GBP/USD managed to edge up in a week that saw some USD weakness and hopes for a Brexit deal. Will they make it? The EU Summit is left, right, and center. Here are the key events and an updated technical analysis for GBP/USD.

Creative ideas for a solution on the thorny issue of the Irish border and reports about a willingness to compromise supported the British Pound in another turbulent week. The US Dollar was on the back foot as Donald Trump criticized the Fed, inflation disappointed once again and as stocks tumbled down.

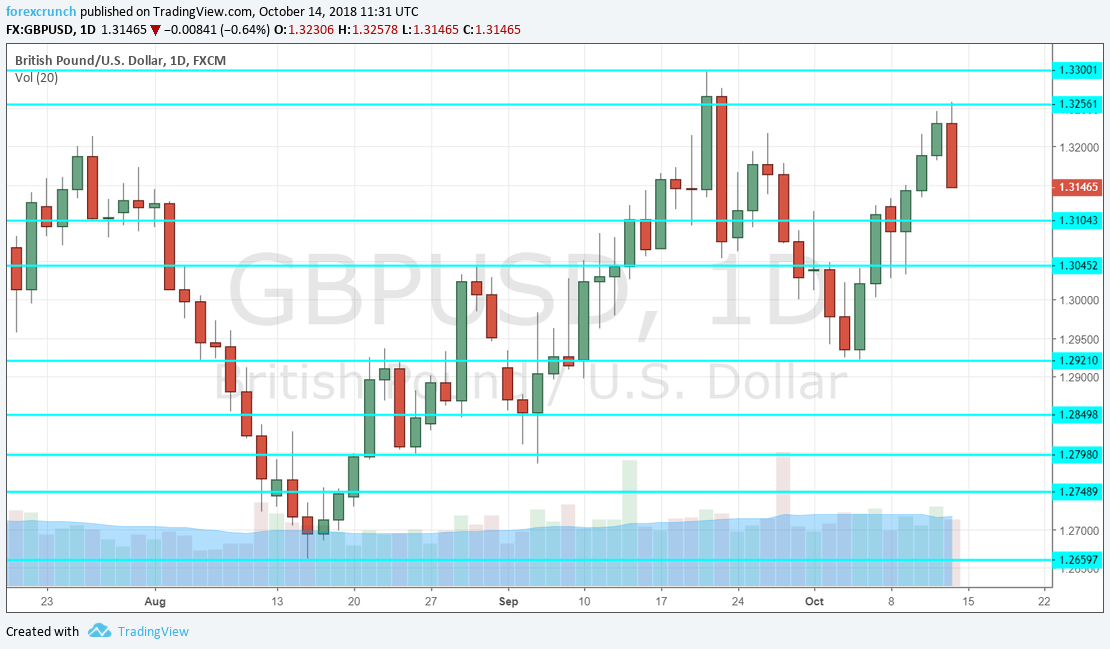

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. While there are other House Price Indices that are considered more accurate, this one is the earliest available in the UK. After two months of declines, Rightmove reported an increase of 0.7% in its HPI back in September. We will now get fresh data for October.

- Jobs report Tuesday, 8:30. Britain enjoys an unemployment rate of only 4% as of July, and this is expected to remain unchanged. However, wage growth is not going anywhere fast and competes with inflation. An increase was seen in July and the same level is on the cards for August. The Claimant Count Change for August showed an increase of 8.7K. The fresh figure for September is forecast to show a more modest increase of 4.5K. A higher rise in jobless claims could be worrying.

- Jon Cunliffe talks: Tuesday, 13:15. The Deputy Governor of the Bank of England will appear before the Treasury Committee and will provide fresh insights about the economy and perhaps hint about future monetary policy. Brexit will also be a hot topic, but Cunliffe will likely dodge politically-sensitive questions.

- UK inflation: Wednesday, 8:30. The UK’s Consumer Price Index rose by 2.7% YoY in August, showing increasing inflationary pressures and helping justify the Bank of England’s rate hike that month. A slower annual increase in prices is on the cards for September: 2.6%. The Retail Price Index (RPI) is projected to rise by 3.5%, repeating the same figure from the previous month. Core CPI is predicted to slow from 2.1% to 2.0% and PPI Input to rise by 0.9% MoM after an increase of 0.5% in August

- CB Leading Index: Wednesday, 13:30. This composite index is made out of no less than seven components. It dropped by 0.2% in July and the figure for August will likely be more upbeat.

- Ben Broadbent talks: Wednesday, 17:00. This Deputy Governor will make a public appearance outside his country, talking at the Brookings Institute in Washington. Broadbent has been somewhat hawkish in the past. The topic of his speech is “unconventional monetary policy”.

- EU Summit on Brexit: Thursday. The leaders of the European Union, which still includes the UK are convening for a planned summit, with Brexit being the main issue. Reaching a Brexit deal by this date was marked as a deadline, but that may slip. Both sides are reporting progress in talks after the Conservative Party Conference ended. The most thorny issue is that of the Irish Border, which is related to the customs arrangements. One option is to place Northern Ireland in a separate customs regime, thus creating a customs border in the Irish Sea. However, the idea is vehemently opposed by the DUP which props up the UK government in a “confidence and supply” deal. A Brexit deal would send the pound higher and the euro would also enjoy it. However, a more likely scenario is that the EU and the UK set a new deadline in November. The option of a second referendum and a no-deal Brexit are also on the cards. High volatility is likely.

- Retail Sales: Thursday, 8:30. Consumers beat expectations in August, making it two months in a row. The warm weather helped shoppers go out and spend. After a drop of 0.3% in August, a decline of 0.3% is on the cards for September.

- Public Sector Net Borrowing: Friday, 8:30. After a month of a surplus in the public coffers, the UK government saw a fresh deficit in August: 5.9 billion. A narrower deficit is now on the cards: 4.6 billion.

- Mark Carney talks: Friday, 15:30. The Governor of the BOE will have an opportunity to react to a Brexit deal, or lack thereof. Carney will speak in New York, late in the week. There is no specific topic for his speech.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar climbed gradually, settling over the 1.3045 level (mentioned last week) before extending its gains.

Technical lines from top to bottom:

1.3375 was a high point in July. It is followed by 1.3300 was the high point in September and also a psychologically important round number.

1.3255 was the high point in mid-October, ahead of the EU Summit on Brexit. The round number of 1.3100 supported the pair earlier in September.

1.3045 provided support in September and beforehand capped the pair in August. The round number of 1.3000 is important after providing support to the pair in late September.

1.2920 was a low point in early October. 1.2850 separated ranges in the last days of August and the first days of September.

Further down, 1.2790 served as support late August and also beforehand. 1.2750 held the pair down when the pair was on the back foot.

The current 2018 trough at 1.2660 is the next level. 1.2590 was a swing low in September 2017.

Even lower, 1.25 is a round number and also worked as support in early 2017.

I am bullish on GBP/USD

The EU Summit may result in an EU-fudge: no full agreement but many smiles that will keep the pound happy until the next crisis.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!