GBP/USD posted sharp gains for a second straight week, as the pair jumped 2.6%. The pound is currently at its highest level since mid-May. There are only three events in the upcoming week. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

The pound rally continued at full steam, after London and Brussels announced that they had reached a deal. There was a hiccup on Saturday, as parliament voted down the deal, saying that lawmakers first had to pass all necessary legislation regarding the withdrawal. Still, Prime Minister Johnson remains adamant that the U.K. will leave the EU at the end of the month.

Meanwhile, wage growth slipped to 3.8% in August, down from 4.0% a month earlier. Unemployment rolls slipped to 21.1 thousand, marking an 8-month low. CPI remained steady at 1.7%, while retail sales improved to 0.0%, after a decline of 0.2% in the previous reading.

There was disappointing news out of the U.S., as retail sales contracted in September. The headline reading declined by 0.3%, after a gain of 0.4% in the previous release. Core retail sales declined 0.1%, missing the estimate of 0.2%. There was no relief from the manufacturing front, as Philly Fed Manufacturing Index dropped to 5.6 in October, compared to 12.0 points a month earlier.

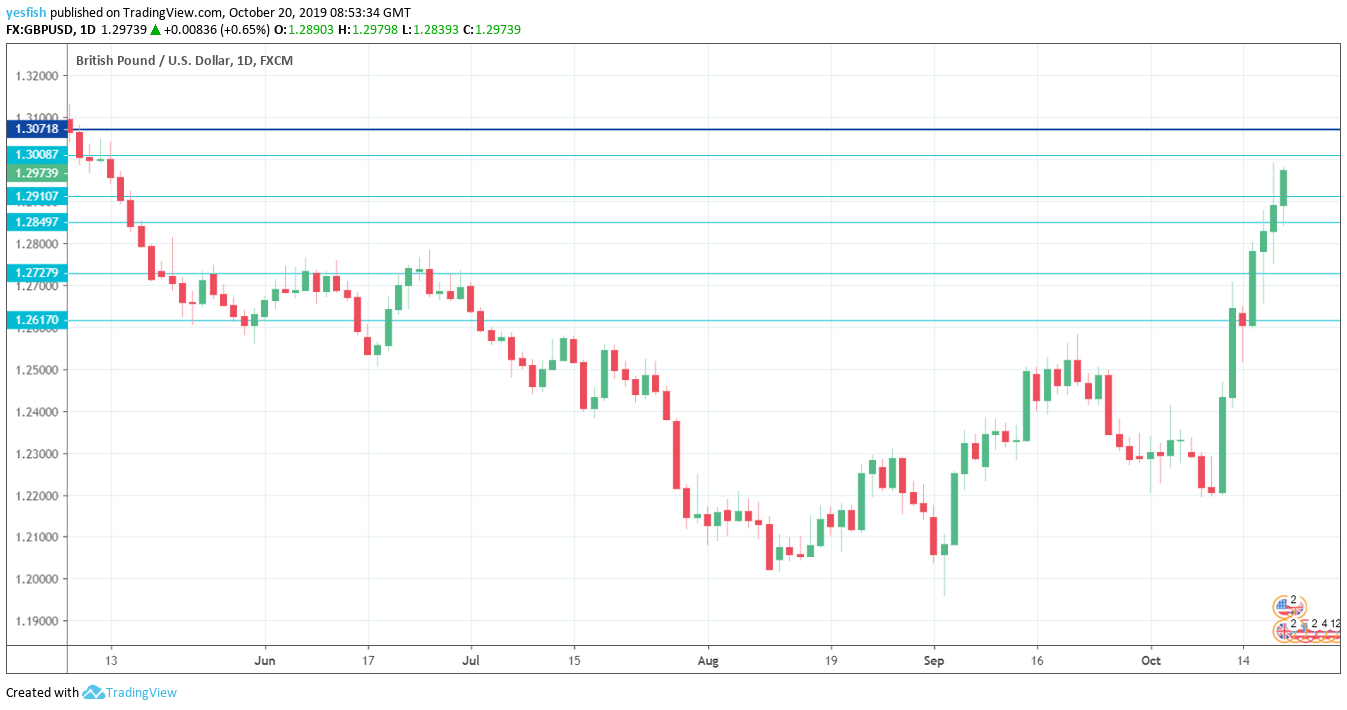

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Public Sector Net Borrowing: Tuesday, 8:30. The U.K. posted a budget deficit of GBP 5.8 billion in August, after a rare surplus a month earlier. The markets are expecting a budget deficit of GBP 8.9 billion.

- CBI Industrial Order Expectations: Tuesday, 10:00. The manufacturing sector remains weak, and manufacturers remain pessimistic about new orders. The indicator improved to -13 in September, but is expected to drop sharply in October, with a forecast of -28.

- High Street Lending: Thursday, 8:30. Loans from major British banks dipped to 42.6 thousand in August, shy of the estimate of 43.2 thousand. The downward trend is expected to continue in September, with a forecast of 42.2 thousand.

GBP/USD Technical analysis

Technical lines from top to bottom:

With the pound posting sharp gains last week, we start at higher levels:

1.3375 was a high point in July. It is followed by the round number of 1.3300.

1.3217 was the high point of the pound rally in late January.

1.3170 is next.

1.3070 was a high point in mid-November.

The round number of 1.3000 has psychological significance. This line, which has held since mid-May, is under pressure in resistance.

1.2910 has switched to a support level.

1.2850 is next.

1.2728 was active in the first half of January.

1.2616 (mentioned last week) is the final line for now.

I am neutral on GBP/USD

The pound has soared over 5% in the past two weeks, after the sides appeared to have reached a deal on Brexit. However, the vote in parliament means that an extension may be required, so we could see volatility from the pound next week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!