 points is expected.

- BRC Shop Price Index: Wednesday, 00:01. The British Retail Consortium’s inflation measure in its own store showed a small increase in prices back in September: 0.2% y/y. We will now get the number for October.

- GfK Consumer Confidence: Wednesday, 00:01. The GfK NOP Consumer Confidence Barometer disappointed in September with a score of -9 points, worse than had been expected and reflecting significant pessimism. The number for October will likely be no better in this 2,000-strong survey. A fall to -10 is expected.

- Manufacturing PMI: Thursday, 9:30. The first of Markit’s purchasing managers’ indices is for the manufacturing sector. The figure stood at 53.8 points in September, significantly above expectations and above the 50-point threshold that separates expansion from contraction. We may see a drop in October. A small slide to 53.1 points is on the cards.

- BOE decision: Thursday, 12:00, press conference at 12:30. This is a more important rate decision by the Bank of England and it has been dubbed “Super Thursday.” The Bank not only publishes its rate decision and the meeting minutes from the event but also makes public its Quarterly Inflation Report (QIR) with an accompanying press conference by Governor Mark Carney and some of his colleagues. The BOE is set to leave its policy unchanged: the interest rate at 0.75% (raised to this level in August) and the QE program at 435 billion pounds. The Monetary Policy Committee (MPC) voted unanimously to maintain this policy in the previous meeting and the same voting pattern will probably be repeated. Any change in this will likely trigger an immediate reaction. The QIR includes new inflation and growth projections, known as “fan charts.” Given the uncertainty surrounding Brexit negotiations, forecasts could go anywhere. Recent data was mixed with inflation slowing down to 2.4% while wages advanced to 2.7% y/y. Retail sales fell short of expectations. Governor Carney will likely be asked many questions about Brexit but he will probably dodge political ones. The BOE plans to raise interest rates very gradually, with a maximum of two hikes in 2019 now on the cards, one being more likely. A hard Brexit could result in a rate cut, but the BOE’s base case scenario is for a smooth transition.

- Construction PMI: Friday, 9:30. The construction sector has been more volatile than others in recent months, temporarily dropping below 50 points at one point earlier this year. In September, the score stood at an unimpressive 52.1 points. A similar level of 52 is expected.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar kicked off the week with a drop below the round 1.30 level (discussed last week). The pair continued lower.

Technical lines from top to bottom:

1.3375 was a high point in July. It is followed by 1.3300 was the high point in September and also a psychologically important round number.

1.3255 was the high point in mid-October, ahead of the EU Summit on Brexit. 1.3115 was a swing low in early October.

The round number of 1.3000 is important after providing support to the pair in late September. 1.2920 was a low point in early October.

1.2850 separated ranges in the last days of August and the first days of September.

Further down, 1.2790 served as support late August and also beforehand. 1.2750 held the pair down when the pair was on the back foot.

The current 2018 trough at 1.2660 is the next level. 1.2590 was a swing low in September 2017.

Even lower, 1.25 is a round number and also worked as support in early 2017.

I remain bearish on GBP/USD

The pound will likely remain under pressure as the BOE is set to reflect the ongoing uncertainty around Brexit, which only intensifies. The UK government may surrender to EU demands and send the pound higher, but this may take some time. The Fed’s hawkish policy and falling stocks push the greenback higher.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!