A late-week rally pushed GBP/USD over 2.5%, marking its best week since January. This week’s key events include employment change, CPI and retail sales. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

British data was soft last week. The monthly GDP report contracted by 0.1%, missing the estimate of 0.0%. Investors looked the other way at the weak data, as there appeared to be progress towards a withdrawal deal. British Prime Minister Johnson and Irish Prime Minister Leo Varadkar held talks which they said were constructive and productive. The pound soared in response, and further developments in the Brexit saga could trigger more volatility from the pound.

Over in the U.S., the Federal Reserve released the minutes of its September meeting, at which the Fed trimmed rates by a quarter-point. The minutes were dovish tone, as members said that the risks to U.S. growth “were tilted to the downside.” Policymakers noted their concerns over weak global growth, the toll of the U.S-China trade war and low inflation in the United States. The Fed appears ready to cut rates again – according to the CME Group, the likelihood of a 1/4 point rate cut in October stands at 75%. U.S. consumer inflation reports for September were a disappointment, missing their forecasts. The headline reading slipped to 0.0%, while Core CPI slowed to 0.1%. Inflation levels remain subdued, well below the Federal Reserve’s target of 2.0%. These figures are the latest indication of a slowdown in the U.S. economy.

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Employment Data: Tuesday, 8:30. Wage growth has been moving higher and hit 4.0% in July, above the estimate of 3.7%. Another gain of 4.0% is expected in August. Unemployment rolls are forecast to drop to 21.3 thousand in September, down from 28.2 thousand a month earlier. The unemployment rate is expected to remain at 3.8%.

- Inflation Data: Wednesday, 8:30. CPI dropped sharply to 1.7% in August, compared to 2.1% a month earlier. The estimate for September stands at 1.8%. Core CPI is projected to improve to 1.7%, up from 1.5% in the previous release.

- Retail Sales: Thursday, 8:30. Retail sales declined by 0.2% in August, its first decline since May. The markets are braced for another decline in September, with an estimate of -0.1%.

- BoE Credit Conditions Survey: Thursday, 8:30. The Bank of England’s quarterly report details lending conditions. Higher levels of debt may pose a risk but also imply confidence in the growth of the economy. The survey provides projections for the next three months.

- CB Leading Index: Friday, 13:30. This index of 7 indicators came in at -0.2% in July. Will we see an improvement in August?

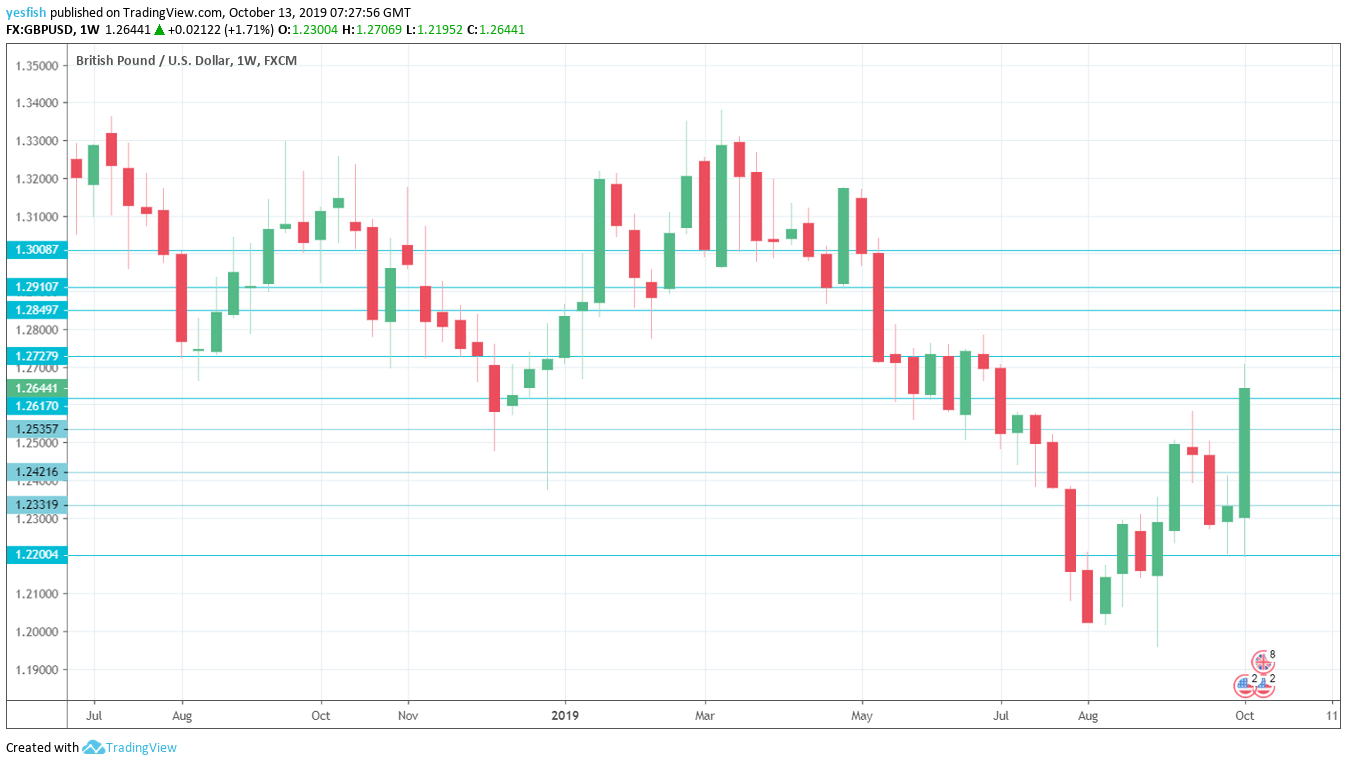

GBP/USD Technical analysis

Technical lines from top to bottom:

With the pound rocketing higher last week, we start at higher levels:

We start with the round number of 1.30. 1.2910 is next.

1.2850 has held firm since mid-May.

1.2728 was active in the first half of January.

1.2616 is an immediate resistance line. It has remained intact since early July.

1.2535 (mentioned last week) has switched to support, after sharp gains by GBP/USD last week. 1.2420 is next.

1.2330 has been relevant since late September.

The round number of 1.22 is the final support line for now. It was an important support level in December 2016.

I am neutral on GBP/USD

The U.K. is scheduled to leave the EU at the end of October and there is a frenzy of activity in an attempt to reach a withdrawal deal in time. The pound could continue to climb if a deal is announced. Conversely, the currency could plunge if no agreement is reached between London and Brussels.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!