GBP/USD had a very volatile week on contradicting reports regarding Brexit. The see-saw will likely continue. A busy week including GBP, the jobs report, and the BOE decision join Brexit talks in influencing Sterling. Here are the key events and an updated technical analysis for GBP/USD.

Chief EU Negotiator Michel Barnier rejected Britain’s Chequers proposal, send cable down on a weekend gap. Then we heard that Germany and the UK dropped key Brexit demands and the pound leaped. A denial sent it back down. Further reports and rumors will likely continue. UK PMI’s were mixed with manufacturing and construction missing expectations but services coming out slightly better. BOE Governor Mark Carney’s future at the helm of the central bank has also been of interest. Elsewhere, concerns about new US tariffs on China supported the US Dollar while no new adverse developments in Emerging Markets helped stabilize the mood.

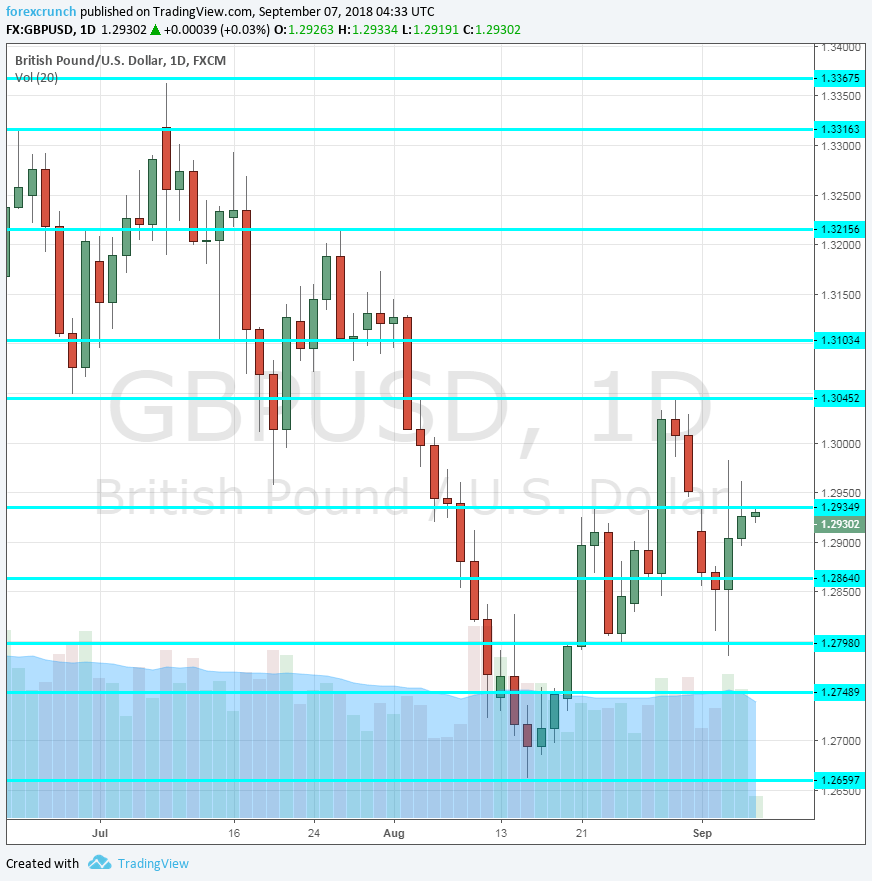

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- GDP: Monday, 8:30. This will be the second monthly GDP report and the first one that stands on its own, without an accompanying quarterly figure. The economy grew by 0.1% in June and now we will get the first read for Q3, beginning with July. It will be interesting to see if concerns about a no-deal Brexit have already impacted economic activity. An advance of 0.2% is on the cards now.

- Manufacturing Production: Monday, 8:30. Alongside the GDP report, a few other indicators are released with manufacturing output standing out. An increase of 0.4% was recorded in June, beating expectations. The small yet significant sector will have likely seen further growth in July. An increase of 0.2% is on the cards. The broader industrial production measure carries expectations for +0.2%.

- Goods Trade Balance: Monday, 8:30. Another noteworthy figure due alongside the GDP is projected to show yet another trade deficit. That deficit stood at 11.4 billion pounds back in June. July will probably see a similar deficit of 11.7 billion.

- UK jobs report: Tuesday, 8:30. The labor market is looking good with only 4% unemployment in June. However, wages are not going very fast, with an increase of 2.4% that month, hardly keeping up with inflation. An increase of 2.5% is on the cards now. Changes in salaries are closely watched by the Bank of England. The unemployment rate is expected to remain unchanged at 4%. Jobless claims rose by 6.2K in July, worse than had been expected. We will now get an update for the Claimant Count Change for August and expectations stand at 3.6K.

- RICS House Price Balance: Wednesday, 23:01. The Royal Institution of Chartered Surveyors re[prted a slightly positive figure in July: +4%, better than previous months. A positive balance implies more surveyors reported rises in prices in comparison to those reporting a drop. 2% is on the cards now.

- Rate decision: Thursday, 11:00. The Bank of England increased the interest rate to 0.75% back in August, in a decision that was accompanied by the Quarterly Inflation Report. The BOE responded to rising inflation but despite a unanimous vote to move rates, Governor Mark Carney and his colleagues remain hesitant given the high level of uncertainty originating from Brexit. The MPC is likely to maintain interest rates unchanged at this meeting and probably the next ones until there is some clarity on Brexit or a significant change in the economic trajectory. The vote will likely be unanimous once again. Any votes for an additional hike could boost the pound.

- Mark Carney speaks: Friday, 10:00. The Governor of the BOE will not speak after the rate decision but will have an opportunity to move the pound on the following day. Markets will want to hear comments on inflation, growth and also his future in his speech in Dublin.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar kicked off the week with a weekend gap, falling towards the 1.2800 level (mentioned last week). It then jumped up and down quite a bit.

Technical lines from top to bottom:

1.3215 was the high point for the pair in mid-July and a lower high on the chart.

1.3100 was a swing low in mid-June and 1.3045 was a high point in August and also close to the initial 2018 low.

Below 1.3000 we find 1.2935, a high point in late August. 1.2865 separated ranges in late August. Further down, 1.2790 served as support late August and also beforehand.

1.2750 held the pair down when the pair was on the back foot. The current 2018 trough at 1.2660 is the next level.

1.2590 was a swing low in September 2017. Even lower, 1.25 is a round number and also worked as support in early 2017.

I remain bearish on GBP/USD

Brexit is biting and the optimism is not based on any confirmed report. Alongside Trump’s trade wars, there is more room to the downside than to the downside.

Our latest podcast is titled Brexit summer blues, trade troubles

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!