GBP/USD was on the back foot as Brexit talks broke down amid a deadlock on the questions of the Irish border and the customs arrangements. What’s next? A speech by BOE Governor Mark Carney stands out. Here are the key events and an updated technical analysis for GBP/USD.

The European Union and the United Kingdom could not find creative solutions for the question of Northern Ireland. Both sides want an open border on the Isle of Ireland and but the exit of the UK from the EU’s customs union poses issues. The talks broke down ahead of the summit, already over the weekend, and sent the pound down with a weekend gap. It then recovered gradually but then dropped to lower ground. A special summit in November seems unlikely at the moment and the EU is stepping up its contingency plans for a no-deal Brexit. UK data was mixed: Average hourly earnings rose by 2.7%, better than had been projected but inflation slipped to 2.4% y/y, pushing back expectations for a rate hike.

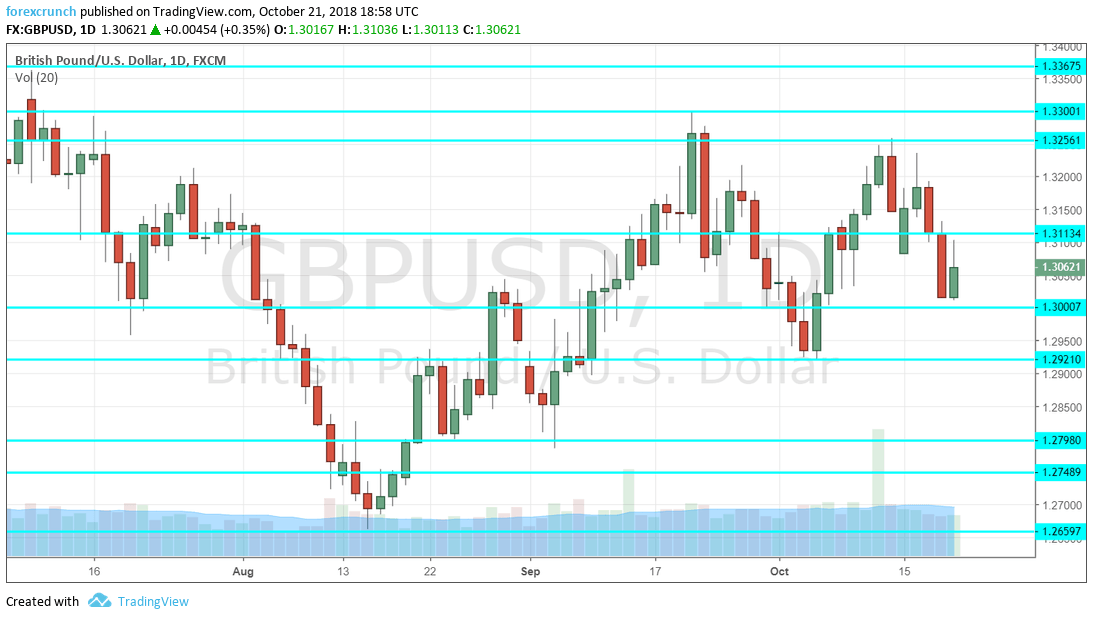

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Tuesday, 10:00. The Confederation of British Industry’s gauge of future orders disappointed in September with a drop to -1, negative territory. A repeat of the same score is projected in October.

- Andy Haldane talks: Tuesday, 10:30. The Bank of England’s Chief Economist will speak in Paris and the event is around policy experiments. Will Haldane provide new ideas for monetary policy? He may provide insights into the economic implications of the current impasse in Brexit talks.

- Mark Carney talks: Tuesday, 15:30. The Governor of the BOE flies to his home country, Canada. The speech in Toronto is about Machine Learning, but Carney may expand and talk about other matters such as the Bank’s monetary policy. The recent Brexit developments complicate the BOE’s task.

- High Street Lending: Wednesday, 8:30. The association provides mortgage data for around two-thirds of mortgages and publishes the data before the official government numbers. After reporting a level of 39.4K mortgages in September, a small drop to 39K is on the cards.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar kicked off the week with a weekend gap, tried recovering, but then fell towards the round 1.3000 level (mentioned last week).

Technical lines from top to bottom:

1.3375 was a high point in July. It is followed by 1.3300 was the high point in September and also a psychologically important round number.

1.3255 was the high point in mid-October, ahead of the EU Summit on Brexit. 1.3115 was a swing low in early October.

The round number of 1.3000 is important after providing support to the pair in late September. 1.2920 was a low point in early October.

1.2850 separated ranges in the last days of August and the first days of September.

Further down, 1.2790 served as support late August and also beforehand. 1.2750 held the pair down when the pair was on the back foot.

The current 2018 trough at 1.2660 is the next level. 1.2590 was a swing low in September 2017.

Even lower, 1.25 is a round number and also worked as support in early 2017.

I am bearish on GBP/USD

The failure of the EU Summit does not mean a failure to reach a Brexit deal. However, such an agreement is unlikely this week and the longer negotiations continue, the heavier the weight on the pound.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!