The UK has raised its Brexit divorce bill offer to a sum closer to the EU’s demands of 60 billion euros. According to a report in the Telegraph, the EU accepts this proposal and this will unlock the next phase of the negotiations, related to the future trade relationship.

Update: the UK government denies the report. Nevertheless, the pound holds onto its higher ground.

Update 2: Despite the denials, it seems quite real. The pound continues rising.

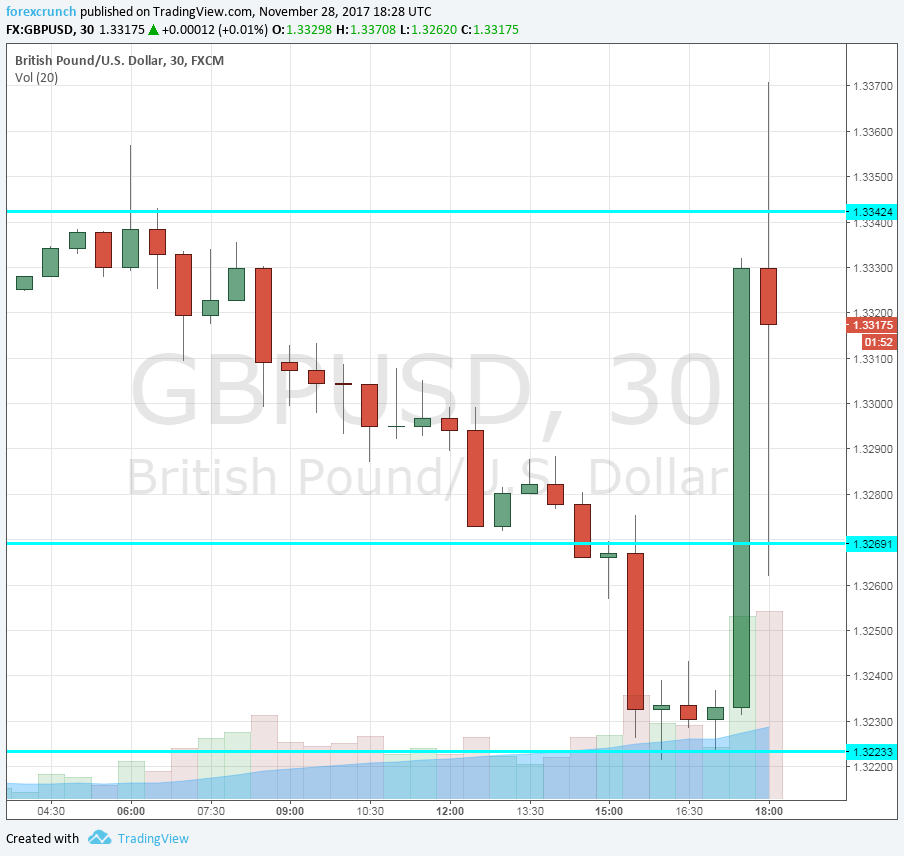

GBP/USD jumped from support at 13220 all the way to 1.3370 before returning to battle resistance at 1.3340. Support is at 1.3270.

Here is a quote from the article:

The Telegraph understands that the final figure, which is deliberately being left open to interpretation, will be between €45bn and €55bn, depending on how each side calculates the output from an agreed methodology.

It is unclear if other issues have been resolved, such as the Irish border and the rights of EU citizens in the UK and UK citizens in the EU. It is important to note that previous reports about imminent agreements did not always materialize. We will probably hear an official confirmation or a denial relatively soon.

The UK originally agreed to pay 20 billion euros and the EU demanded 60 billion. So, the sum is unsurprisingly closer to the number that the EU wanted.

Hints over the past few weeks pointed to a caving in by the British government, which is the weaker side in this negotiation.

Here are how things look on the GBP/USD chart: