- GBP/USD outlook is extremely bearish.

- Coronavirus cases in the UK are spreading a lot.

- British authorities have been criticized for lifting the lockdown.

The GBP/USD outlook continued its downward movement on Tuesday, while the EUR/USD pair practically did not move. Thus, it can be assumed that the reasons for the collapse of the British Pound should be sought in the UK. You won’t need much time to find out the reasons.

–Are you interested to learn more about forex options trading? Check our detailed guide-

As we have already understood, Brexit has long been of no interest to market participants. At least until the escalation of the conflict between London and Brussels over the trade agreement and the “Northern Ireland Protocol” begins. But the markets are very sensitive to the growing number of cases of “coronavirus” every day.

The UK has already been listed as “not recommended to visit” in many countries worldwide. Yet, at the same time, the UK authorities completely lifted all quarantine restrictions this Monday. In this way, whatever plans the British government may have regarding containment of the spread of the “coronavirus”, the markets consider its actions to be wrong.

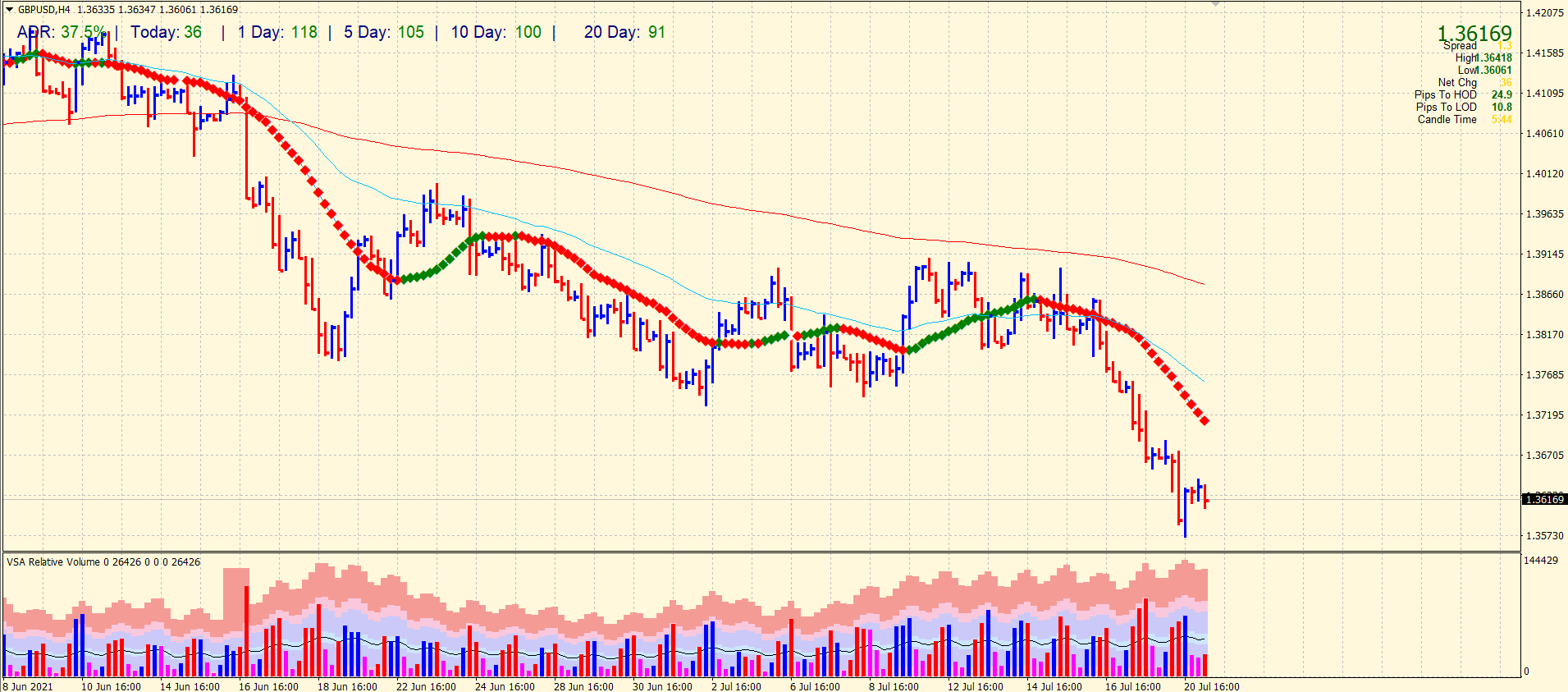

Therefore, short selling of the British currency continues. We are expecting GBP/USD in the area of “‹”‹1.3600 – 1.3666. However, this area has already been worked out and even overcome. Therefore, at the moment, the downward movement continues based on the pandemic situation in Foggy Albion. In the current conditions, the downward movement may continue further.

The British authorities are playing with fire. Moreover, this also applies to the fate of an entire nation and its own destinies. Still fresh in my memory is the story with Boris Johnson’s phrase that he “would rather see a mountain of corpses than introduce a lockdown”. Of course, there is no evidence that Johnson actually uttered this phrase. However, a stain on Johnson’s reputation formed.

The markets also did not forget about the statements of the former chief adviser to Johnson Dominic Cummings. He said that the entire British government proved to be surprisingly incompetent during the first and second “waves” of the pandemic in 2020 and made many wrong decisions that killed tens of thousands of citizens. In this way, the current decision of the British government to open up the entire economy and the country will be examined under a microscope by opposition political forces, sceptics, and everyone who worries about the health of the British nation.

In the last two days, the number of daily recorded cases of the disease began to decline, and the day before yesterday, only 40k new cases were recorded. However, 40k is still a lot. And no one can guarantee that tomorrow, these figures will not creep up again. The British government itself gives practically no comments on the fourth “wave”. Just yesterday, Chief Scientific Advisor Patrick Vallance said 60% of people admitted to hospital with complications are unvaccinated. Thus, the public should have concluded that all vaccinated Britons have nothing to fear from this statement.

–Are you interested to learn about forex robots? Check our detailed guide-

However, other data suggest that even those Britons who received both doses of the vaccine are admitted to hospitals, and 90% of those newly infected have become infected with the “Indian strain.” In addition, some media outlets accuse the British authorities of adjusting the real mortality data during the fourth “wave”.

GBP/USD technical outlook: Hope of bullish reversal?

Technically, the pair is still bearish, but hope for bulls has emerged with the appearance of an up bar with a very high volume, rising from the 1.3570s area. This could be a dead cat bounce as the selling volume is much higher than the buying volume. The key moving averages are pointing south. However, a 50-pip bounce is still expected from here as the 20-period SMA can attract price towards itself.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.