In our GBP/USD forecast we note that the pair fell immediately after the Bank of England Monetary Policy Committee (MPC) decision was released, perhaps as a result of dashed hopes for more hawkish bias on tightening.

The BoE’s MPC voted 8 to 1 to keep bond buying unchanged at £895 billion and interest rates stay pat on 0.1%, presenting no surprises for the market.

However, the Bank says it now expects to see inflation move above 3%, in a change from previous assessments, although it still maintains it will be transitory. Traders seem to been disappointed that the assessment didn’t come with any hints of tightening to head off inflation or overheating in the economy.

In May UK CPI inflation jumped unexpectedly from 1.5% to 2.1%.

MPC: “growth and inflation will fall back”

A summary statement accompanying the report in part read: “The committee’s central expectation is that the economy will experience a temporary period of strong GDP growth and above-target CPI inflation, after which growth and inflation will fall back,” it said in its summary of the meeting

Andy Haldane, the Bank’s chief economist, voted to reduce gilt purchasing by £50 billion. Haldane is leaving his post at the Bank soon.

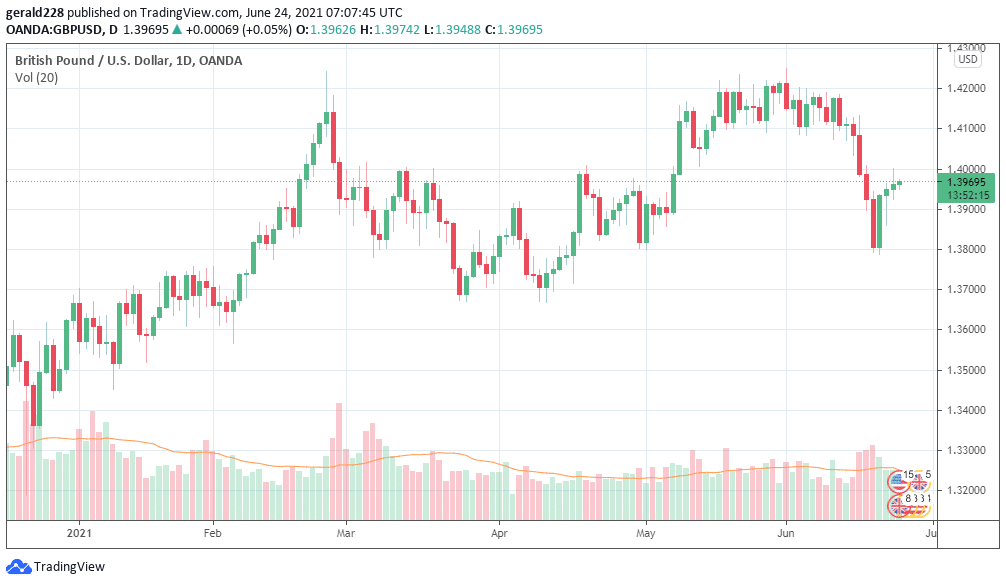

The GBP/USD pair had looked reasonably bullish for the next few days and there seemed to be strong support for the pound. After dropping to an intraday low of around 1.3860, the trading pair had recovered to reach a weekly high of 1.3963.

Before the rate decision the GBP/USD pair was trading at around 1.3966 and was in the the green on the back of promising data. Bulls had appeared to be strongly in the equation although several events could affect the long-term outlook.

Major events that could impact the GBP/USD are the situation regarding Covid19 and the US Fed’s doveish policy.

Cases are rising fast in the UK but there do not appear to be any major death numbers with the NHS ‘well on top’ according to Vaccines Minister Nadeem Zawarhi. Fed Chairman Powell’s recent statement to Congress where he said he expects inflation to eventually subside could also have an effect on the GBP/USD in the long term.

General outlook shows support for Pound

The GBP/USD pair ended yesterday’s session at the 1.3959 mark. Although Covid19 cases are rising fast with 16,000-plus cases reported yesterday, this does not seem to be causing a corresponding rise in deaths. The Health Secretary Matt Hancock said that the data looked quite good. This has fuelled further expectations that the reopening planned for July 19 can go ahead.

Expected Announcements And Events

The UK published its May Public Sector Net Borrowing which declined slightly to £23.605 billion. The seasonally adjusted HIS Markit/CIPS UK Manufacturing Purchasing Managers Index was down for June to 64.2. It was expected to be 64.0. This is down from the 65.6 registered in May.

