Optimism is rampant for a big Brexit breakthrough. First, we learned that the May is ready to open the checkbook regarding the divorce bill. Now, we also learn that Dublin and London are drawing closer to some kind of an agreement on the Irish border. And to top it off, the Times report also discusses a potential agreement with the EU on a transition deal.

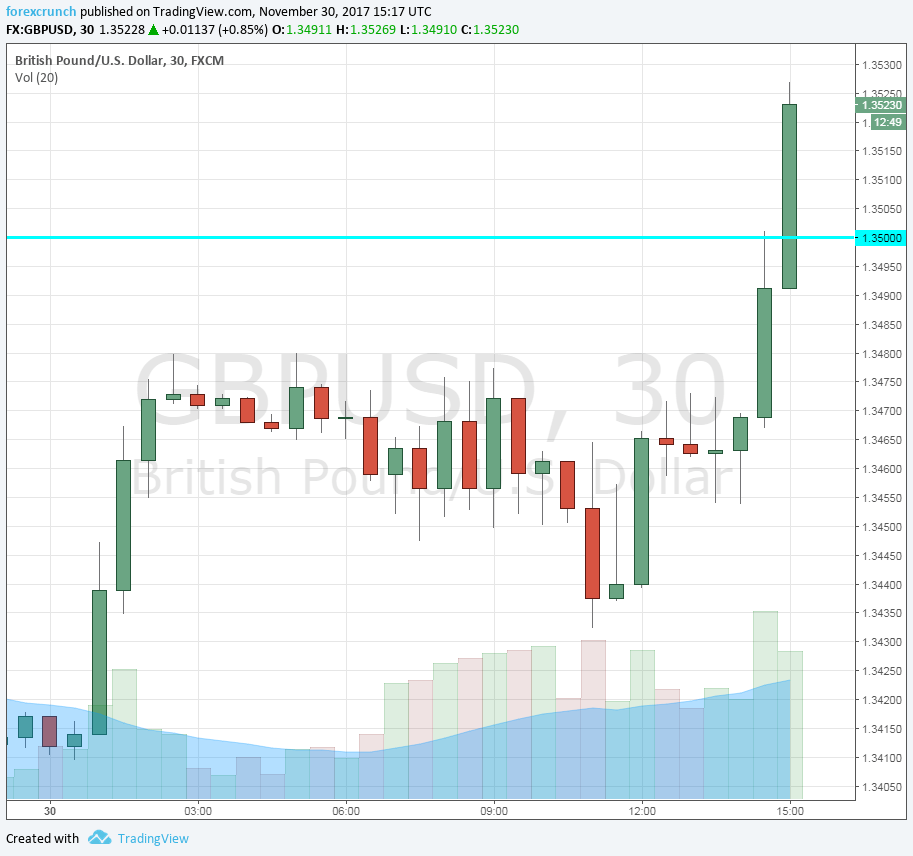

GBP/USD is already over 100 pips up on the day, rising to 1.3525.

Update: This is far from being a done deal. May government could collapse on a potential Irish border deal

Here is a quote from the article:

British officials tabled proposals this week to avoid a “hard border” in Ireland that could unblock the last remaining major obstacle to a deal, The Times understands.

And here is a snippet about the transition deal which might be agreed upon in December, if the report is correct:

In return the EU will pledge at a summit in Brussels next month to speed up approval for a transition deal that maintains Britain’s present relationship with the EU, reassuring businesses that might otherwise begin implementing plans for a hard Brexit.

The pound is also gaining ground against the euro and the yen, but the largest rise is against the greenback, thanks to some profit-taking.

US Secretary of State Rex Tillerson may be on his way out, and this ongoing political turmoil in Washington is also weighing on the US dollar.

Above 1.35, pound/dollar is above the initial post-Brexit limits. However, earlier this year the pair had already passed 1.36, hitting a high of 1.3615, which is the next line of resistance.