- Initial claims in the United States increased slightly to 245,000 in the most recent week.

- Data on business activity showed that the world’s biggest economy was still strong.

- British earnings increased more quickly than predicted last month.

The GBP/USD weekly forecast is slightly bearish as the UK economy suffers amid high inflation while the Fed prepares to hike rates in May.

–Are you interested in learning more about STP brokers? Check our detailed guide-

However, high Uk inflation might lead to a bigger BOE hike supporting the pound.

Ups and downs of GBP/USD

Initial claims in the United States increased slightly to 245,000 in the most recent week, indicating an easing labor market.

However, data on business activity showed that the world’s biggest economy was still strong. It backed expectations that the Fed will lift rates in next month’s policy meeting.

Inflation in Britain is proving to be far more persistent than anticipated. It is significantly higher than everywhere else in Western Europe.

British earnings increased more quickly than predicted last month. Economists say it may push the Bank of England towards raising interest rates again next month, despite an unexpected unemployment rate jump.

The pound dropped on Friday after economic statistics revealed that British consumers are buckling under the weight of inflation.

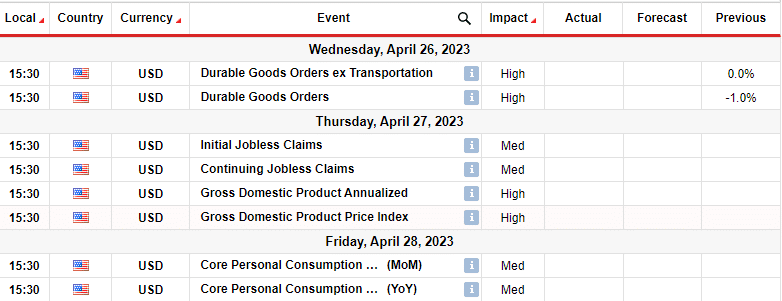

Next week’s key events for GBP/USD

Investors will focus on data from the US next week. More attention will be given to the GDP numbers and the core PCE index.

The GDP numbers will show the state of the economy amid worries about a recession. The core PCE is the Fed’s preferred measure of inflation and might influence the Fed’s next move.

GBP/USD weekly technical forecast: Bears face strong support at the 22-SMA

GBP/USD has pulled back to retest the 22-SMA support in the daily chart. This is also where the 1.2401 level is, making a strong support zone. The bullish bias is strong because the price has traded above the 22-SMA with the RSI above 50.

–Are you interested in learning more about forex robots? Check our detailed guide-

The bullish move, however, stopped at the 1.2524 resistance level, where bears returned for a retracement move. Bears made a strong candle that might lead to a break below the SMA.

However, given the bullish bias, there is a high chance that the price will push higher to retest 1.2524. A break above this resistance would strengthen the bullish bias.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money