- The GBP/USD is hovering near a two-month high, while the latter is not decided.

- There are no major meetings scheduled after Brexit, which will add to the supply shortage.

- Johnson hopes to stop the viral wave without isolating the country, and Frost joins the Tory group of regulators to fight Covid.

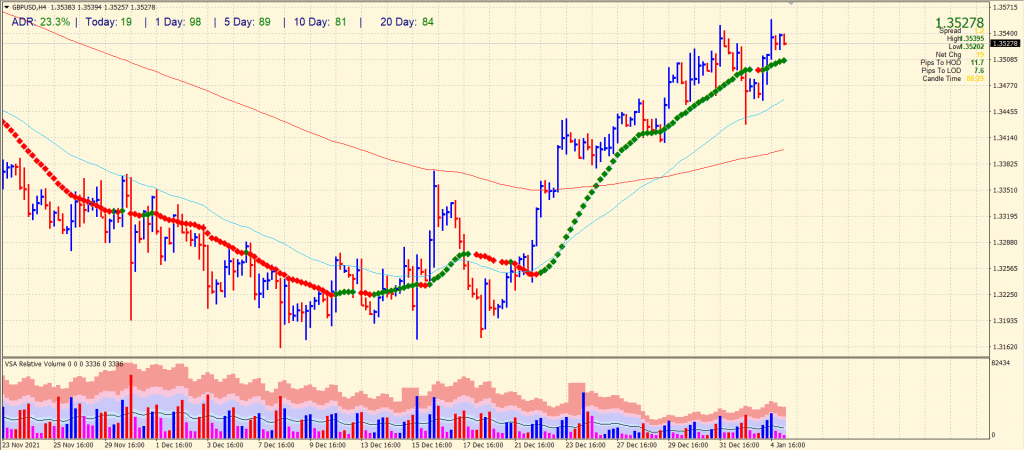

As of early Wednesday morning, the GBP/USD price forecast remains in equilibrium around 1.3530. Despite consolidating the previous day’s gains in a 20-pip trading range, the cable pair shows cautious market sentiment at its highest level in two months.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

Recent moves in the GBP/USD pair are shaped by the lack of major Brexit updates and mixed concerns over the South African variant of Covid, Omicron.

Bloomberg is aware of the recent challenges UK forwarders face regarding post-Brexit border controls, and IT changes. As companies cope with the new wave of post-Brexit bureaucracy, merchants face a new IT system that tracks goods across the Channel.

Supply chains are tight, and GBP/USD demands are high. However, the meeting on the calendar between the European Union (EU) and British diplomats seems to have been stuck for quite some time. It is also worth noting that former Brexit minister David Frost recently announced that the Conservative party opposed Covid-related restrictions.

Meanwhile, there are more than 200,000 Covid cases reported daily in the UK, and updated research and comments from WHO Incident Manager Abdi Mahamoud have helped UK Prime Minister Boris Johnson remain upbeat despite record-high but upbeat rates. UK Prime Minister Johnson stated: “We have a chance to get through this wave of Omicron without being banned.”

Nevertheless, the UK Manufacturing PMI increased from 57.6 from the previous forecast to 57.9 in December, while the US ISM Manufacturing PMI fell to its 11-month low of 58.7 in December compared to 60 forecasts and 61.1 in November. Additionally, US JOLTS vacancies in November decreased from €11.091 million to €10.562 million from the previous revision upward.

Moreover, comments from Minneapolis Federal Reserve President and 2022 FOMC voting member Neil Kashkari reaffirmed modest inflationary expectations in the US. For example, 10-year break-even inflation (FRED) data from the St. Louis Federal Reserve Bank also favored GBP/USD bulls the day before.

The GBP/USD pair could remain stable if ADP weakens, as anticipated. Nevertheless, the hawkish tone of the FOMC minutes will be enough to scare the pound bulls.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

GBP/USD price technical forecast: Bearish reversal in preparation

The GBP/USD pair posts fresh 2-month highs above mid-1.3500 and pares off 30 pips. The pair has formed a bearish reversal pattern as the widespread up bar closed near the middle with a very high volume. Hence, we can expect a fall towards 1.3475 ahead of 1.3440. On the flip side, we may find a bullish validation if the price hits fresh highs above 1.3555. In that case, the probability of testing 1.3600 will be quite high.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.