The Flash UK Services Business Activity Index for June was down to 61.7. This compares to May’s result of 62.9 as final and 62.8 expected. This figure was the lowest for the index in the last two months.

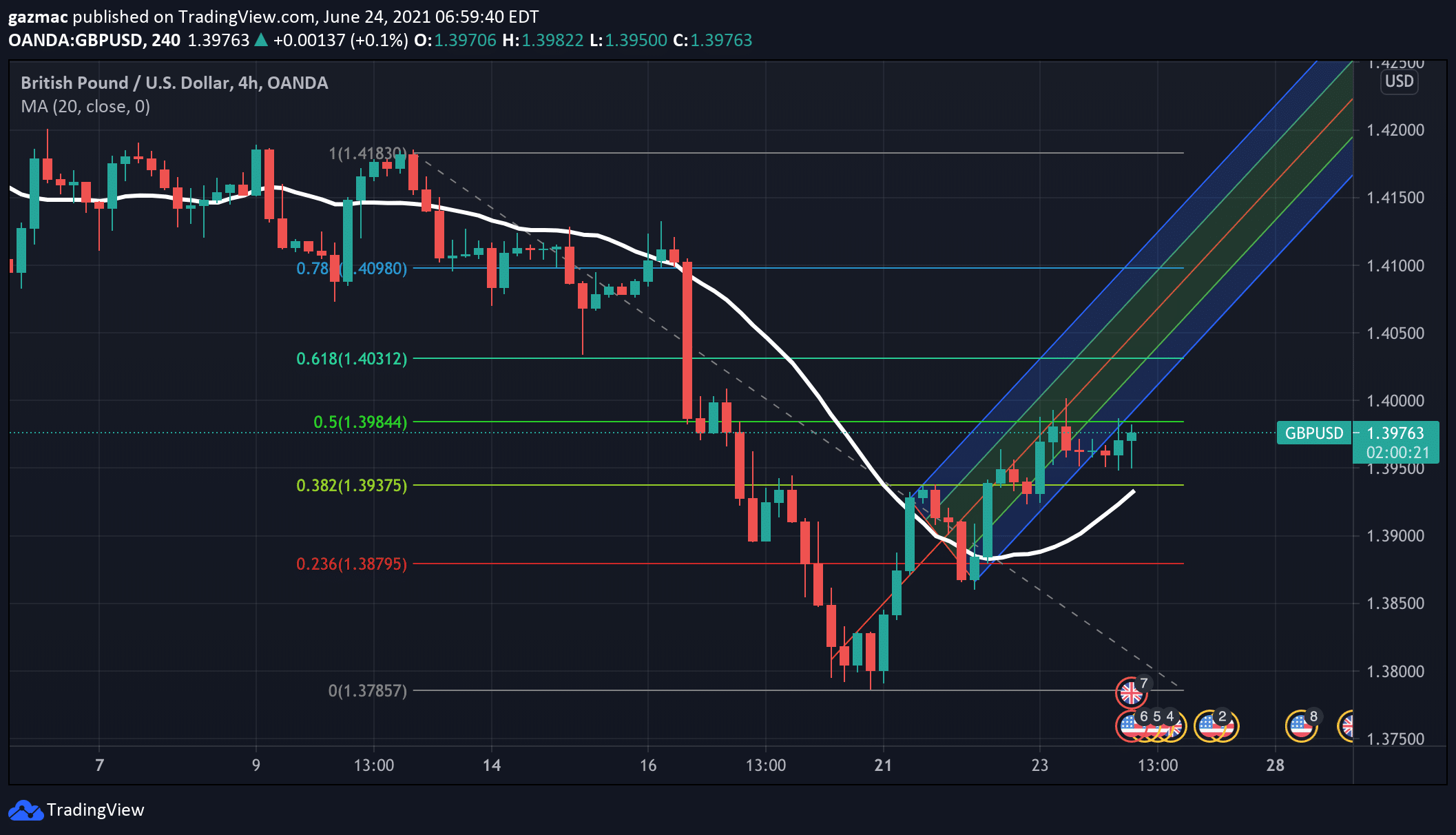

GBPUSD Forecast: Technical Analysis – A Neutral To Bullish Stance

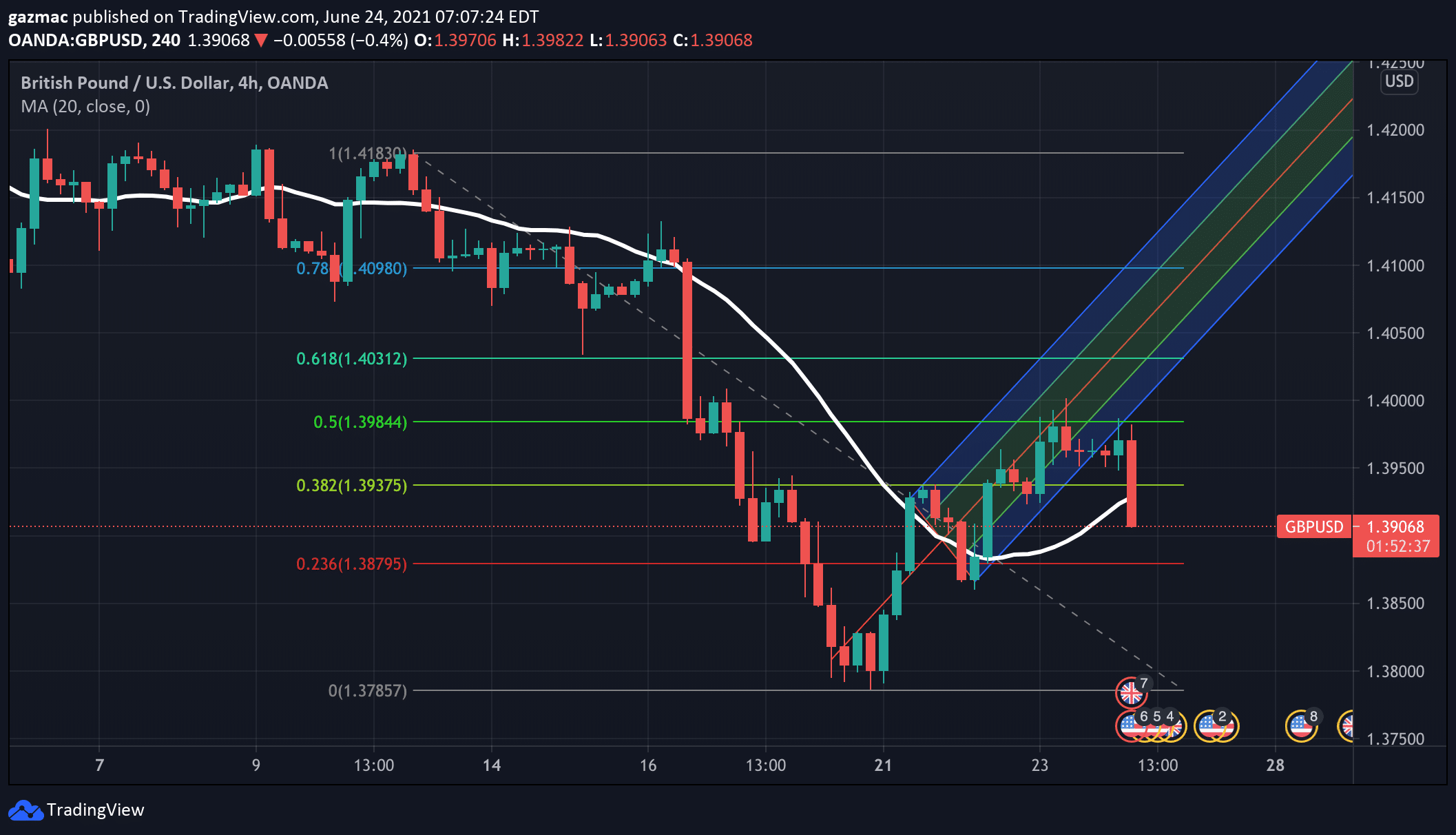

Bearish indicators going into the BoE meeting had looked like they were falling away, but that. hsa broken down near term, as can be seen in the difference between the pre meeting 4-hour chart and the one a few minutes after, shown below:

GBPUSD forecast 4-hour chart BEFORE MPC announcement

GBPUSD forecast 4-hour chart AFTER MPC announcement

GBP/USD has slipped 0.40% immediately after the MPC announcement, which was followed by an upward revision in GDP, which puts any monetary tightening even further into the background.

Significantly, our GBP/USD forecast notes that the instrument has now slipped below the 20-day moving average with 0.236 retracement level the next line of support at 1.3879.

There could be further pressure on GBP/USD when the US initial jobless claims land at 13:30 EST today. The forecast is for an improving employment situation, with the forecast citing 380k as against 412k previously.

The UK’s relatively isolated position vis a vis Russia, following news of Germany and France’s attempt to set up a summit with Russia, may also be unnerving sterling traders.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.