- GBP/USD remains negative despite modest intraday gains from the YTD lows.

- Disappointing UK GDP report capped the pound gains.

- BoE’s stance remains dovish, keeping the sellers active.

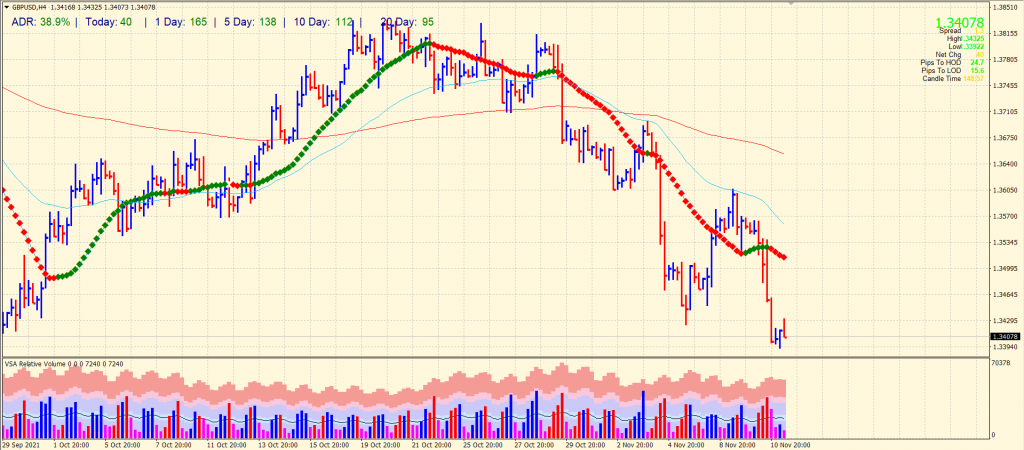

The GBP/USD poses a negative outlook as the entire week sees a huge downfall amid broader risk-off sentiment and Brexit concerns.

-Are you looking for CFD brokers? Take a look at our detailed guideline to get started-

Following the UK macro release, the GBP/USD pair maintained its modest intraday gains heading into the European session, despite falling a few pips from the daily highs.

The GBP/USD pair recovered from its lowest point since December 2020, which it hit on Thursday, despite showing some resilience below 1.3400. However, despite the bullish tone, there was little follow-up buying or optimistic confidence, and the rally dwindled slightly after the disappointing UK GDP report.

The Office for National Statistics reported that the UK economy grew 1.3% between July and September, down from a forecasted 1.5%, suggesting a sharp slowdown from 5.5% growth in the previous quarter. In addition, UK manufacturing and industrial production figures fell short of expectations, adding pressure to the pound sterling.

Markets worldwide fear that Article 16 of the Northern Ireland Protocol will be enforced by the UK government. Last week, the Bank of England’s decision to keep rates unchanged favors bearish traders and points toward a continuation of the downward trend that started over three weeks ago.

In addition to the strong downward sentiment against the US dollar, expectations of a Fed tightening support the negative outlook. Despite this, the relatively weak liquidity conditions over the US Veterans Day weekend may deter decliners from placing new bets.

GBP/USD price technical outlook: YTD lows formation

The GBP/USD price formed a new YTD low under 1.3400 handle today. The price managed to gain back above 1.3400 area but remains feeble. If the bearish pressure persists, the price can plunge down to the 1.3300 level. However, we may see an upside correction towards 1.3400 ahead of 1.3500 as well. The volume data is clearly in favor of bears. The average daily range is 38% for now, which is low.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

Traders should wait for the consolidation to break on either side to open any new position. The path of least resistance lies on the downside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.