- GBP/USD price gains above 1.2500 as the US dollar corrects lower.

- The US dollar continues to fall, and DXY fell 1% to a two-week low.

- Wall Street’s recovery subsided, with the Dow Jones at 1.10%.

The GBP/USD outlook turned bullish on Thursday after recovering fully from Wednesday’s decline, though the stock market is still down and under pressure. Over 150 pips have been added from the daily low, and the pair has recently hit 1.2514, its highest level since May 5th.

–Are you interested in learning more about forex robots? Check our detailed guide-

The GBP/USD rose due to extensive dollar weakness. In spite of risk aversion, the DXY fell 1.05% to 102.80, a two-week low. Wall Street declined by 1.00%, and the FTSE 100 declined by 2.12%. Nasdaq gained 0.35 percent and entered positive territory.

Government bonds spurred demand for risk assets. US 10-year government bond yields are 2.81%, far from Wednesday’s 3%. Over the past decade, UK earnings have been around 1.85%. Yields fell Thursday, causing the dollar to fall the most among the G10.

According to US economic data, long-term claims for unemployment benefits dropped to their lowest level since 1970, while unemployment benefits rose to 218,000, the highest level since January.

In May, the Philadelphia Fed dropped to 2.6 (compared to an expected market reading of 16). In April, dwindling home sales decreased by 2.4%. Friday will see the release of the UK retail sales report for April.

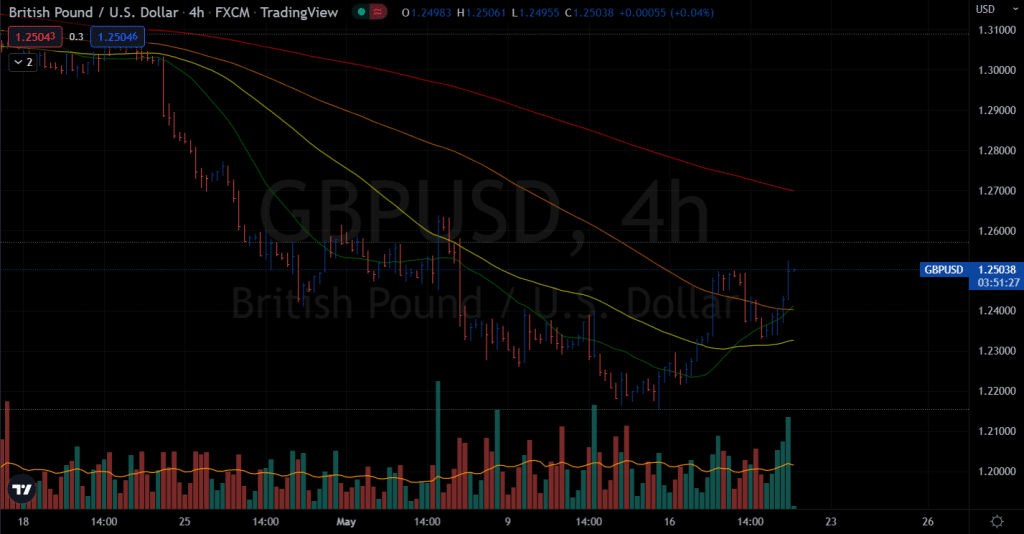

GBP/USD price technical outlook: Buyers challenging 1.2500

The GBP/USD price broke the 1.2500 resistance area. The pair is well above the key moving averages on the 4-hour chart. The 20 and 50 period SMAs are going to make a bullish crossover. It indicates that the price has the potential to rise further. The next upside resistance lies around the May highs at 1.2637. However, the bias will turn bullish once the price clearly exceeds the 1.2637 level.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

On the flip side, sliding below the 1.2500 level may turn the bias neutral. In that case, the pair may slip lower towards 1.2410 ahead of 1.2330. If bears persist further, the downside may aim for 1.2165.

The volume data shows a strong bullish bias. This is because the volume bars are rising while the price is on the rise too. Hence, the bias will be confirmed if the price consolidates with a declining volume.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money