- Tenreyro voted against a subsequent BoE rate increase last month.

- The BoE is expected to increase its key interest rate from 4.25% to 4.5% next month.

- UK consumer price inflation is expected to drop to 9.8% from 10.4% on Wednesday.

Today’s GBP/USD outlook is bearish. Silvana Tenreyro, a Bank of England policymaker, stated that it would take time for previous interest rate increases to impact inflation. Therefore, it was necessary to avoid making major changes to policy while this influence was still being felt.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

At a panel discussion the International Monetary Fund convened in Washington on Friday, she stated, “We need to be patient. We don’t want to be burned. We prefer not to get an icy shower.”

Tenreyro quoted Milton Friedman, a Nobel Prize-winning economist, who compared setting an economic policy to altering the temperature of a shower that was slow to respond to changes in the taps.

Tenreyro voted against a subsequent BoE rate increase last month. She claimed that the previous tightening was more than sufficient and could, in the medium term, drive inflation well below target.

According to financial markets, the BoE is expected to increase its key interest rate next month from 4.25% to 4.5%, which would be its 12th straight increase since December 2021.

According to economists, consumer price inflation is expected to drop to 9.8% from 10.4% on Wednesday. However, it will remain far higher than the rates in the US and most of Europe.

GBP/USD key events today

There won’t be any significant news releases from the UK or the US today. Therefore, we might see the price consolidating as investors await important data.

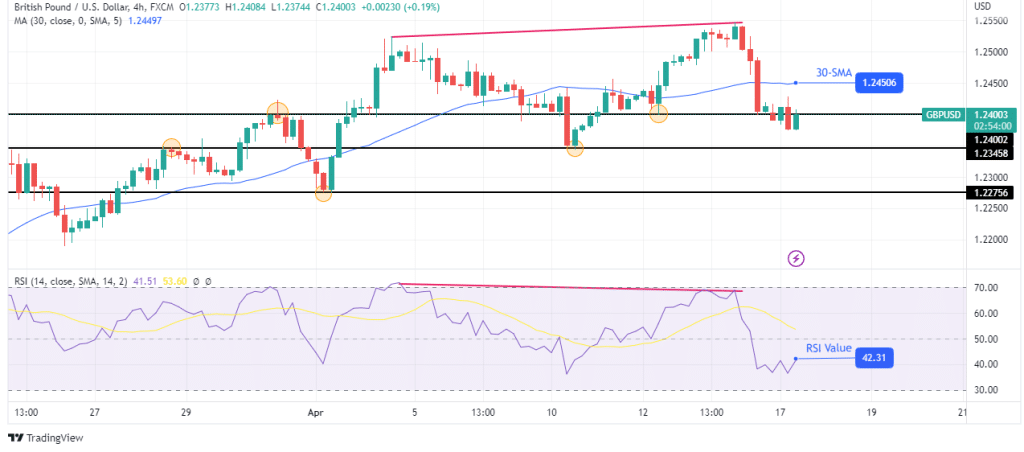

GBP/USD technical outlook: Bearish RSI divergence

GBP/USD has crossed below the 30-SMA in the 4-hour chart. The RSI has also crossed below 50. This is a sign that there has been a shift in sentiment from bullish to bearish. This comes after a bearish RSI divergence. The price has paused at the 1.2400 key level and is attempting to go below.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

Although there has been a shift in sentiment, the trend has not yet reversed. For there to be a bearish reversal, bears need to break below the 1.2345 support level and start making lower lows and highs. If this does not happen, we might see bulls return to make a new high.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.